SUI: Is recent bull behavior pointing to a 20% rally?

- In the past 24 hours, SUI bulls’ long positions were significantly higher than bears’ short positions.

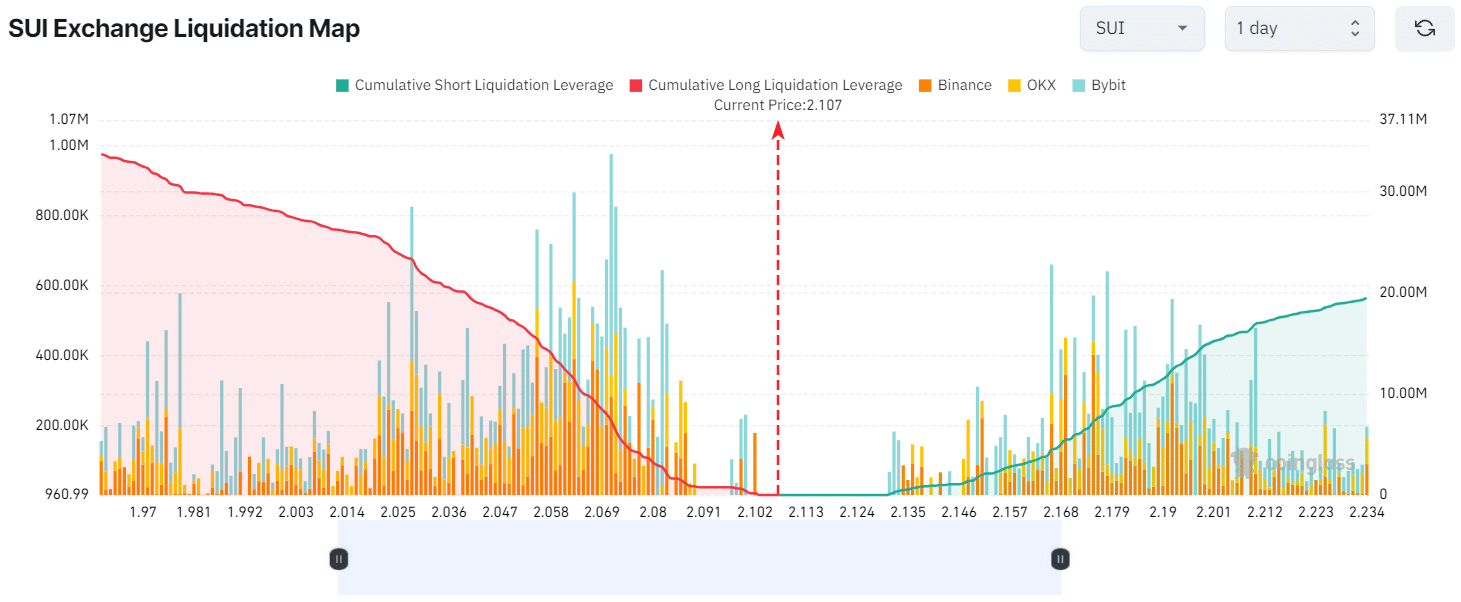

- Traders over-leveraged at $2.07 on the lower side and $2.166 on the upper side.

After an impressive price recovery across the cryptocurrency landscape, major cryptocurrencies faced a price correction.

Amid this, Layer-1 token Sui [SUI] token has successfully retested its breakout area, and looked poised for a significant upside rally.

