SUI’s price dip threatens $19.7M whale position – Here’s why

- A whale’s $19.7M long position on SUI was liquidated when price reached 4.56.

- SUI hovered around $4.52 but had surged past $5.36, suggesting robust movement.

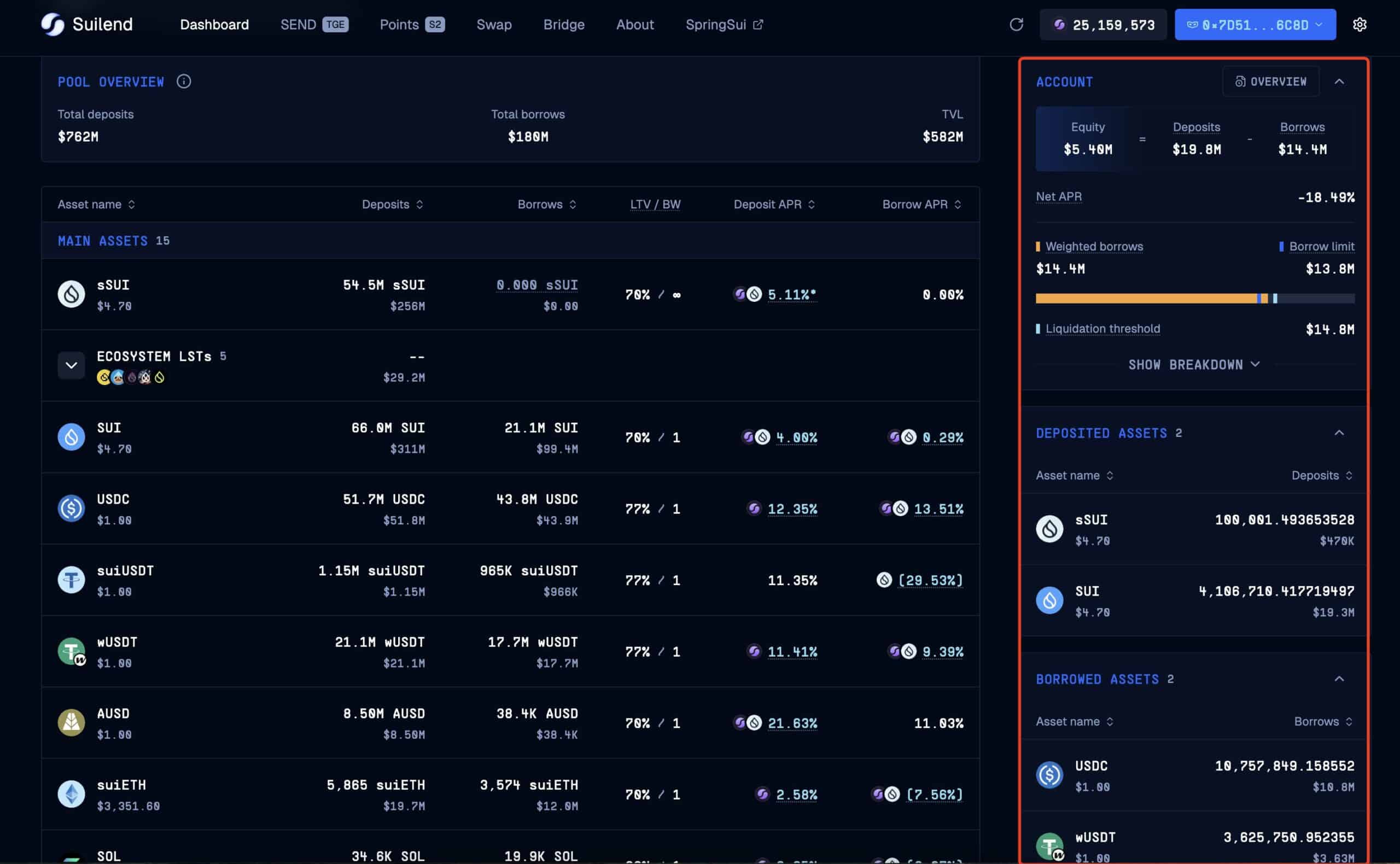

A Sui [SUI] holder on the Suilend platform injected a substantial amount, valued at approximately $19.7M, into the lending pool and leveraged this to borrow against in stablecoins.

