Ethereum

Supply dynamics post ATH indicate this for Ethereum in the near future

Ethereum, the king altcoin has enjoyed a steady climb upward, reaching an ATH of $4,440.77 and was still trading at a modest $4,330.08. While price predictions and anticipations

of a run to another ATH are floating around in the market, Ethereum’s supply dynamics have been narrating a separate tune, a pleasant tune (luckily for the bulls).Increased Utility

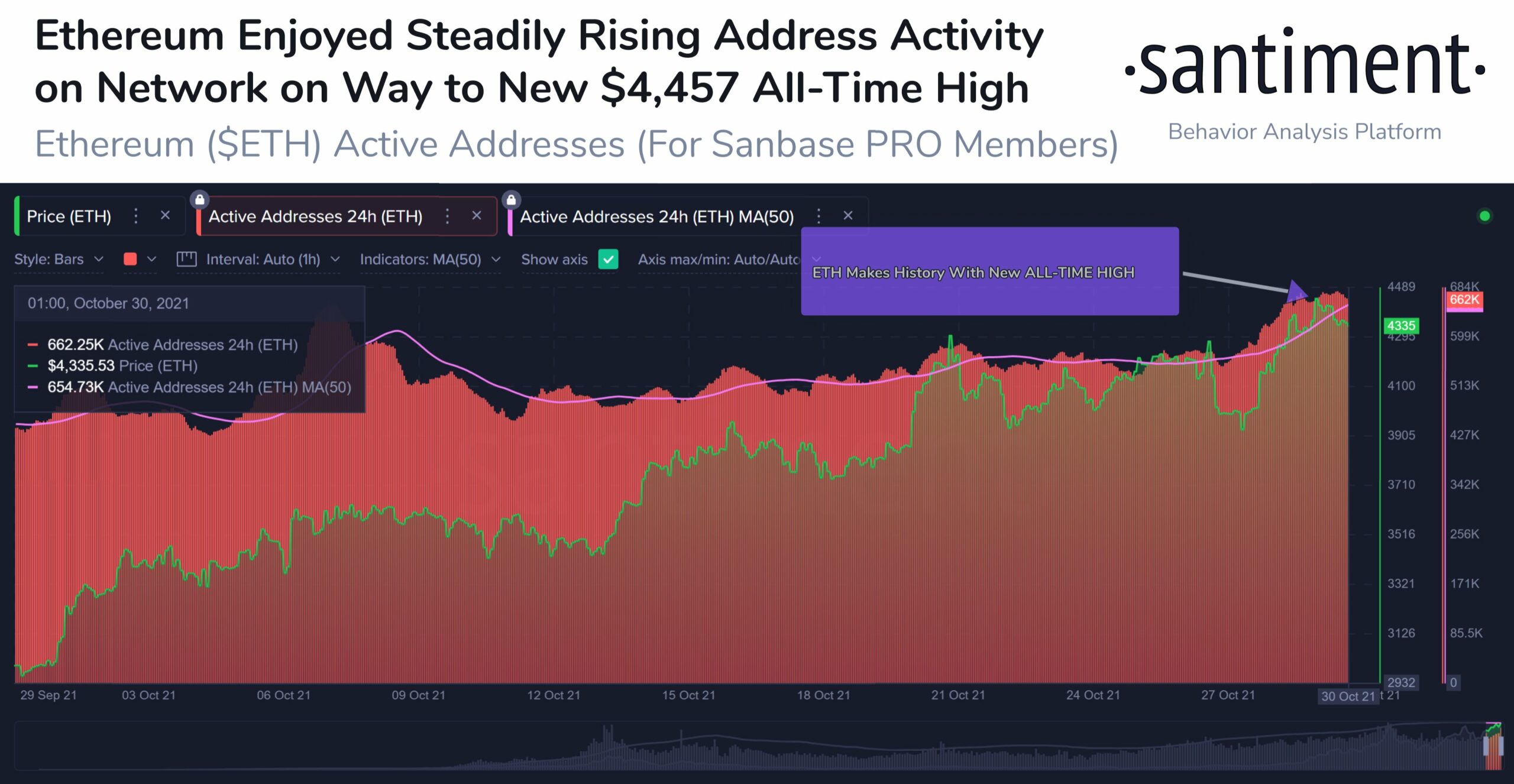

Notably, the number of ETH active addresses over the past month saw a steady rise which was key to establishing its new price ATH of $4,457 on October 29. This increased utility continued to be one of the main proponents for price gains.

Source: Santiment

The good news was that active addresses still held the higher levels, as did ETH’s price. Further, the number of new addresses also saw a massive uptick presenting heightened market euphoria and newer participants flocking to the network. The number of new addresses climber by over 65% in less than a week.

That being said, as Ethereum hit a new ATH after reaching a massive token circulation output day of 1.74M $ETH, the same created a bullish divergence. All in all, on-chain metrics appeared to be quite healthy for the top altcoin as utility seemed to be boosting too.

Source: Santiment

Supply and demand leading to price discovery

For the fourth time since May 2021, Ethereum was reaching the all-time high level of $4400. In that same period of time, the supply and demand of Ethereum changed drastically. Notably, in only five months’ time, the available supply of Ethereum on central exchanges has decreased by 18%, which equals an amount of more than 4 million ETH.

Source: CryptoQuant

A CryptoQuant post highlighted how based on supply and demand dynamics, the aforementioned trend could lead ETH into price discovery very soon.

However, in the near future, one possible scenario for Ether would be to flip the $5000 support/resistance and then continue rallying upward. Analyst Michaël van de Poppe also noted that the next Ethereum impulse wave target could be $6,000.

Notably, as per data from Skew there are close to 102K calls placed at the $5K level for Ether according to Ether options global interest by strike. So, seems like a large chunk of the market hopes to see ETH above $5K.