Story [IP] joins top 10 AI tokens, but is a 15% drop ahead?

- IP’s Average Directional Index (ADX) stood at 59, at press time, indicating strong momentum.

- On-chain metrics revealed that exchanges have witnessed an outflow of $2.15 million worth of IP tokens.

The recently launched crypto AI project, Story [IP], is making waves in the cryptocurrency market with its impressive upside momentum.

With the massive 32% surge, traders and investors are strongly betting on the asset and accumulating it, as reported by the on-chain analytics firm Coinglass.

IP’s current price momentum

Not only that, but it has also secured a spot among the top ten crypto AI tokens by surpassing Virtuals Protocol [VIRTUAL]. At the time of writing, IP was trading near $3.42 and has witnessed a 97% surge in trading volume.

Since the project’s launch, exchanges have seen a consistent outflow of IP tokens, suggesting that investors and long-term holders are accumulating the asset.

Data from the spot inflow/outflow reveals that, in the past 24 hours, exchanges have recorded an outflow of IP tokens worth $2.15 million.

This significant outflow from exchanges could create buying pressure and drive further upside momentum. This might explain today’s substantial rally.

Following this accumulation and price surge, intraday traders entered the market heavily. This resulted in a 70% increase in IP’s Open Interest (OI).

The rise in OI indicates that traders have increased their positions on both the long and short sides.

Major liquidation areas

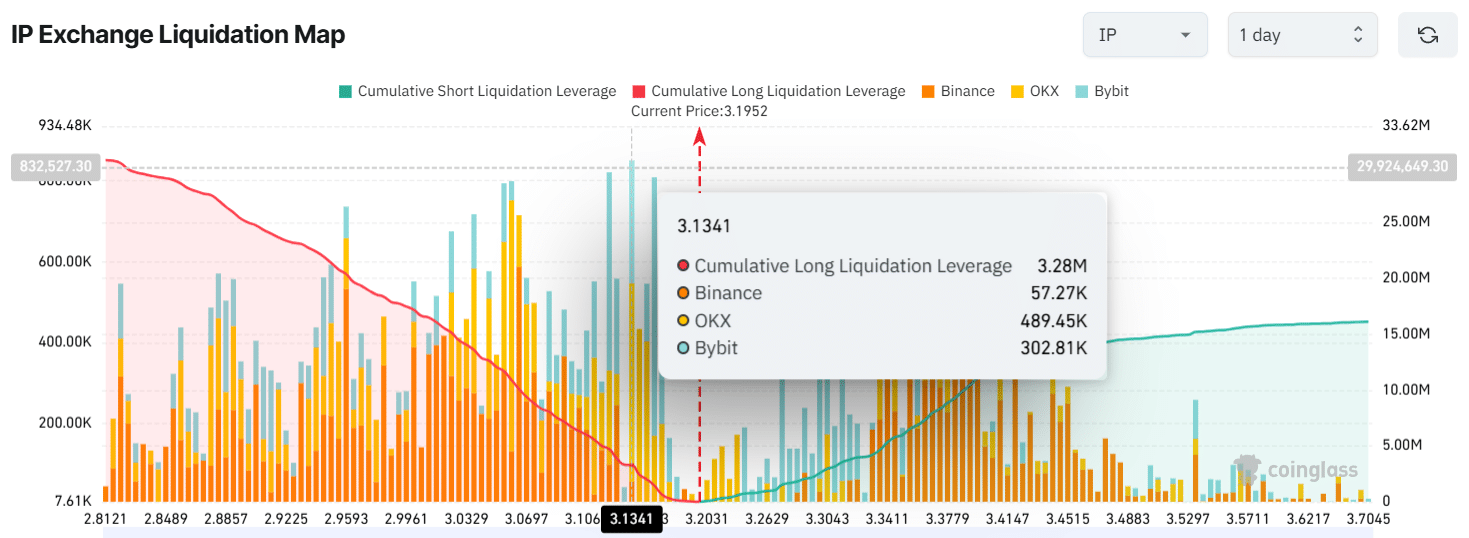

Data from Coinglass revealed that traders betting on the long side are currently dominating the asset and are over-leveraged at the $3.134 level, holding $3.28 million worth of long positions.

On the other hand, short sellers appear to be exhausted, as they are over-leveraged at the $3.276 level, with $1.54 million worth of short positions.

These on-chain metrics indicate that bulls are strongly supporting the asset, which could help sustain its upside momentum.

IP’s technical analysis and key levels

According to AMBCrypto’s technical analysis, IP appears bullish as the Average Directional Index (ADX) currently stands at 59, indicating strong momentum.

The upward-sloping ADX line suggests that IP’s momentum is accelerating.

However, despite ADX’s bullish trend, the four-hour chart indicates that the asset might experience a short-term price correction.

Based on recent momentum, IP could see a 15% price drop, potentially reaching the $2.61 level in the coming days.