SUI price prediction: After $3.51 ATH, will $6 be next?

- Sui price prediction is poised for a move beyond $3.54.

- The steady buying pressure in recent months was a sign that SUI is likely to run higher.

Sui [SUI] saw a $3 billion trading volume in the past 24 hours and the market cap of the asset was $9.4 billion, putting it at the 14th rank on CoinMarketCap.

Multi-billion dollar assets sometimes struggle to move higher quickly, unlike smaller assets.

The strength that SUI has shown since September was evidence of the bullish conviction in the token. A move beyond $3.54 and $4 is the more likely scenario than a pullback toward $2.5.

SUI price prediction is bullish on higher timeframes

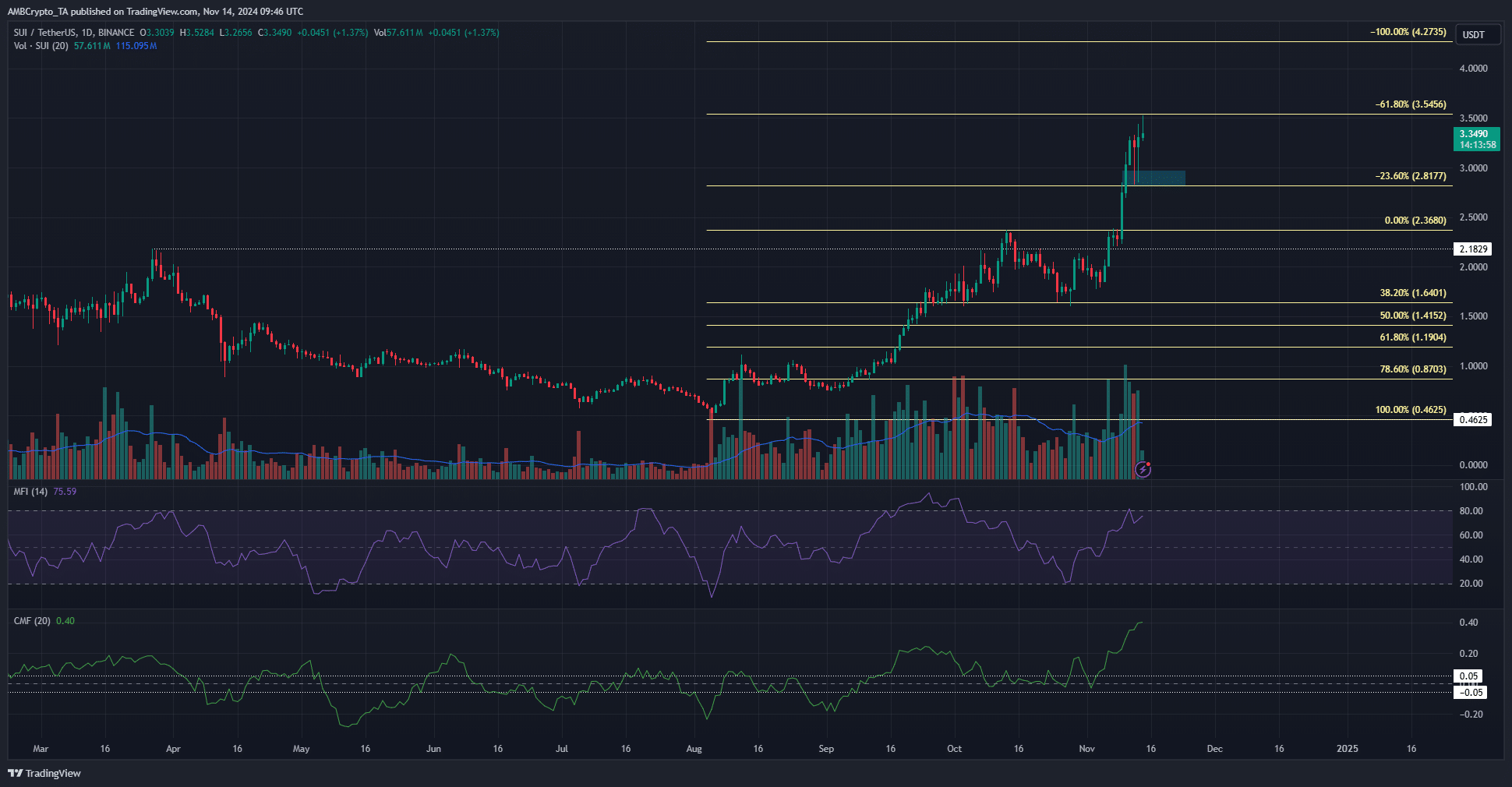

SUI has a strongly bullish market structure. It has been trending higher since mid-September, but the signs of a rally were present in August.

The altcoin had been in a downtrend since April, and the trading volume had been low.

This trading volume trend changed enormously in August. The influx of capital was evenly poised, but bulls won in September, and SUI hasn’t looked back since.

The Sui price prediction is bullish in the long term, but some volatility is possible in the short term. The lower timeframe analysis showed that the 23.6% Fibonacci extension level at $2.81 was a key support zone.

A deeper retracement below $2.81 would flip the lower timeframe bias bearishly, but the daily chart would remain bullish. The MFI showed hefty upward momentum and no bearish divergence.

The CMF climbed past last November’s highs to reflect enormous capital flow into the market.

