Altcoin

SushiSwap becomes Filecoin’s first DEX, how about FIL?

SushiSwap revealed that users would be able to make cross-chain transactions on Filecoin network across 30 different blockchains.

- Filecoin integrated the SushiSwap v2 and v3 AMM on its network.

- FIL price may pullback but a move higher than $4.50 may be close.

Decentralized storage network Filecoin [FIL] has adopted SushiSwap [SUSHI] as its first Decentralized Exchange (DEX). To be clear, a DEX is a cryptocurrency exchange that operates on the blockchain without any intermediary.

SUSHI gets added to the storage

According to SushiSwap’s official X handle, both the v2 and v3 Automated Market Maker (AMM) would be deployed on Filecoin.

An AMM is a DEX that makes it easy for traders to buy and sell cryptocurrencies using robot algorithms instead of the usual traditional order book.

SushiSwap also revealed that users would be able to make cross-chain transactions on Filecoin across 30 different blockchains.

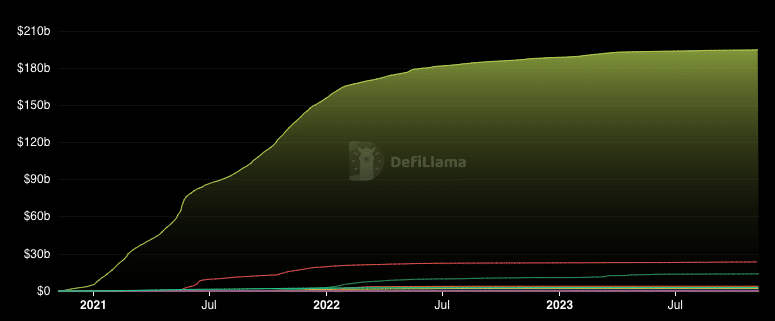

According to DeFiLlama, SushiSwap’s DEX volume increased by 95.84% in the last seven days.

This jump in trading volume indicates that users have been actively using SushiSwap. It also means that there is a wide range of tokens available for exchange, thereby increasing the liquidity on the chain.

In terms of the price action, SUSHI, despite a 77.89% 30-day increase has decreased by 15.94% in the last seven days. The plunge in price could be linked to profit-taking by market players who had held the token at very low values.

FIL, on the other hand, was having a field day. According to CoinMarketCap, the price of FIL moved up by 12.57% within the same period as the token hit $4.50.

FIL moves higher, SUSHI activity follows

A price analysis by AMBCrypto showed that FIL’s price may continue to increase in the short term. This was because of the indications shown by the Exponential Moving Average (EMA).

At press time, the 20 EMA (blue) was above the 50 EMA (yellow). This stance is a sign of a bullish trend. Meanwhile, the Relative Strength Index (RSI) dropped to 59.45.

The decrease in the RSI reading is proof that buying pressure is waning. So, there is a chance that the Filecoin native tokens will pull back before another uptrend.

When considering the active addresses on SushiSwap, on-chain data from Santiment revealed that the number has been increasing since 8th November. The increase in active addresses means that transactions using the SushiSwap network have been reviving from their lows.

With the Filecoin integration, there is a chance that the activity on the SushiSwap network may increase. Therefore, there could also be a jump in the 24-hour active addresses.

On the social front, Filecoin seemed to be getting more recognition and attention from the market.

Read Filecoin’s [FIL] Price Prediction 2023-2024

This inference was based on social dominance. As of this writing, the social dominance was up to 0.142%, indicating a surge in the hype FIL has.

The rise in social dominance could be a sign that FIL has hit a short-term market peak. Therefore, participants should be wary of buying FIL at the current market price if they intend to make quick profits from the token.