Analysis

Stalemate, progress, and drawbacks: Analyzing the crypto sector’s push for revival

This report highlights how projects have taken advantage of the bear market to create more solutions for the blockchain space. User adoption has increased as the NFT market aexpands.

– Developers are shifting away from contributing to the U.S. crypto ecosystem.

– Smart contracts deployment and active addresses across all blockchains have reached their respective ATHs.

Since Bitcoin [BTC] marshaled many other assets to reach their respective All-Time Highs (ATH) in 2021, the cryptocurrency landscape has been characterized by its dynamism and volatility, with constant ups and downs.

Although there has been a concerted effort to propel the industry forward, there have also been changes in trends, developments, participation, and regulatory hurdles that never seem to disappear.

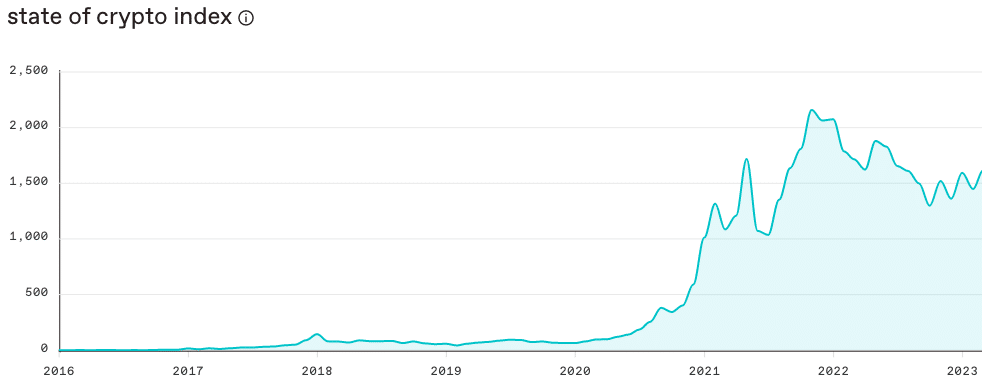

In between all of these, the State of Crypto index gained 11.54% in the last 30 days. But in the last year, the index decreased by 5.86%.

Put together by a16z, the state of the crypto index refers to the percentage change that reflects the development, innovation, and contributing parameters to the entire crypto economy.

For the unschooled, the venture capital firm has been providing this data since 2016. According to the latest release, it was obvious that the sector has experienced growth in the last month. And possibly, the whole of 2023. But there were downsides as well that surely stunted the growth rate.

Battling with regulatory fever, and attracting more developers

Based on the report, the United States’ approach to regulation has been a hindrance. For a while, the regulatory bodies, led by the U.S. SEC, have been giving crypto firms a hard time. Because of this, the likes of Ripple [XRP] had to fight tooth and nail to keep up with its progress. Exchanges, stablecoins, and promoters of the regulatory body tagged “securities” have not been left out.

Well, some might say the clampdown has been justified, especially with the way several institutions in the sector crumbled in 2022. Examples include the infamous Sam Bankman-Fried- led FTX, Celsius [USDC], and crypto hedge fund Three Arrows Capital (3AC).

For some, “extreme market conditions” were the cause of their downfall. Others could, however, not escape the glaring cases of mismanagement. But as regulation forces its way into crypto organizations, a16z noted that the country was losing its lead in terms of developers and traffic.

Nevertheless, the decreasing interest in the U.S. has not entirely affected the ecosystem negatively. Although there have been some drawbacks, active and interested developers have maintained a good level of interaction.

Active developers refer to the number of developers engaged in building publicly in crypto. This metric measures the rate of public GitHub repositories. Interested developers are, however, those that relate to open-source projects in the crypto ecosystem.

As of February 2023, active developers were 28,240. On the other hand, interested developers were 55,760. This figure implies that developers’ interest in engaging in technological advancements in this space remained visible.

ZKs, Optimists top the drivers of participation

Consequently, the developers involved have propelled the number of verified smart contracts to an all-time high. Smart contracts are self-executing programs used to automate the execution of an agreement on the blockchain.

At the time the report was released, the verified smart contracts were 33,870. This means that the number of crypto applications already deployed has outpaced all the previous years. Interestingly, these programs were not alone in reaching new highs.

Active addresses followed in the same footsteps as well. In crypto, an active address is a participant in successful transactions. Therefore, active addresses are the number of senders and receivers over a particular blockchain.

However, this a16z data cumulated the metric across several blockchains. And, at the time of writing, active addresses were over 15 million. But there are reasons why participation increased. One notable part is the way several promising paths have been involved in driving traction and user adoption.

For instance, the Ethereum [ETH] blockchain has seen the introduction of optimistic rollup scaling projects like Arbitrum [ARB], and Optimism [OP]. The Zero-Knowledge [ZK] part too has not been left out. In this case, Polygon [MATIC], zkSync, and StarkNet [STRK] have shown what they can offer.

This, invariably, has turned out to be a positive development for Ethereum. The blockchain also recorded a substantial increase in transaction fees. Besides that, the staking withdrawal activation is also expected to drive more adoption for the second-largest blockchain in market value.

NFT bulls may be on their way to…

Still on Ethereum. Recall that the blockchain was one of the major drivers and beneficiaries of NFTs in the 2021 bull market. Yes, floor prices and sales volume shrunk, but NFT royalties have risen to the tune of $1.9 billion across all chains.

Moreso, some of the biggest web2 brands are now exploring the digital collectibles space and web3. Due to this, and the development of new marketplaces like Blur, the number of NFT traders recovered from the notable decline registered in 2022.

Apparently, Bitcoin has also been involved in this aspect with the evolution of Ordinals Inscriptions. But as it stands, the crypto sector is not entirely exempt from challenges, especially with regard to unfavorable regulatory conditions.

In fact, some of these have pushed users to reduce exposure to centralized entities. In turn, it has driven the volume of Decentralized Exchanges (DEXes) to increase. Policymakers are conflicted in creating bipartisan bills while enforcing regulatory action.

However, progress has been made. And with more builders entering the crypto space, there is a possibility that it creates more opportunities. Meanwhile, one can’t deny that NFT and DeFi activity were submerged. Despite that, there seem to be early signs that the chaos experienced could soon change into a pleasing market cycle