SUSHI: What to look out for and how to take advantage

To many, SushiSwap is one of the most exciting projects in the DeFi space, with features ranging from swapping, stack yielding, lending, borrowing and leveraging all on one platform. Price action wise, since the beginning of 2021, SUSHI has given phenomenal returns – rallying by nearly 1000% in just two and a half months.

However, it hasn’t been doing very well since. In fact, it didn’t even participate in ‘Uptober’ or the November 2021 bull run phase. According to some, currently, it is in a very worrisome situation.

Technically, SUSHI is trading at the very bottom of a descending triangle, barely teetering on the bottom edge. Any slip-up from this point on can, quite literally, cause a freefall since there isn’t any meaningful support level until around $0.5.

In other words, no support for a further 80% fall in market cap. Even the RSI has been following the prices and with it placed around the 42-mark, it can fall further before breaching the oversold territory.

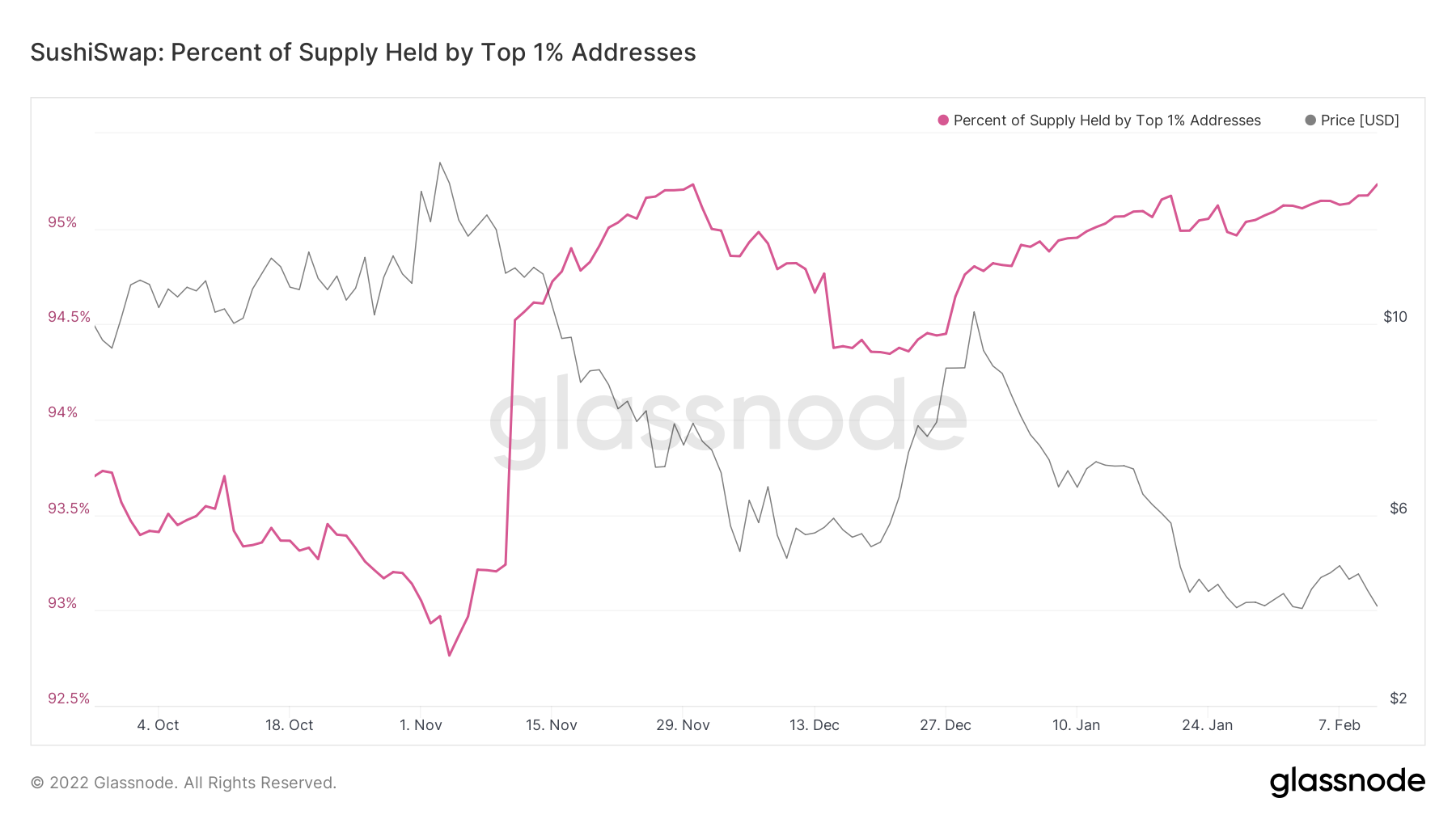

Additionally, on-chain metrics are throwing up major red flags all over the place. For example – Percentage of supply held by top 1% of addresses has been showing an inverse relationship to prices. Usually, the more bigger players hold on to a particular coin, the more it is expected to appreciate.

However, in SUSHI’s case, the opposite seems to be the case. Bigger players are in it only to trade off SUSHI, with very little long-term conviction. Whenever there has been a price rally in the past, it was usually accompanied by falling percentage of supply held by these bigger players in the market.

