SUI stands out amid crypto pullbacks: Can bulls sustain the rally?

- SUI bulls maintain strong stance despite price being extremely overbought.

- Assessing potential for profit-taking and sell pressure as price flashes multiple signs.

Sui [SUI] continues to demonstrate robust demand as most other top cryptocurrencies experience sell pressure and pullbacks. The performance reflects its growing popularity but can this cryptocurrency maintain its current trajectory for a while longer?

SUI stood out among its peers this week courtesy of its price action. Every once in a while, one major cryptocurrency tends to detach from the rest of the market by soaring while others experience outflows.

SUI happens to be it this time as majority of the top cryptos kick off October on a bearish leg.

Can SUI bulls keep pushing higher without a retracement?

Although SUI bulls remain dominant, an only-up trajectory is unsustainable. Those who bought at the bottom will be enticed by profits at some point. The cryptocurrency has so far flashed some major sign which could signal the return of sell pressure in the coming days.

The first major observation is that SUI price recently formed a bearish diversion pattern with the RSI. This is after pushing as high as $2.01 in the last 24 hours, which represents a new 5-month high.

The bearish divergence could indicate that the bulls might be preparing to go for a break.

On top of the bearish divergence, SUI was severely overbought at the time of observation. This means it could be sensitive to a wave of sell pressure in the coming days.

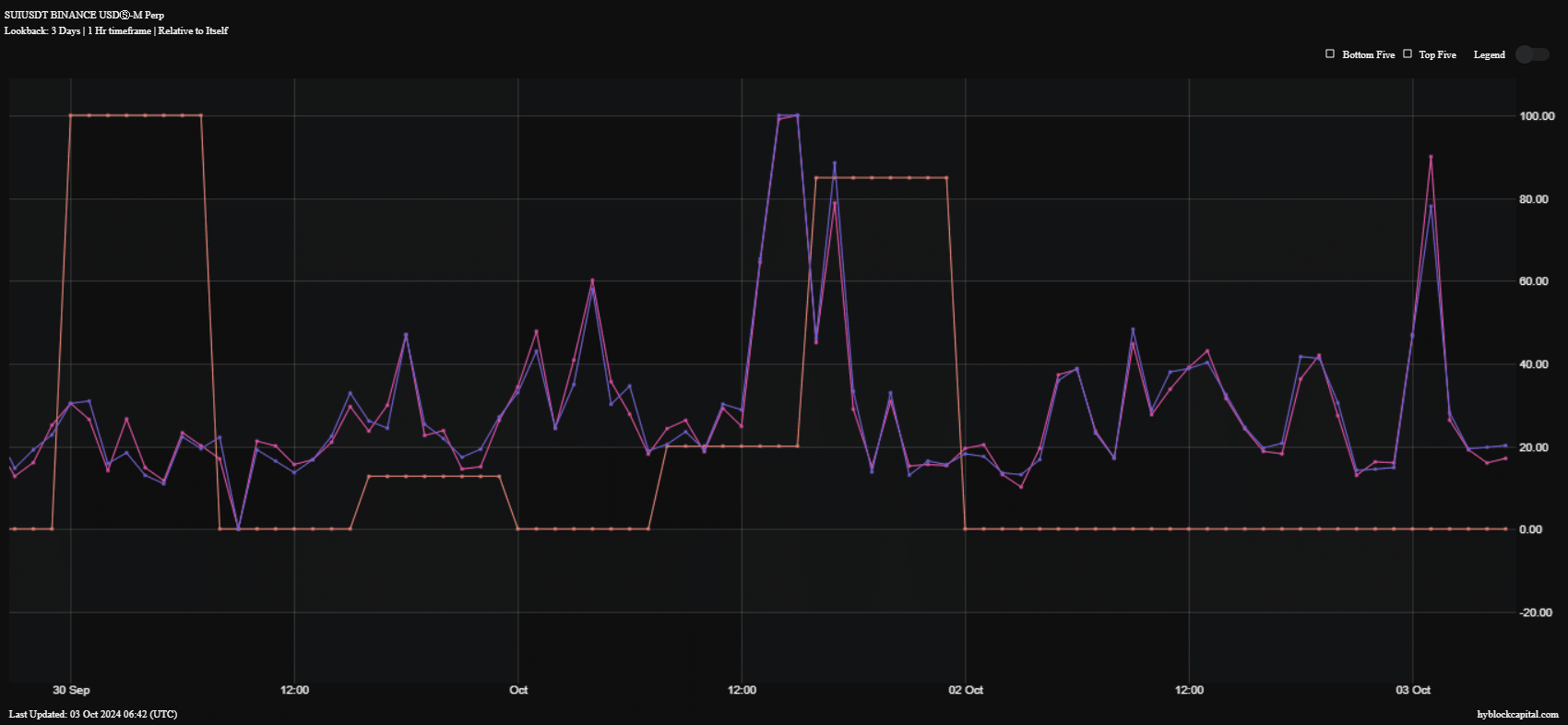

Although the cryptocurrency has maintained an overall uptrend, there have been sell pressure attempts along the way. Hyblock data reveals that there have been instances where sell pressure surged in the last three days.

However, it was also accompanied by a surge in buying volume, cancelling out any potential downside.

It is worth noting that sell pressure was slightly higher than buy volume at the time of observation. If this trend continues, then the cryptocurrency could be headed for some more downside.

Realistic or not, here’s SUI market cap in BTC’s terms

SUI also registered a noteworthy decline in funding rate within the last 3 days. This suggests that the derivatives segment may be experiencing more uncertainty regarding the next move. As well as a potentially higher level of short liquidations.

SUI’s ability to hold on to recent gains could underscore the fact that buyers are optimistic about its long-term potential. This would explain the unwillingness to focus on short-term profits when the cryptocurrency has potential for higher gains.