Surge in Shiba Inu exchange inflows isn’t all bad news – Here’s why

- Shiba Inu inflows to derivative exchanges have surged to a three-month high amid rising leverage.

- SHIB also made a bullish crossover on the one-day chart after the 50-day SMA moved above the 150-day SMA.

Shiba Inu [SHIB] traded at $0.000019 at press time after a slight 4.8% gain in 24 hours. These gains come as many altcoins track Bitcoin [BTC] performance, which is fast approaching its all-time highs.

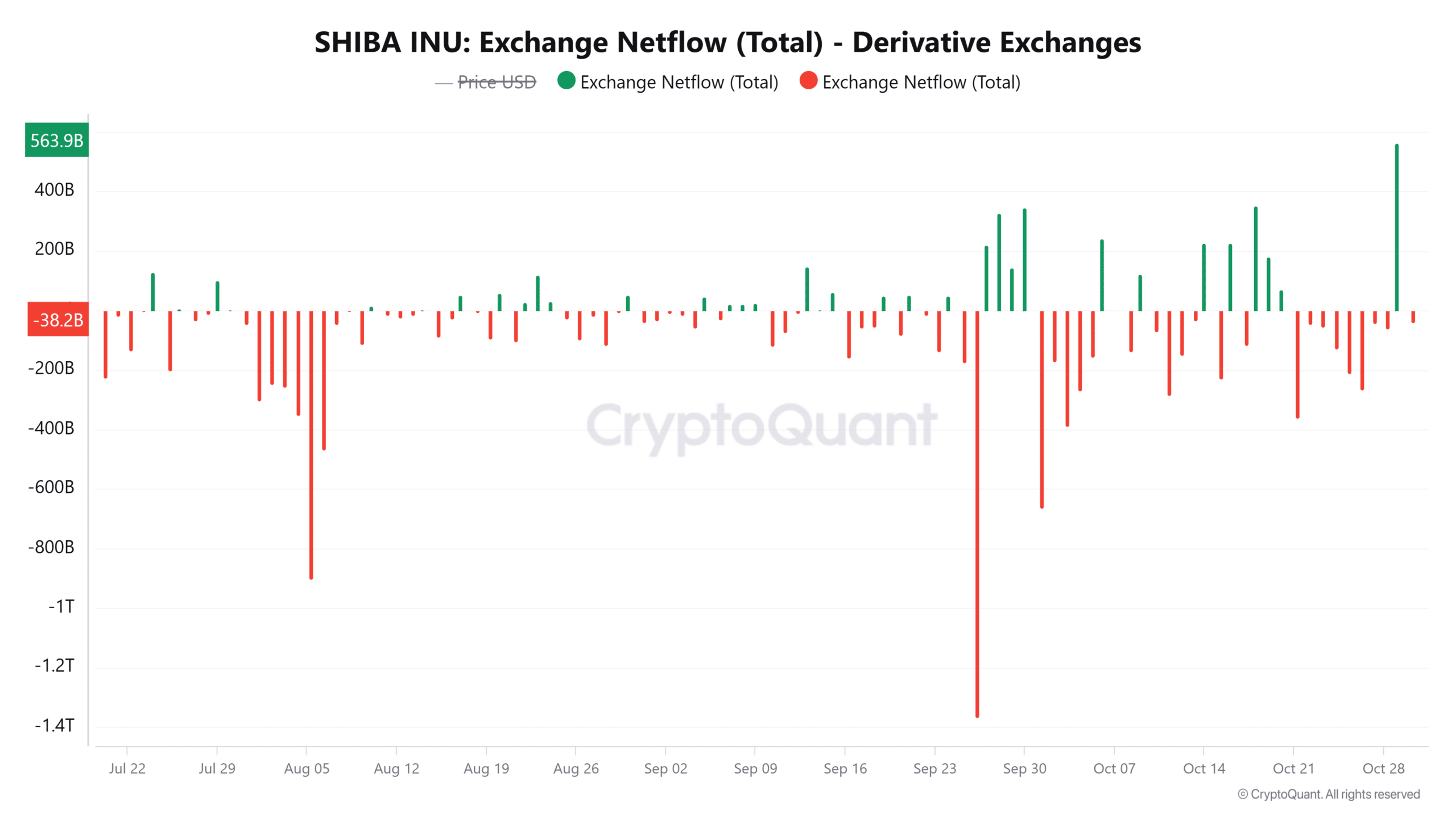

The recent gains coincided with a spike in inflows to derivative exchanges. On 29th October, SHIB netflows to derivative exchanges reached a three-month high of 563 billion.

Unlike in spot exchanges where rising inflows signal selling pressure, inflows to derivative exchanges usually indicate increasing leverage.

