STX: Social activity booms, but there’s a catch

- There has been an uptick in STX’s social activity.

- STX was trading at an overbought high, putting it at risk of a decline.

Stacks [STX] has been the talk of the crypto town lately, with its social media mentions skyrocketing. This surge in social volume comes amid a significant price rally in the altcoin’s value.

In the last week, STX’s price has risen by over 30%, according to data from CoinMarketCap.

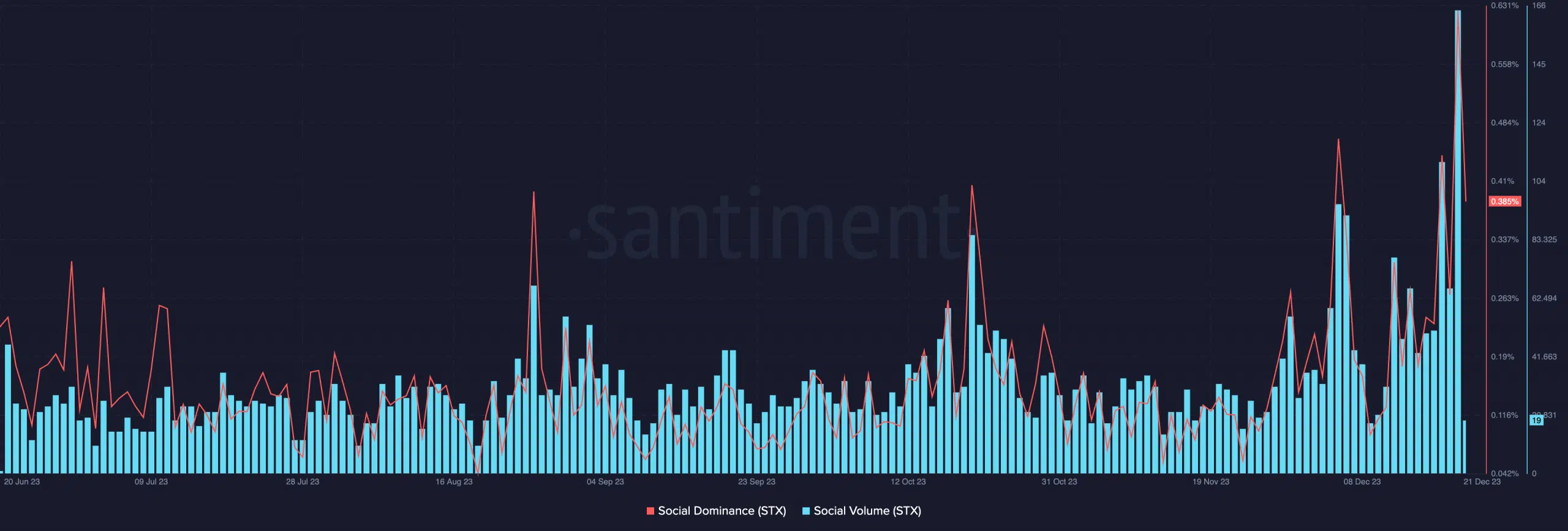

On the 20th of December, the token’s social activity rallied to its highest level in eight months. AMBCrypto found that STX’s social dominance touched 0.62 on that day, while its social volume was 165.

The steady growth in the token’s price in the last month has led to increased social interactions around it.

However, in a recent post on X (formerly Twitter), on-chain data provider Santiment warned that such high levels of social activity often trigger “fear of missing out” (FOMO) buying.

?️ #Solana (+13%), #Stacks (+23%), and #NEARprotocol (+17%) are the top trending assets, according to rising social volumes. In each case, when there is mainstream talk at this level, #FOMO will create price tops. If holding any, take a cautious approach. https://t.co/bb3O2lFJd1 pic.twitter.com/oMnVvAI0ea

— Santiment (@santimentfeed) December 21, 2023

This typically results in the creation of local price tops, followed by a rapid price correction once the hype subsides.

Brace for decline?

An assessment of STX’s price movement on a daily chart showed the presence of volatility, confirming Santiment’s position. Firstly, as its price increased, the gap between the upper and lower bands of its Bollinger Bands (BB) indicator widened.

When the gap between the upper and lower bands of an asset’s BB widens, it suggests that price movements are becoming more erratic and unpredictable and that there lies a chance of significant price swings.

The rise in STX’s Average True Range (ATR) confirmed the possibility of a price swing.

The token’s ATR — which measures market volatility by calculating the average range between high and low prices over a specified number of periods — has trended upward by 140% since the 3rd of December.

As of this writing, STX’s ATR was 0.12.

Further, due to the upswing in demand for the token in the past few weeks, its key momentum indicators have been pushed to overbought highs.

How much are 1,10,100 STXs worth today?

At press time, STX’s Relative Strength Index (RSI) and Money Flow Index (MFI) were 71.56 and 80.22, respectively.

Buyers’ exhaustion is common at these overbought levels, as traders typically find it challenging to sustain further price growth. Hence, a price decline might ensue.