Starknet TVL pumps 194% in 7 days: What about STRK?

- The rise in TVL suggested that the project had regained market trust.

- STRK’s price might continue to drop unless ETH makes a big upswing.

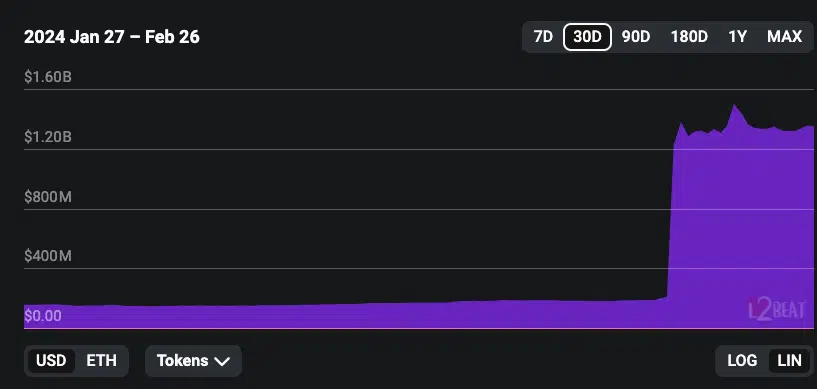

The Total Value Locked (TVL) of Starknet [STRK] increased by 194%, according to data AMBCrypto got from L2BEAT. At press time, Starknet’s TVL was $1.32 billion.

The increase in TVL meant the Ethereum [ETH] Layer 2 had become the fourth-largest L2 out of the already-launched projects on the blockchain.

The TVL measures the value of assets locked to staked on a particular blockchain network. For Starknet, this growth could be considered an impressive one.

The trend just got better

This was because it only launched on Mainnet on the 14th of February. Starknet’s launch was a successful one, as it rewarded its early adopters with over 700 million STRK tokens.

However, the introduction was not without controversy, as AMBCrypto reported earlier.

Over the previous week, there have been allegations that the Starknet team dumped on the community by selling a ton of their tokens. This caused STRK’s price to slide below $2.

There was also an error with its token issuance.

Furthermore, the increase in TVL showed that the tides might have changed. If the TVL had decreased, it would have suggested that market participants were being cautious about adding liquidity to the Starknet.

Therefore, the hike implied that participants perceived the L2 to be trustworthy.

If the TVL continues to increase, then STRK could have a shot at surging higher than its press time value. However, the TVL alone cannot determine if STRK’s price will increase or not.

Therefore, we took time to look at other metrics.

Can STRK quit its losing streak?

One of the metrics we considered was the development activity. Development activity tells if a project is shipping new features on its network. It does this by tracking the public GitHub repositories on the network.

When the metric increases, it implies that developers are launching new features.

Thus, the decrease in Starknet’s development activity suggests that developers’ code commits had slowed down. The reading of the metric could be considered a bearish sign.

However, that does not entirely imply that STRK was headed for doom even though it was one of the biggest losers of the just-ended week

When it comes to stablecoin supply on the network, Santiment’s on-chain data showed that there has been some improvement. As of this writing, the stablecoin supply held by whales had increased to 53.99.

The increase here suggests that the whales had enough buying power that might be enough to trigger a jump in STRK’s price.

Realistic or not, here’s STRK’s market cap in ETH terms

Going forward, STRK’s price might stabilize or register a significant increase. One of the reasons could be connected to the change it made per its token unlock schedule.

Another factor that could impact its price is ETH. If ETH rises toward $3,500, betas like STRK might also climb.