A typical ‘sell on rise, buy on dip’ trading strategy.

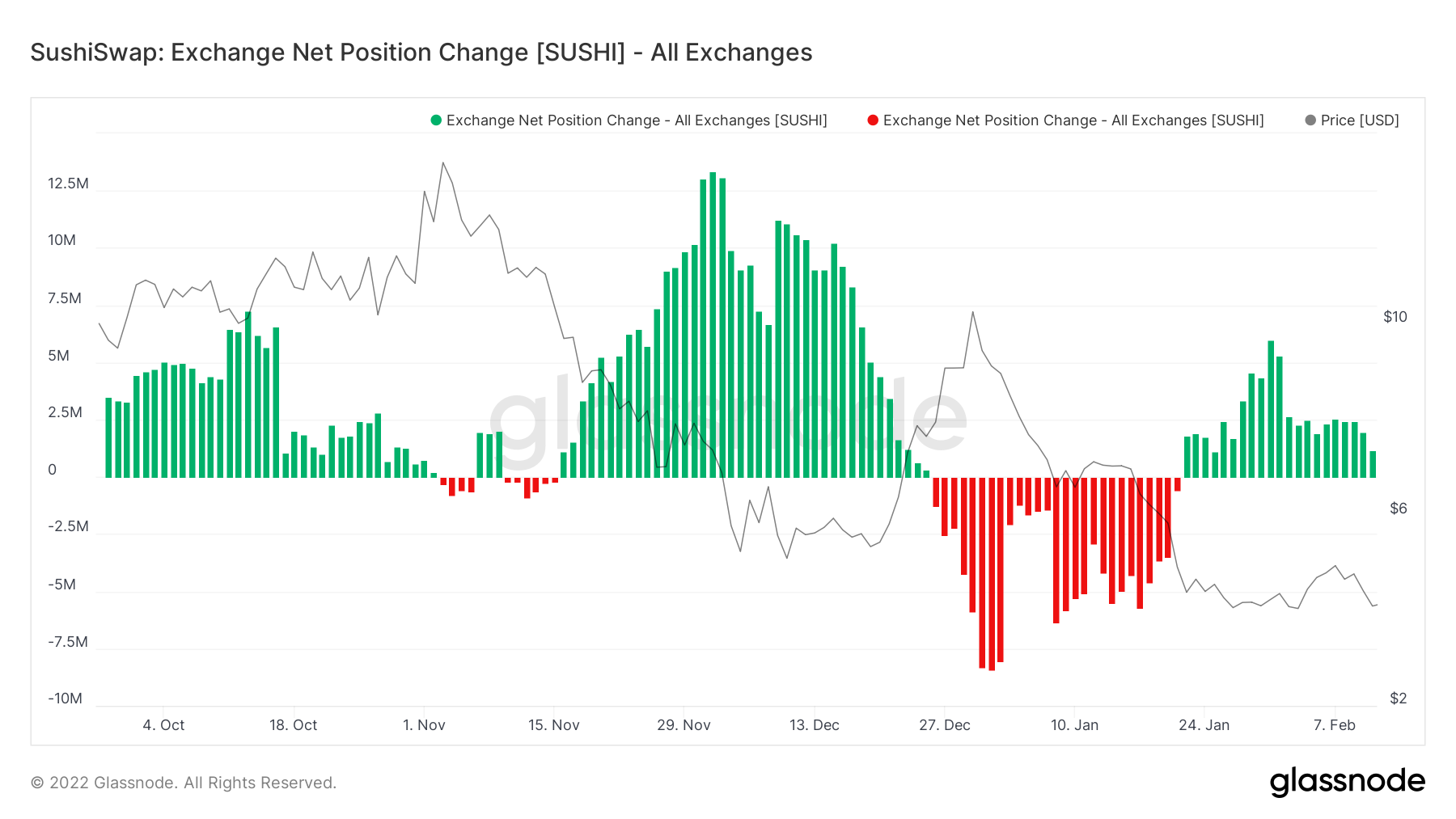

Here’s another way to look at it,

All price rallies have been immediately followed by a significant increase in the exchange net position change – Suggesting a transfer of tokens from wallets to exchanges to sell them off. Inversely, all dips were immediately followed by a fall in the exchange net position change – or buying the dip.

To add to that, the supply held by top exchange addresses has been significantly greater than the supply held by top non-exchange addresses on the chain – proving the above inference yet again.

Supply held by top non-exchange addresses vs Supply held by top exchange addresses | Source: Santiment

Also, the NVT Ratio for SUSHI has been quite high despite its fall in prices. One can quite clearly how overvalued the network is based on this ratio. The ratio is calculated by dividing the market cap by the transferred on-chain volume – and a jump in NVT with falling market cap shows how poor the transferred on-chain volumes are.

So overall, unlike most other prominent coins which have lost value due to market sentiments while keeping their fundamentals intact, it seems SUSHI has been deteriorating and can be expected to fall further on such weak fundamentals. A short position on this coin can be a viable strategy, however, one needs to be careful and impervious to extreme volatility in the short term.