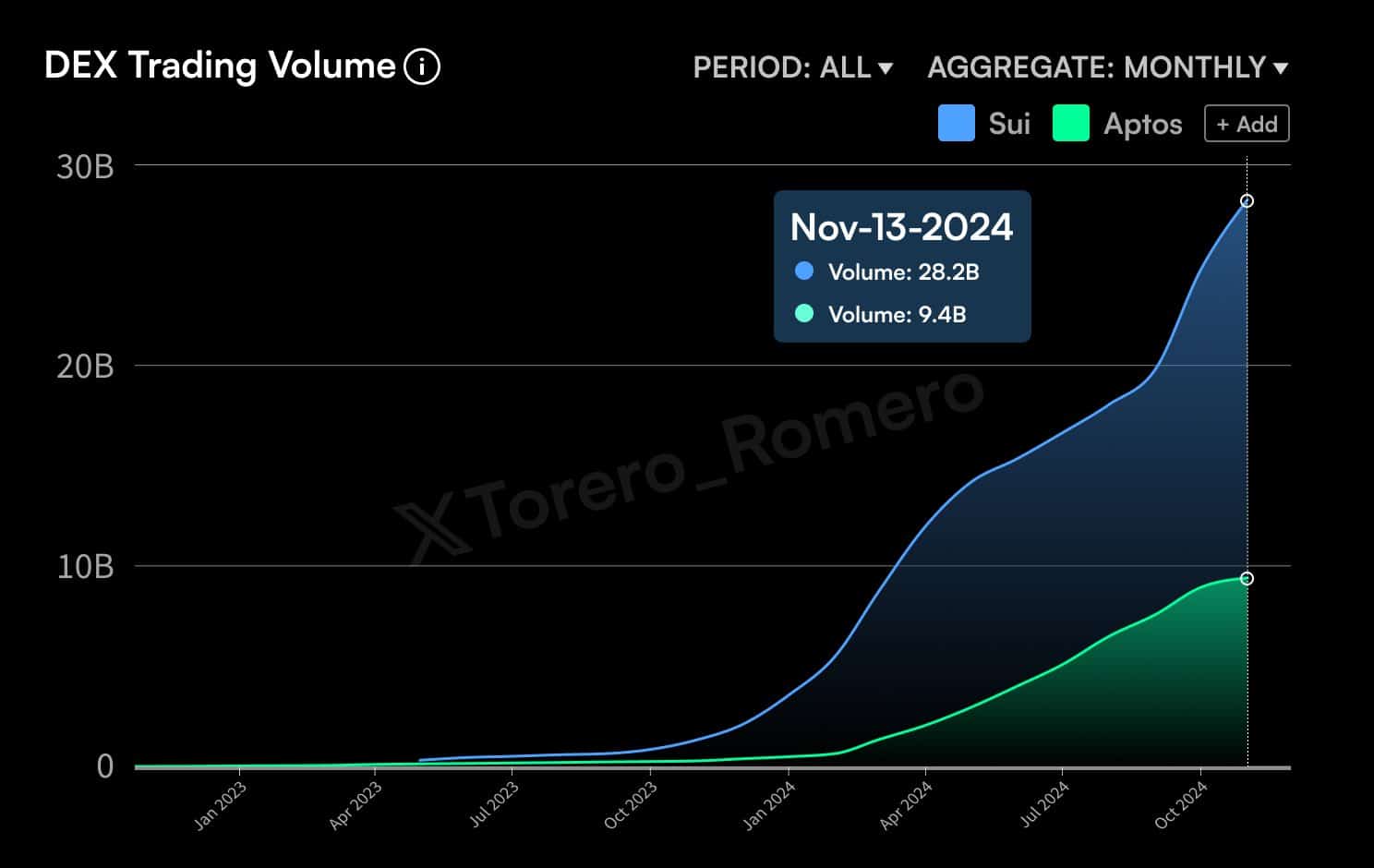

SUI’s DEX volume is now 3x of Aptos, but on the price front…

- SUI’s trading volume soared to $28B, tripling APT’s figures

- SUI’s and APT’s bearish trends were super bullish at press time

The recent surge in crypto markets has contributed to a significant hike in DEX trading volume for Sui Network (SUI), compared to Aptos (APT).

SUI’s trading volume soared to $28 billion, tripling APT’s volume which stood at $9.4 Billion. The steep upward trajectory of SUI’s line suggested rapid growth and heightened activity on its DEXs. This difference in volume is a sign of strong market preference and liquidity on Sui Network, possibly reflecting superior technological adoption or investor confidence over Aptos.

If this trend continues, SUI could enhance its position as a leading platform, by attracting more investors interested in leveraging its higher liquidity and active trading environment.

