Staking frenzy grips Ethereum: 33.9% of ETH now staked

- Interest in staking Ethereum surged significantly over the past few days.

- Network growth for ETH fell materially despite the surge in price.

Over the last few days, Ethereum [ETH] has seen massive volatility in terms of price movement, which has impacted sentiment around the token significantly.

Interest in Ethereum staking surged

The ETH2 Beacon Deposit Contract, the backbone for staking deposits in Ethereum 2.0, has reached a new peak, locking in a whopping 47.36 million ETH. This represents a significant chunk of the total supply, amounting to 33.9%.

The value is more than triple the amount staked just two years ago, which was only 10.9%. The surge in deposits indicates growing confidence in Ethereum 2.0 and its potential to revolutionize the Ethereum blockchain.

With a significant portion of ETH locked up in staking deposits, the circulating supply of ETH effectively decreases. This can lead to upward pressure on the price due to basic principles of supply and demand.

Moreover, since staked ETH is locked up for a period of time, it’s less likely to be sold on the open market in the short term. This can help reduce downward pressure on the price, especially during periods of market volatility.

Daily activity on the network fell

However, despite the surge in ETH staking, the overall interest in the Ethereum ecosystem waned.

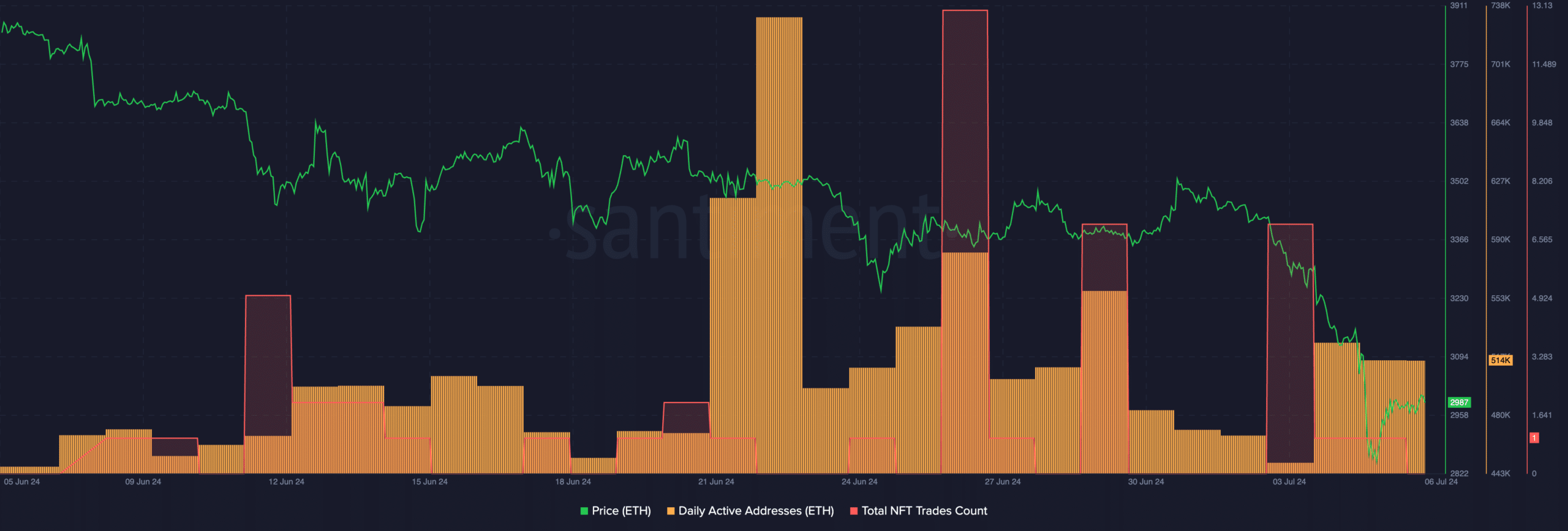

AMBCrypto’s analysis of Santiment’s data revealed that the overall active addresses on the Ethereum network declined significantly over the past month.

Moreover, this decline in activity coincided with the number of NFT trades occurring on the Ethereum network falling.

This suggests that despite the potential benefits of staking, fewer people are actively using the Ethereum network for other purposes.

This could be due to a number of factors, such as high gas fees, a lack of new applications, or a general bearish sentiment in the cryptocurrency market.

At press time, ETH was trading at $3,087.00 and its price had grown by 10.91% since the 10th of July. Despite the surge in price, the overall trend for ETH remained bearish.

Read Ethereum’s [ETH] Price Prediction 2024-25

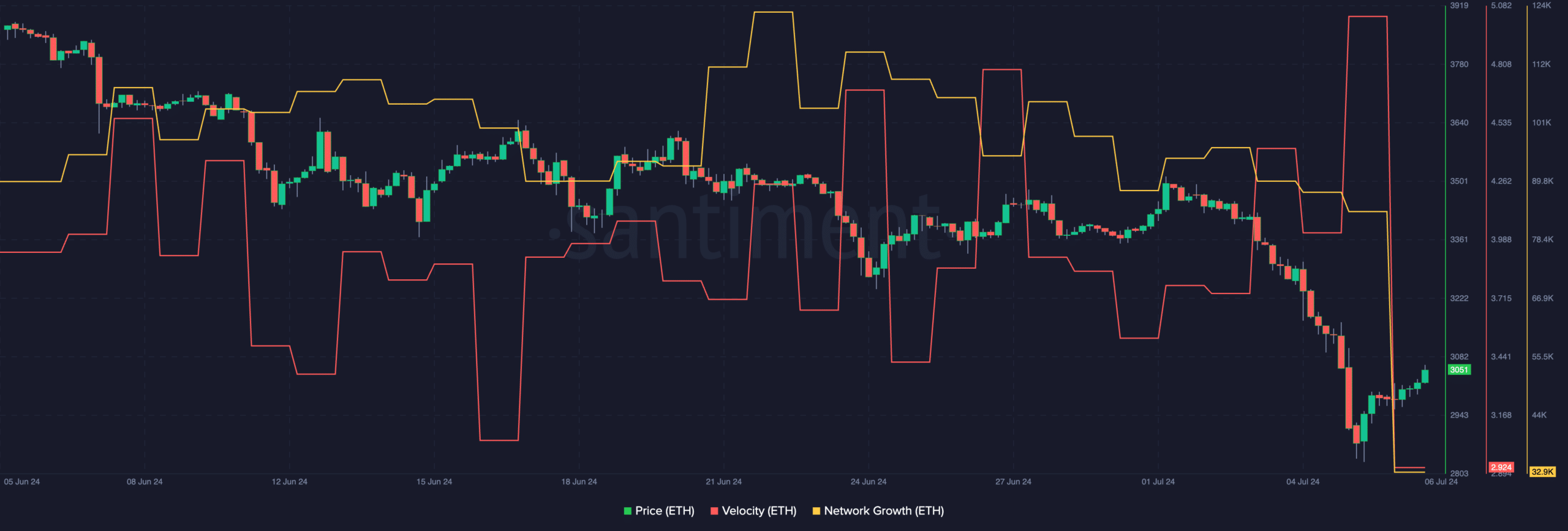

Additionally, the network growth for ETH fell materially, indicating that new addresses were losing interest in ETH.

Coupled with that, the velocity at which ETH was trading at had also fallen,, implying that the frequency at which ETH was being exchanged had declined.

![Sonic [S] sees $1.4 billion liquidity surge as network upgrade sparks investor interest](https://ambcrypto.com/wp-content/uploads/2025/03/F0D8CF78-0B88-471B-BD85-84A9F049FDBA-400x240.webp)