This data suggests that derivative traders could be opening new positions on SHIB. Per Coinglass, these inflows coincided with a spike in open interest and funding rates showing that traders were opening long positions.

An influx in long positions usually portrays bullish sentiment. At the same time, technical indicators suggest that SHIB is poised for more gains.

SHIB portrays bullish signs

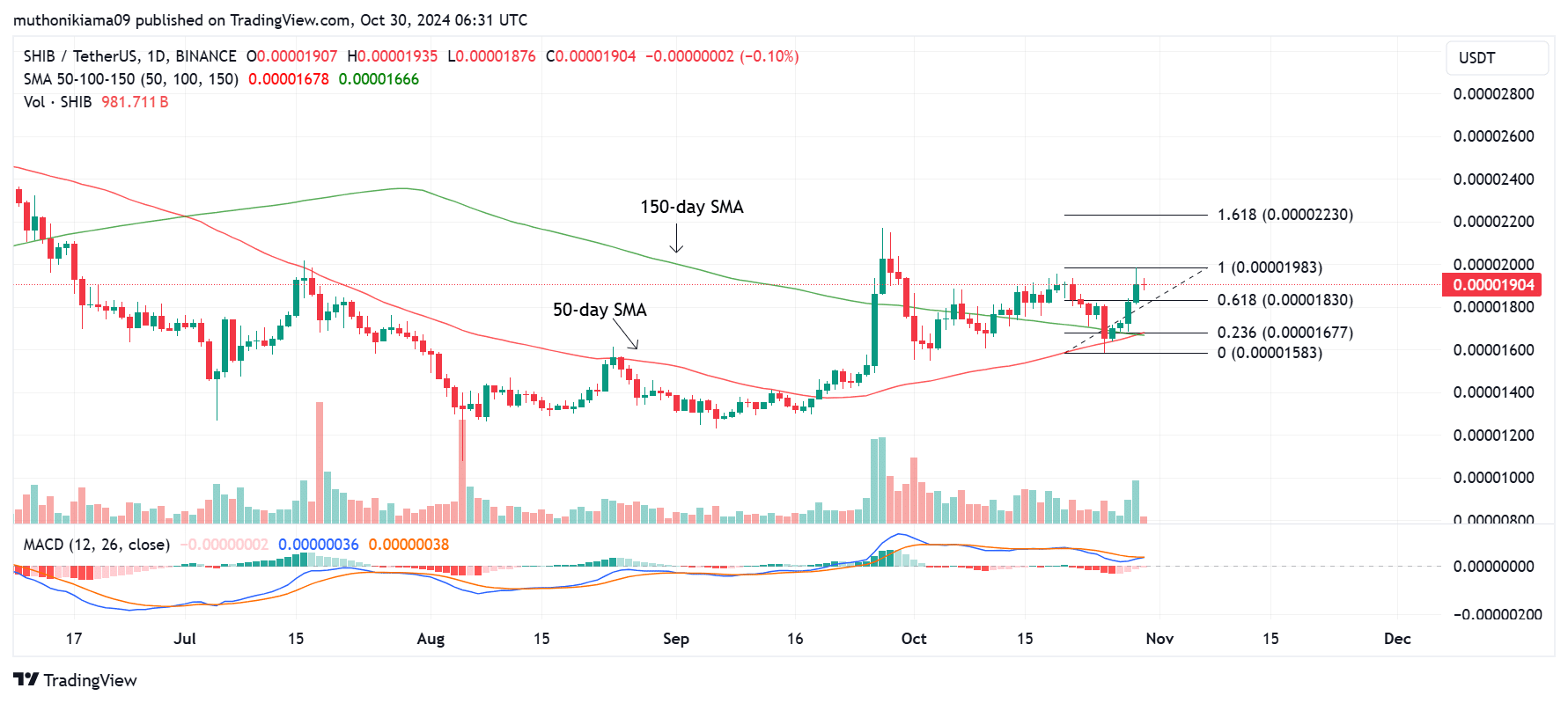

Shiba Inu’s one-day chart shows a myriad of bullish signs after the 50-day Simple Moving Average (SMA) crossed above the 150-day SMA.

This crossover suggests that the short-term bullish momentum is gaining strength, which could support the continuation of the uptrend.

Besides the moving averages, technical indicators suggest that SHIB’s bulls are gaining strength. The Moving Average Convergence Divergence (MACD) line has converged with the signal line, suggesting that the downtrend is weakening.

The MACD histogram bars are also shrinking and fading, further showing that the selling pressure is waning.

If the MACD moves above the signal line, it will create another buy signal that could see SHIB prices post a 17% rally to the 1.618 Fibonacci level ((0.0000223).

