Stellar finds recovery elusive after hitting key demand zone

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- XLM hit the range-low and was yet to form a solid reversal.

- The drop to the range low offered sellers more market control.

Stellar [XLM] sellers who took advantage of the roadblock at the range-high ($0.13) around 11-12 September had +16% gains at press time. XLM traded at $0.11(a range-low) at the time of writing.

Is your portfolio green? Check out the XLM Profit Calculator

The range low has seen two solid recoveries during past retests. But recovery was elusive during the third retest.

Meanwhile, Bitcoin [BTC] retreated $26.0k at press time, a range low that could further delay XLM’s recovery.

When is a recovery likely?

In the second half of September, Spot market demand for XLM declined, as demonstrated by the retreating Relative Strength Index (RSI).

Similarly, the Chaikin Money Flow (CMF) dropped, indicating massive capital outflows from the XLM markets, underscoring the bearish bias over the same period.

The bearish pressure saw XLM depreciate from the range high of $0.13 to a range low ($0.11). A weekly bullish order block (OB) of $0.095 – $0.109 (cyan). So, the area between $0.095 and $0.11 could act as a solid bullish zone.

Northwards, the key resistance levels to consider are $0.115, 50-EMA (Exponential Moving Average) of $0.120, mid-range ($0.1220), and range-high ($0.13).

Sellers gained market control

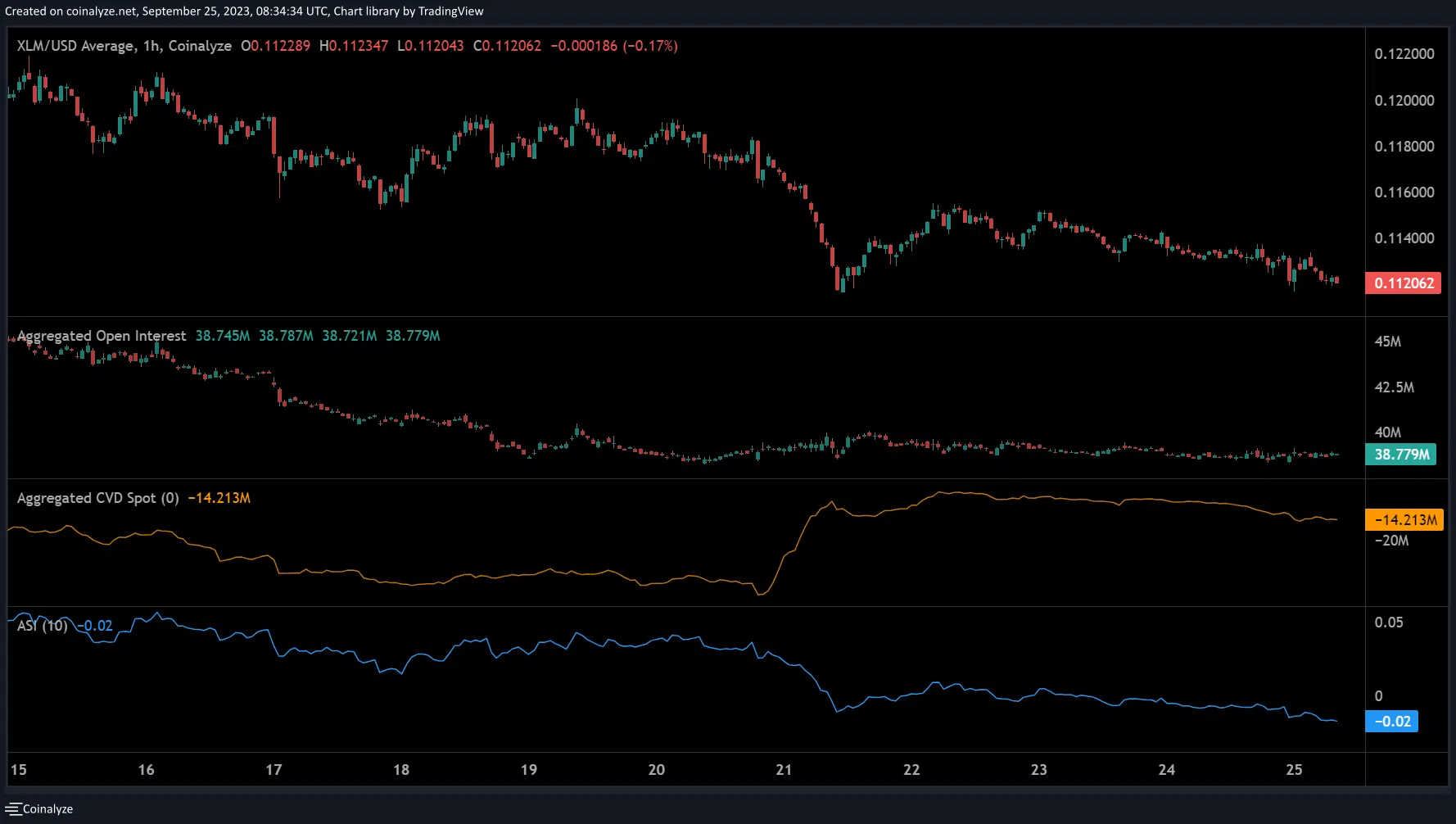

Futures market data showed sellers gained extra market following the price decline to the range low. The Open Interest rates dropped from $45 million on 15 September to $38 million at press time. It indicates that demand for XLM also dropped in the derivatives market – A bearish bias.

How much are 1,10,100 XLMs worth today?

The CVD (Cumulative Volume Delta) spiked on 21 September but retreated steadily afterward, denoting that sellers gained more market control.

The long-term downtrend also confirmed the bearish bias, as shown by the negative Accumulative Swing Index (ASI).