The precarious nature of the position depends on the price staying above $4.56 to avoid liquidation, a scenario that was closely approached at the then-current trading price.

A potential drop below this threshold triggered the liquidation of the whale’s position, likely causing a ripple effect in market sentiment and possibly leading to a price dip due to the sudden increase in supply.

Conversely, the whale’s liquidation potentially stabilized or even boosted market confidence.

This event indicated the delicate balance whales maintain in crypto markets and highlighted the significant impact their actions can have on liquidity and price stability.

Price action and prediction

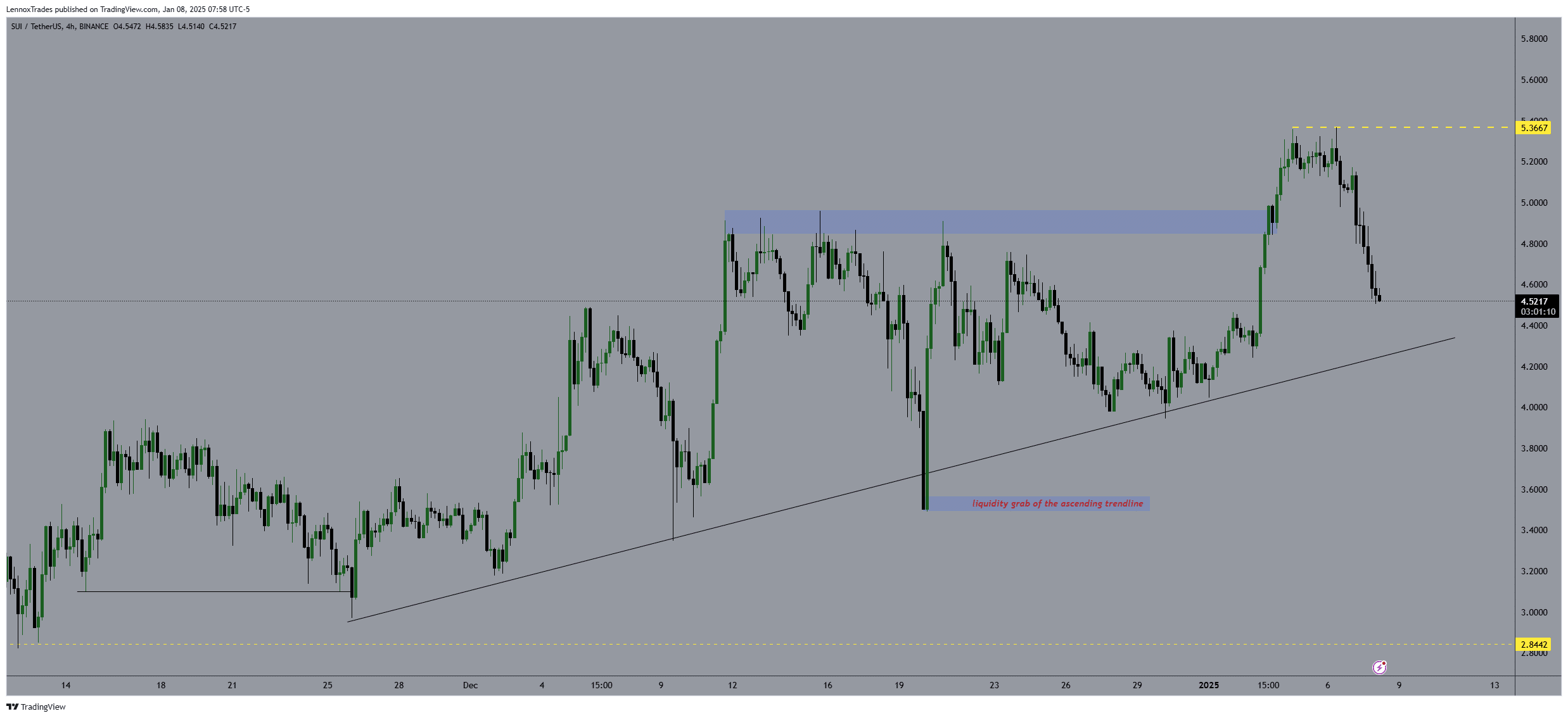

SUI’s price action indicated significant movements, with long positions prevailing. Initially, SUI’s price hovered around $4.52 but then surged past $5.36, suggesting a robust resistance level.

Following this peak, the price experienced a steep decline, descending back toward the $4.52 mark.

This pattern forms a critical area of the ascending trendline, often seen by traders as a liquidity grab zone.

Given the sharp rebound from the lower boundary, the coin might offer a lucrative buy opportunity if it continues to respect this ascending support.

However, caution is warranted, as a break below this ascending trendline could see the price target in the $2.84 area, marking a significant drop. These levels could dictate the short-term price trajectory.