Comparing performance and price action

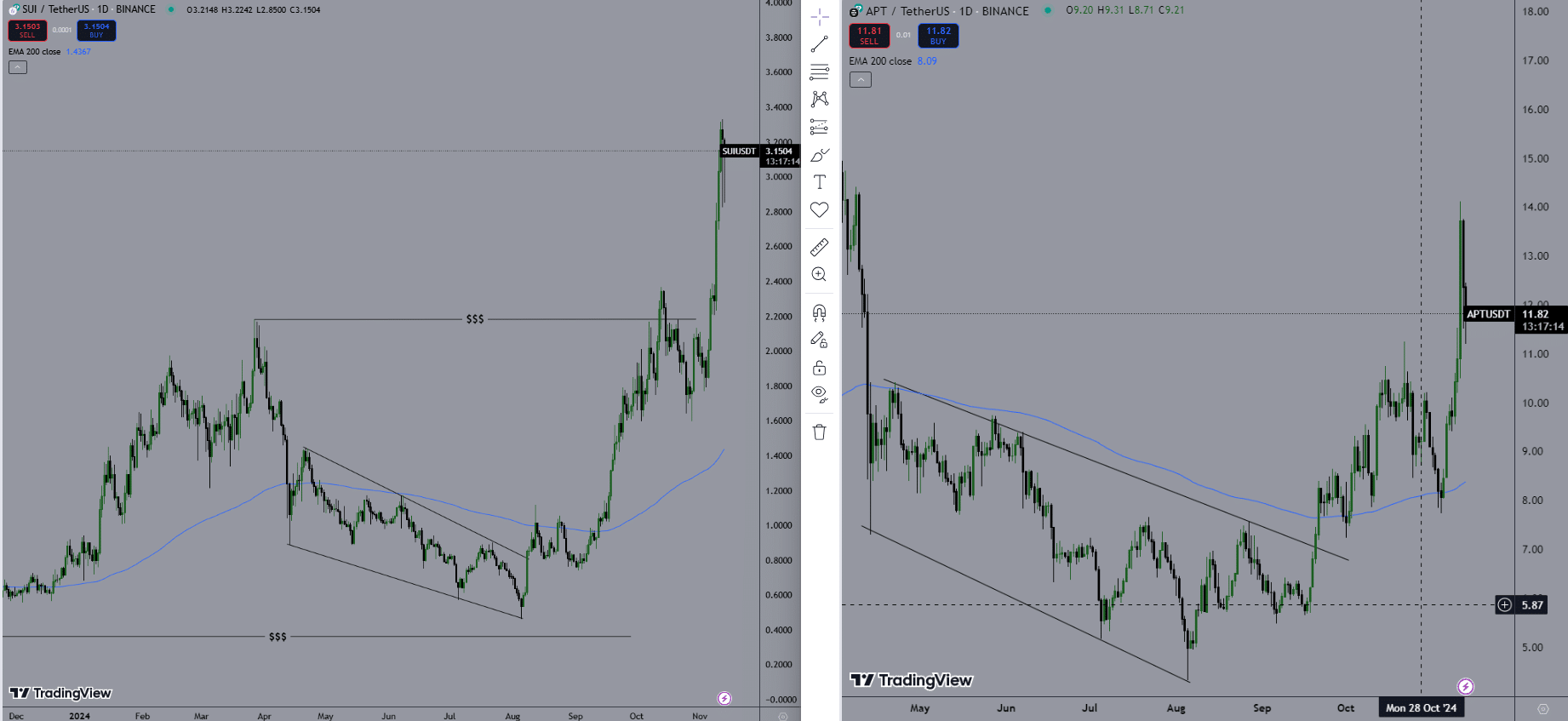

SUI‘s slight 8% hike over the last 24 hours propelled its price to $3.18, while Aptos‘ 1% uptick sent it to $12.24, at the time of writing.

Both recorded a surge in price during the most-recent crypto bull run that began late last week, driven by Bitcoin’s strong performance. However, Sui’s trading volume fell by 22%, while Aptos saw a nearly 60% drop.

SUI’s price action displayed an uptrend, breaking out of a bearish channel in late August and maintaining a sharp rise since then. This breakout, followed by sustained gains, indicated strong buying interest and bullish sentiment.

The price recently crossed above its long-term moving average (EMA 200), suggesting potential for further upward momentum. In fact, SUI could target higher resistance levels, while potentially approaching the $4-mark on the charts.

On the contrary, APT’s chart revealed a dramatic price spike after a prolonged downtrend within a bearish channel. The recent surge, breaking above its previous resistance levels, indicated a strong reversal and greater investor confidence.