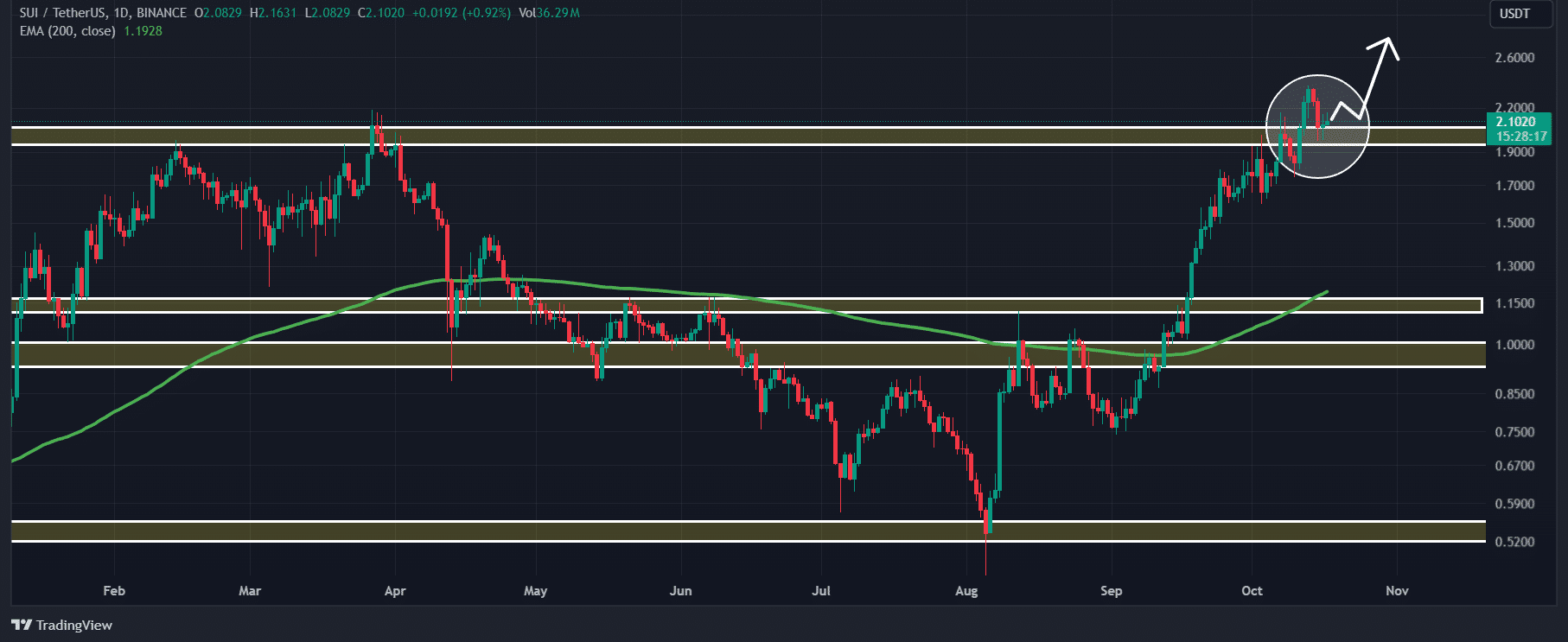

SUI: Assessing key levels

According to AMBCrypto’s technical analysis, SUI appeared bullish as it breached a strong resistance level of $2.05 with a three-white-shoulder candlestick pattern on the daily time frame.

Following that breakout, SUI experienced a price surge of nearly 20%. However, amid the ongoing price correction, SUI has retested that level and is now moving in an upward direction.

Based on the historical price momentum, if SUI holds itself above the $1.80 level, there is a strong possibility it could soar by 20% to reach the $2.50 level in the coming days.

On the other hand, if SUI fails to maintain the $1.80 level, a significant price decline to the $1.40 level may occur.

Given the current market sentiment, it appears that SUI will stay above the resistance level and rise significantly in the coming days.

SUI’s positive outlook was further supported by on-chain analytics firm Coinglass. It revealed that SUI’s Long/Short Ratio was 1.02 at press time, indicating bullish sentiment among traders.

Additionally, its Futures Open Interest jumped by 4.1% over the past 24 hours. So, more positions have been built in the past 24 hours compared to the previous day, which is often considered a positive sign.

Major liquidation levels

As of press time, major liquidation levels are near $2.07 on the lower side and $2.166 on the upper side, with traders over-leveraged at these levels, according to Coinglass.

If the market sentiment remains unchanged and the price rises to the $2.166 level, nearly $4.52 million worth of short positions will be liquidated.

Read Sui’s [SUI] Price Prediction 2024–2025

Conversely, if the sentiment shifts and the price falls to the $2.07 level, approximately $7.35 million worth of long positions will be liquidated.

This data suggests that bulls’ long positions are significantly higher than bears’ short positions.