SUI: Will $4.76 resistance hold or break in 2025?

- Sui approaches $4.76 resistance, with consolidation signaling a possible breakout or reversal.

- Bullish liquidations outweigh bearish, while technicals show mixed signals awaiting confirmation.

Sui [SUI] has made headlines with a record-breaking $270 billion in total volume, with 90% of this growth occurring in 2024, demonstrating its massive adoption in the crypto market.

At press time, SUI was trading at $4.11, gaining 1.07% in a day. Sui’s next price movement hinges on key technical levels and shifting market dynamics.

Traders and investors are closely watching if the token will breach its critical resistance or consolidate further. As 2025 approaches with growing optimism, this question looms large.

SUI price action analysis: A breakout in sight?

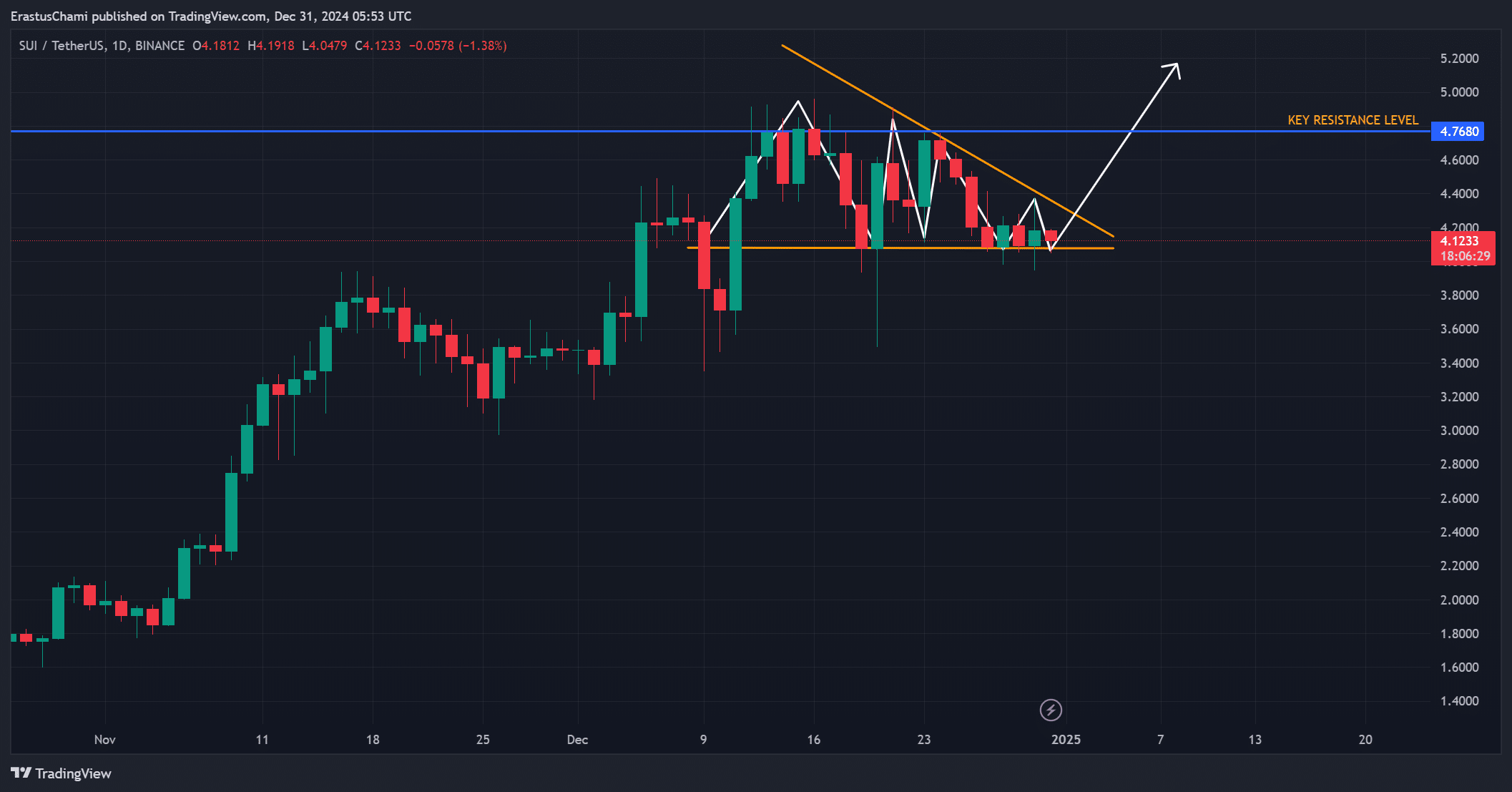

Sui is at a critical juncture, testing the descending triangle pattern that has defined its recent price movement. Despite several attempts over the past month, the key resistance level of $4.76 remains unbroken.

The token is consolidating near the triangle’s apex, which typically precedes a breakout. However, if it fails to breach this level soon, it could lead to a bearish move toward $3.80, forcing bulls to re-evaluate their positions.

SUI social dominance analysis: A steady decline

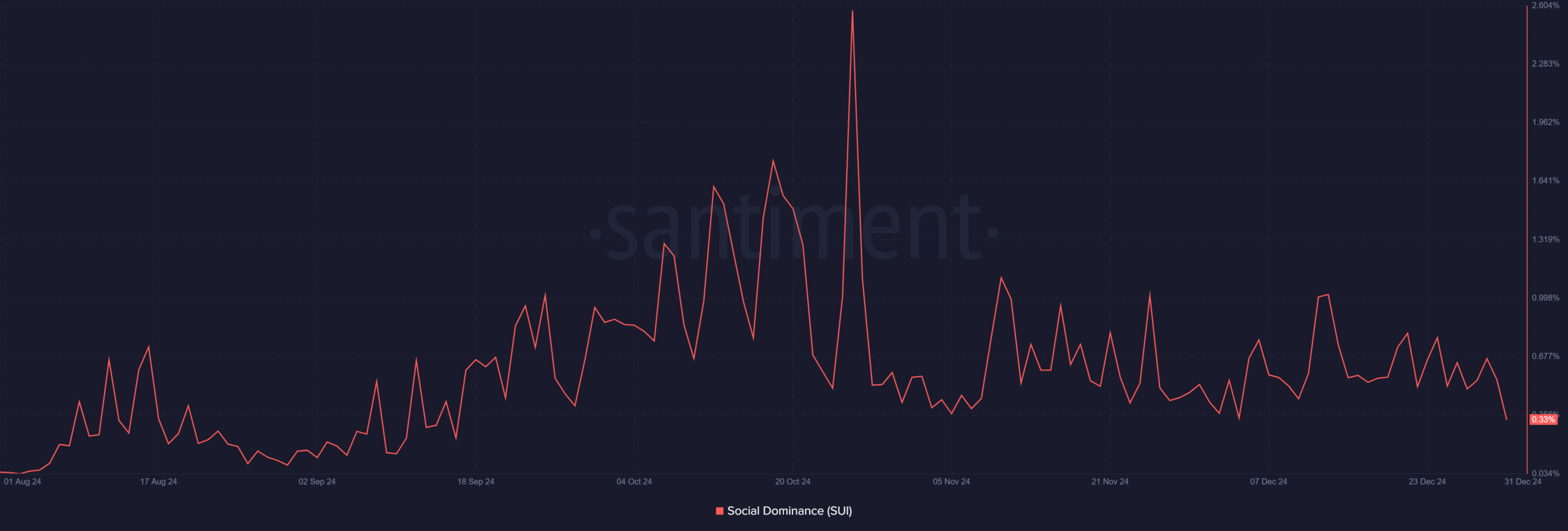

Although Sui has seen unprecedented trading volumes, its social dominance has decreased steadily, raising questions about market sentiment. For example, social mentions fell sharply from 2.28% in October to just 0.33% by December’s end.

This decline suggests reduced community engagement, reflecting waning hype or a shift in focus to other projects. However, lower social dominance does not always indicate negative sentiment. It might also signal accumulation by quieter market participants.

Technical indicators: Bulls and bears at a crossroads

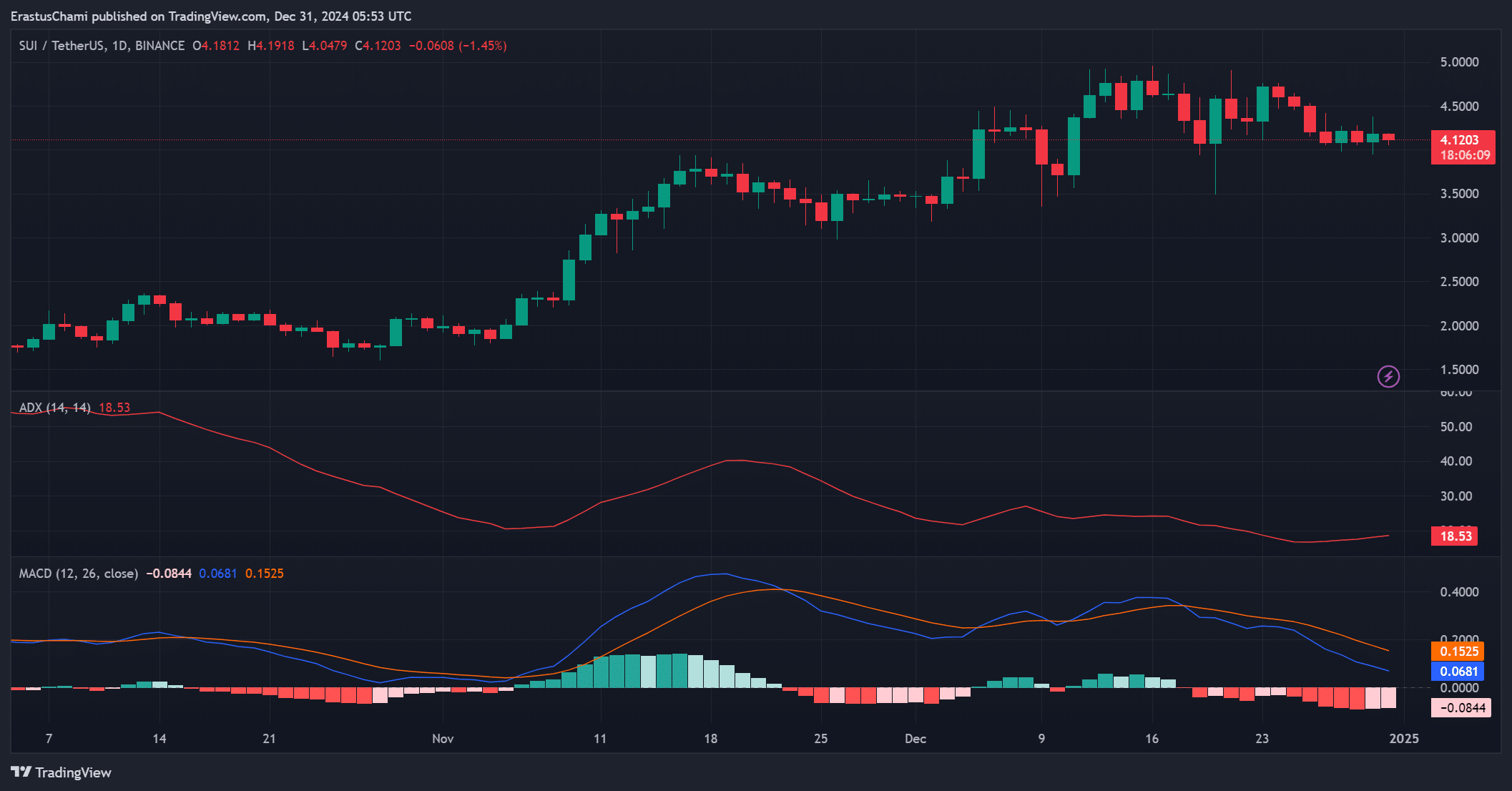

Sui’s technical indicators reveal mixed signals, adding to the market’s uncertainty. The Average Directional Index (ADX) is at 18.53, indicating a weak trend and a potential stalemate between buyers and sellers.

Meanwhile, the MACD shows a bearish crossover, suggesting declining upward momentum. However, the recent price consolidation could allow buyers to regroup if market conditions improve.

Additionally, a confirmed breakout above $4.76 would likely invalidate these bearish signals, providing clarity for traders.

SUI liquidations analysis: Bullish resilience persists

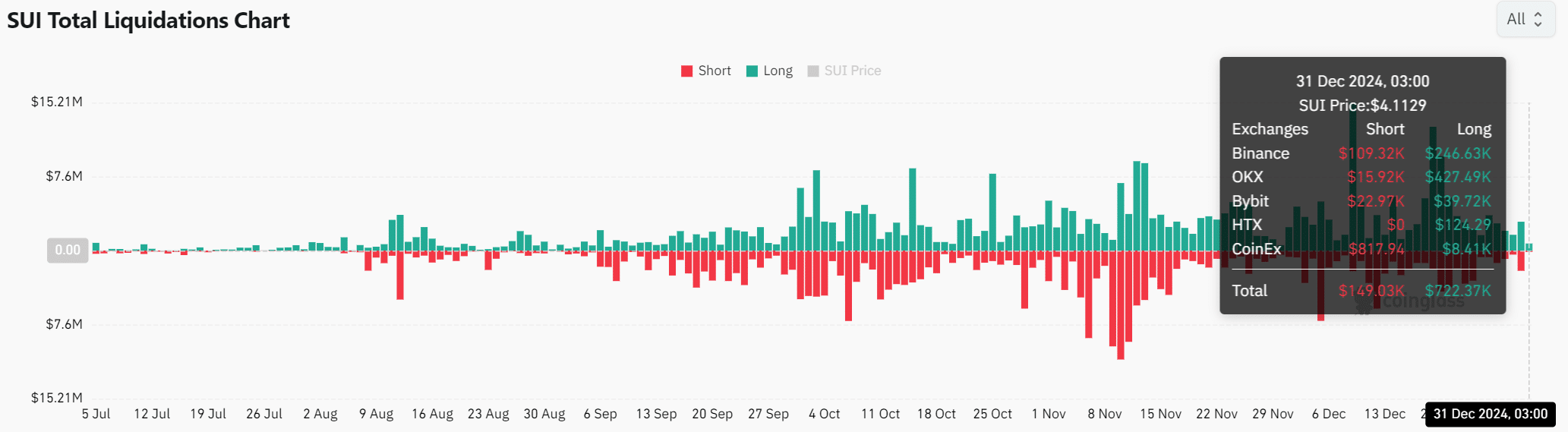

Liquidation data reveals stronger interest from bullish traders, with $149.03K in short liquidations compared to $722.37K in long liquidations at press time. This imbalance highlights growing confidence among buyers, despite the token facing resistance.

Additionally, long liquidations often indicate higher stakes from bullish positions, suggesting traders anticipate a price breakout.

However, if bearish pressure increases, these liquidations could quickly shift market dynamics, emphasizing the importance of near-term resistance levels.

Is your portfolio green? Check out the SUI Profit Calculator

Sui’s ability to break above the $4.76 resistance will determine whether it can sustain its bullish narrative in 2025. Based on its technical position and market sentiment, the token has the potential for upward momentum if it clears this critical hurdle.

However, failure to do so may lead to a period of consolidation or downside correction, requiring renewed efforts from buyers. All signs suggest a decisive move is near.