Aptos, attracting over 8 million monthly users, launched the world’s first staking ETP on the SIX Swiss Exchange, in an attempt to foster institutional adoption. It’s plausible to predict a test of higher price points for APT, potentially the $15-level.

Can SUI flip APT’s price?

In conclusion, both have demonstrated strong recoveries, indicating bullish sentiment that could influence their future prices. If the press time momentum holds, both could continue their uptrends, while affecting the broader altcoin sector.

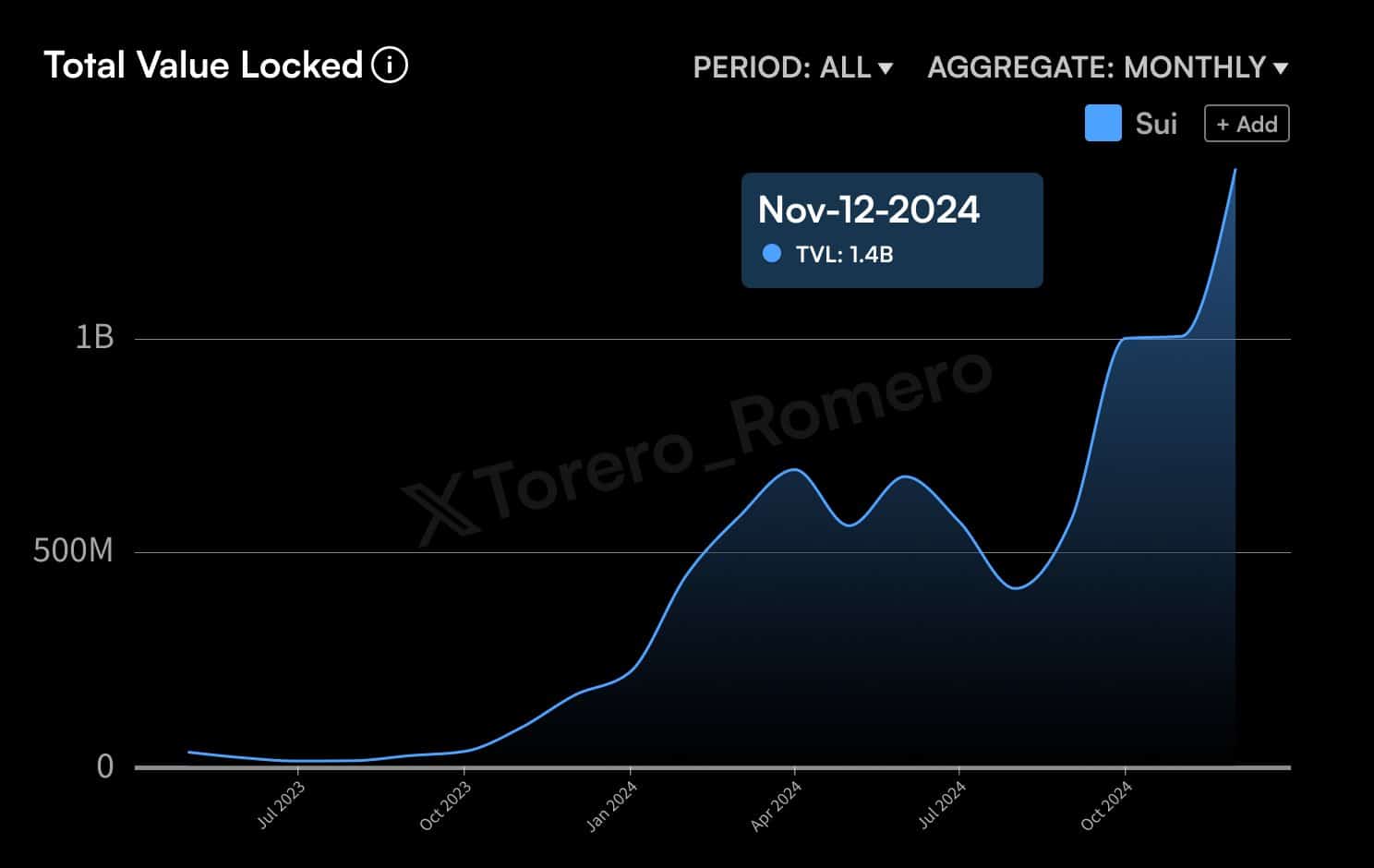

However, surpassing APT’s price will be challenging if we account for the total supply of both tokens. This, while other metrics like market cap and TVL which hit a new ATH of $1.4B, and volume, might be easier flip and outpace.

Looking ahead, SUI may be poised to potentially outpace Aptos in terms of price gains. Especially if it can replicate Solana’s success in the memecoin space.