Spike in active addresses

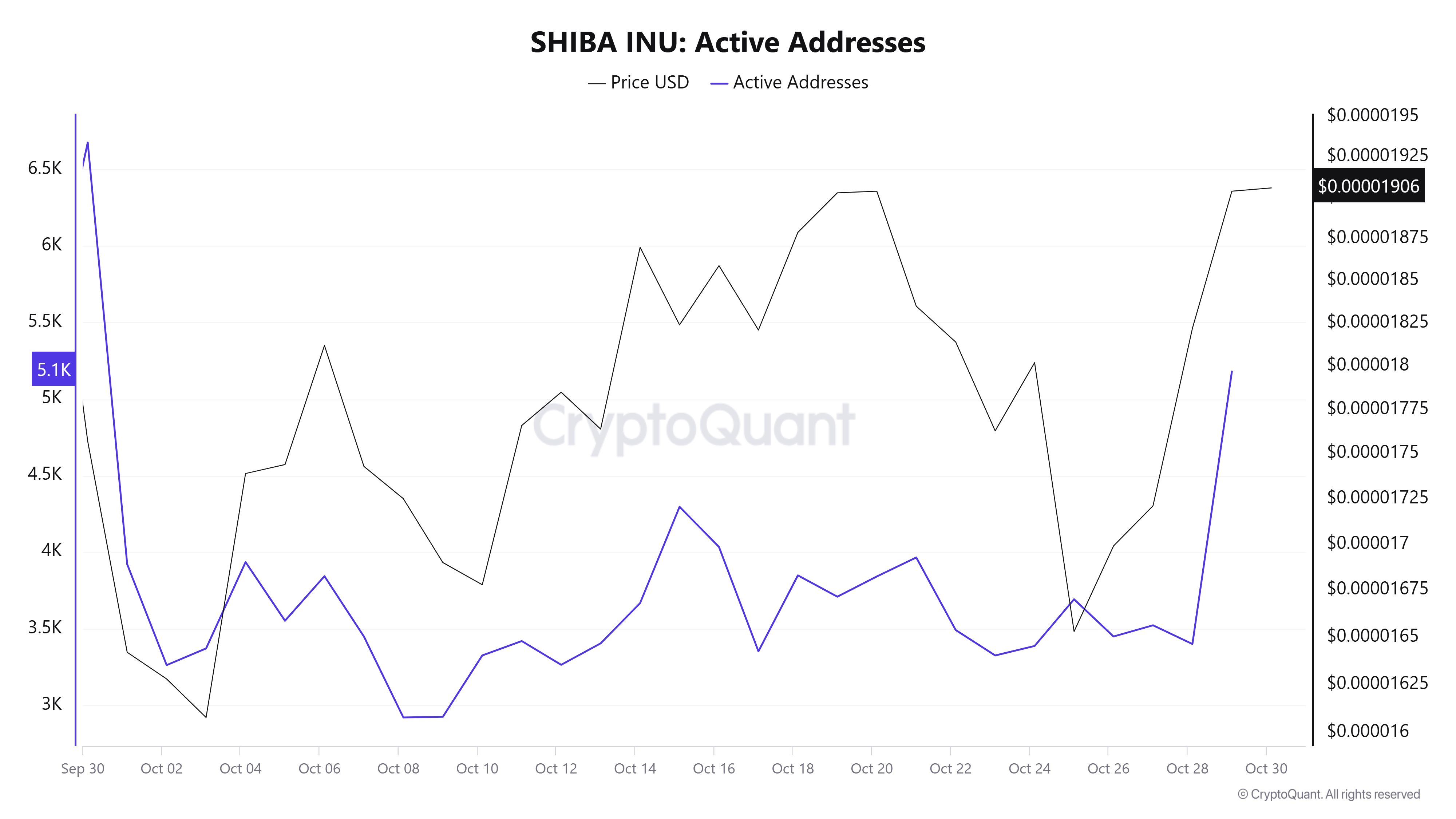

A surge in SHIB active addresses is also fuelling the bullish narrative. In 24 hours, the daily active addresses increased from 3,400 to a three-week high of 5,200, signaling rising user engagement and high demand for Shiba Inu.

Besides the increase in daily active addresses, SHIB transaction volumes also increased to 7.6 trillion tokens. This was a seven-fold increase in just three days per IntotheBlock.

Read Shiba Inu [SHIB] Price Prediction 2024-2025

A sustained increase in active addresses and the transaction count could support Shiba Inu’s uptrend. However, the sustainability of the rally will depend on the market sentiment.

Data from Market Prophit shows that the crowd sentiment around SHIB is bullish while smart money sentiment is bearish.