This analysis, focused on SUI’s potential for lower buy-in points, aligns with broader market observations and trading strategies commonly employed in volatile cryptocurrency markets.

SUI’s on-chain analysis

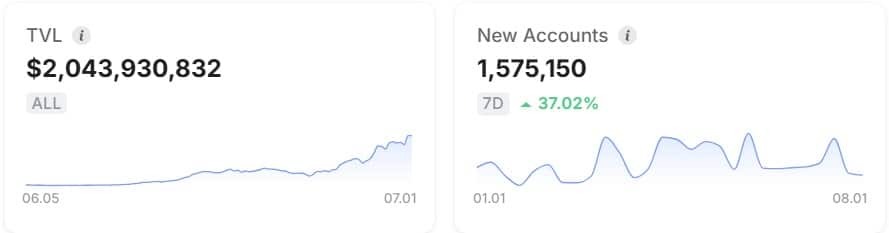

The TVL growing to $2 billion alongside a 37% week-on-week increase in new accounts, signaling strong network engagement despite broader market corrections.

Historically, such positive metrics hint at a potential uptick in the coin’s price as increased adoption may counteract prevailing downward pressures.

The influx of new accounts during a market downturn could imply growing trust and interest in SUI, possibly cushioning it against harsher drops and setting the stage for recovery.

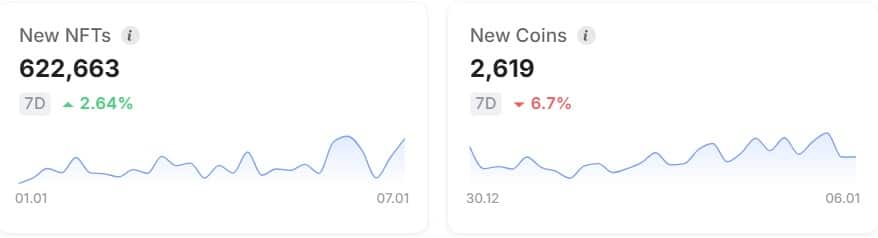

In the past seven days, new NFTs on the SUI blockchain increased by 2.64%, while the creation of new coins dropped by 6.7%. This indicates a shift in development focus towards non-fungible tokens despite the ongoing market correction.

Is your portfolio green? Check out the SUI Profit Calculator

This trend might suggest a heightened interest in NFTs on the SUI platform, potentially stabilizing or even increasing the price of SUI as investors and users engage more with NFT-centric projects.

Source: SUI Explorer

This shift could buffer SUI’s price against broader market trends, provided NFTs continue to attract attention and investment within the ecosystem.