Open Interest takes a slight hit

Source: Coinglass

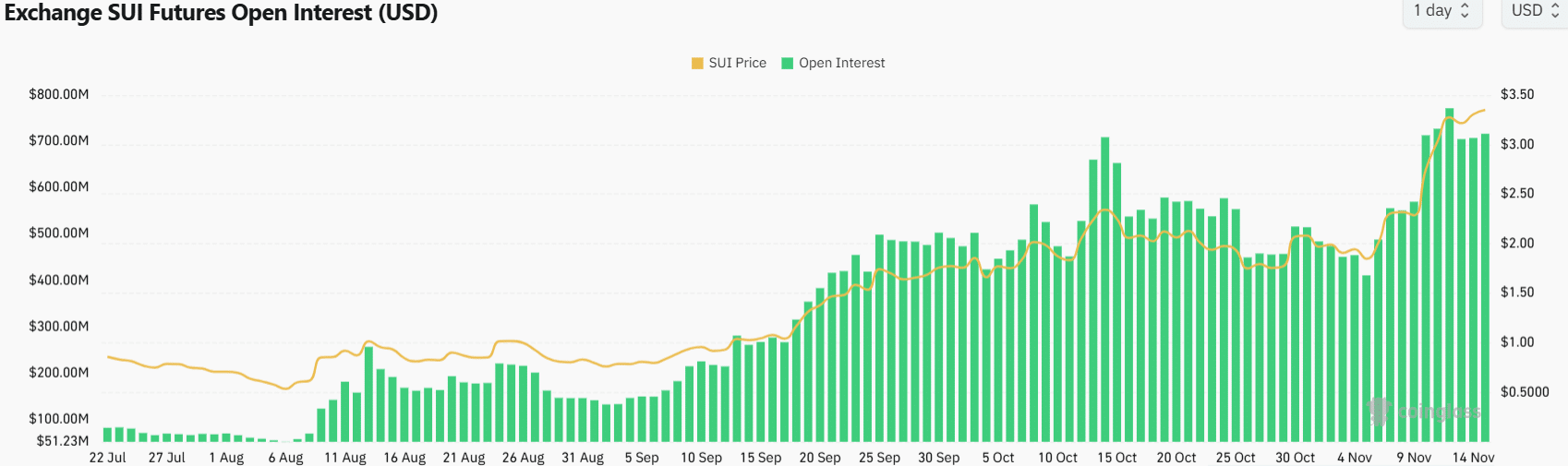

Like the trading volume, the Open Interest also began to pick up in August.

Alongside the rising prices in the latter half of September, the uptick in the OI reflected steady bidding in the futures market. It outlined bullish belief.

The OI dropped from $771 million to $716 million over the past three days as SUI faced some selling pressure in the $3.3 region.

Source: Santiment

Realistic or not, here’s SUI’s market cap in BTC’s terms

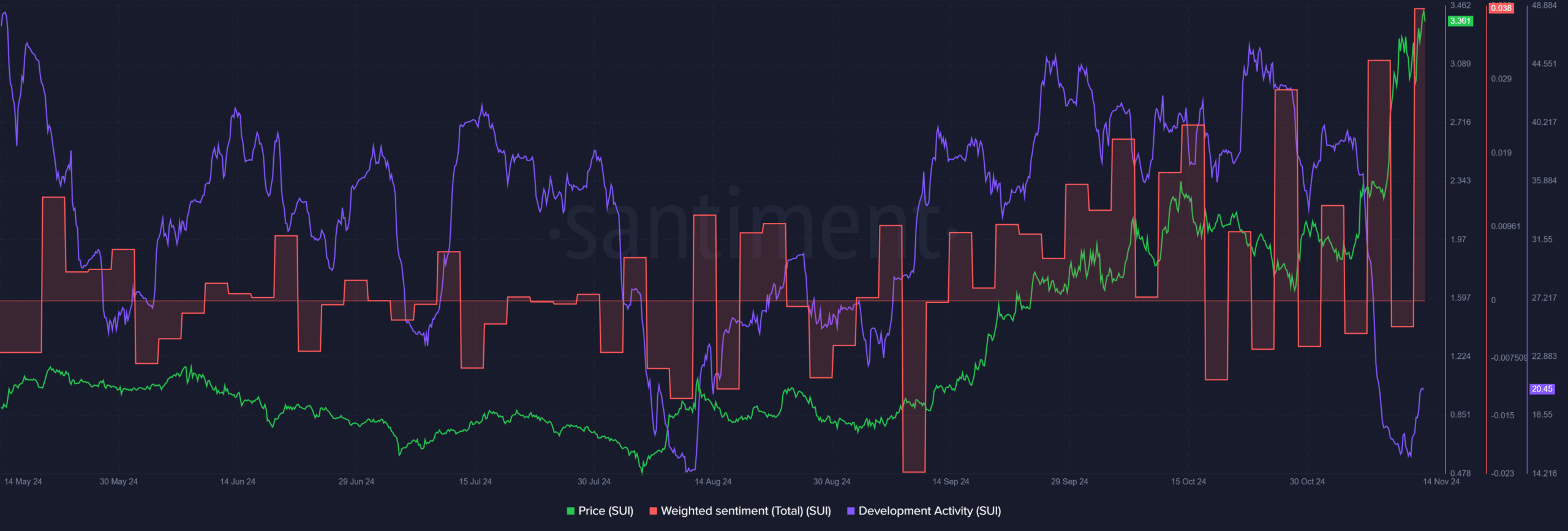

The Weighted Sentiment remained firmly bullish and has been for most of the past month. However, the development activity took a sharp drop in recent weeks.

This dip is likely not a cause for worry, as there have been several such drops in 2024.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion