Sui’s bullish signs: $1 billion TVL and rising active addresses

- Sui’s TVL surpassed $1.03 billion, signaling growing liquidity and increased trust in the network.

- With rising active addresses and market activity, SUI is positioned to break the $1.38 resistance.

Sui [SUI] has crossed a significant milestone, with its total value locked (TVL) surpassing $1.03 billion on September 19. This achievement reflects growing trust and capital inflows into the blockchain’s decentralized finance (DeFi) ecosystem.

With Sui trading at $1.34, reflecting a 14.84% increase over the last 24 hours at press time, the question now is: could this spark a bullish rally and push SUI’s price beyond its current $1.38?

TVL growth: A Catalyst for momentum

Sui’s rapid rise from $802 million to $1.03 billion in TVL within a short time signals increased confidence in its ecosystem. The accompanying chart shows that Sui’s TVL has experienced consistent growth, particularly throughout 2024, peaking at this $1 billion mark.

TVL is a key metric in DeFi, as it reflects the total capital locked in smart contracts, driving liquidity and attracting developers to the platform.

Reaching $1 billion is not just a psychological barrier—it solidifies Sui’s position among top DeFi protocols. The additional liquidity may entice more users and investors, further boosting the network’s adoption and long-term prospects.

Rising active addresses: Growing user participation

Sui has also seen a rise in daily active addresses, increasing from 1.47 million to 1.66 million, representing a 12.93% increase in just one day. This surge indicates growing engagement with the platform’s decentralized applications and services.

A growing user base often translates to more assets being locked into smart contracts, which could sustain the upward trajectory of Sui’s TVL and contribute to future price movements.

Volume and liquidity: signs of a bullish outlook

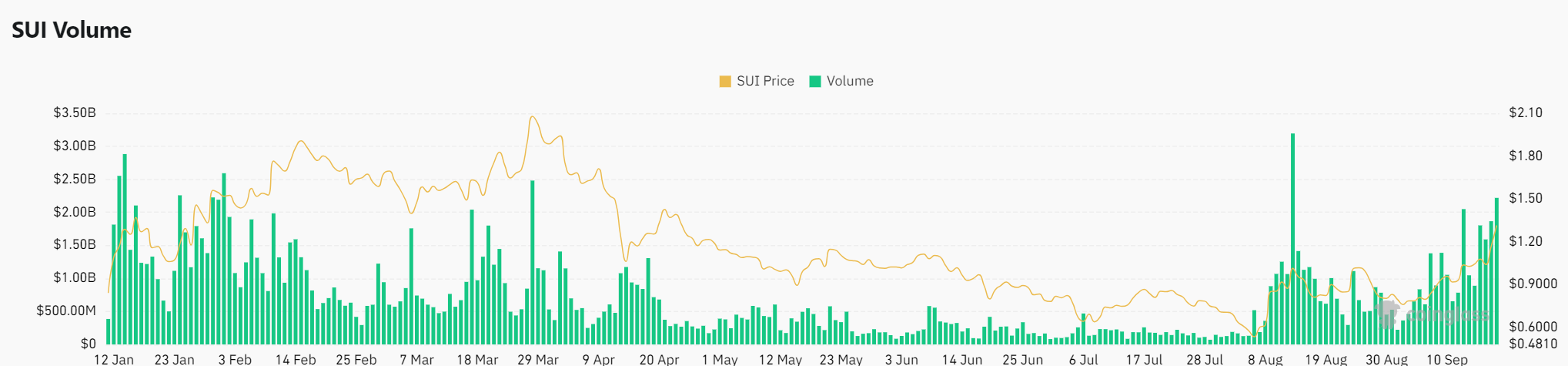

Sui’s $2.49 billion derivatives volume, up 35.57% in 24 hours at press time, points to increased market activity.

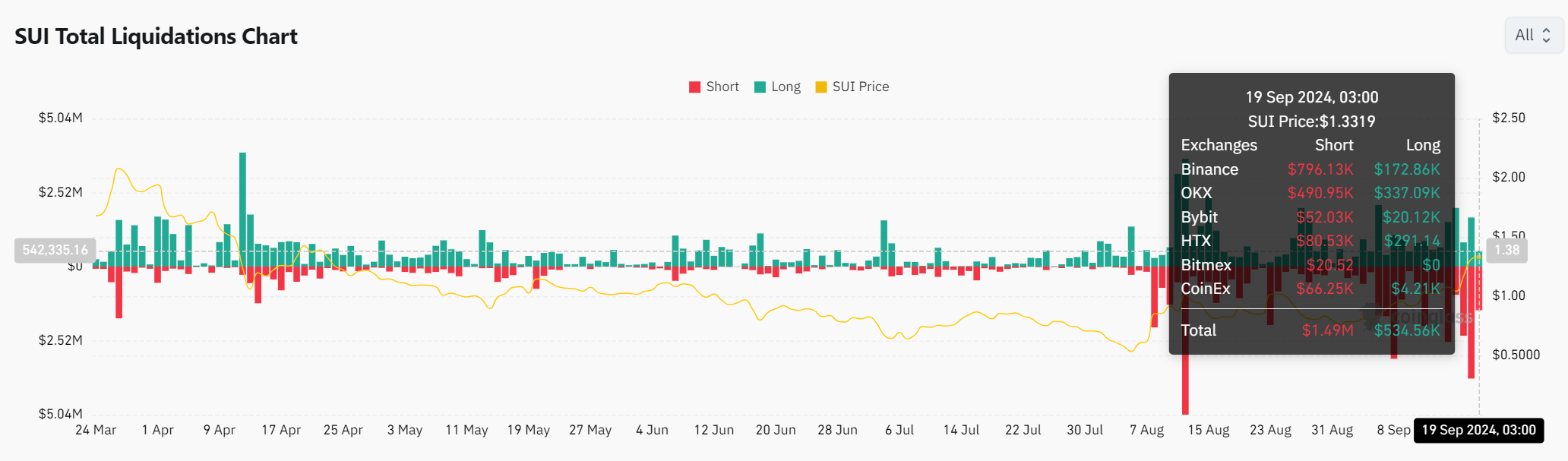

Moreover, the liquidation chart shows $1.49 million in short liquidations versus $534,560 in longs, suggesting a shift in sentiment as shorts are squeezed out.

This indicates potential bullish momentum, especially as trading volumes rise alongside TVL growth.

Can SUI break through $1.38?

Given the rising TVL, increased user activity, and strong trading volumes, Sui is positioned for a potential breakout.

Read Sui [SUI] Price Prediction 2024-2025

The $1.38 price level is a critical resistance, and if Sui can surpass this, it could signal the start of a sustained bullish rally.

Investors will be closely monitoring whether this momentum can drive prices higher.