SushiSwap: This new tokenomics model to be introduced following $3M hack

HD: SushiSwap [SUSHI] to promote Uniswap v3 adoption as part of its new tokenomics model

SushiSwap [SUSHI] aims to introduce sweeping changes to tokenomics following $3.3 mn hack

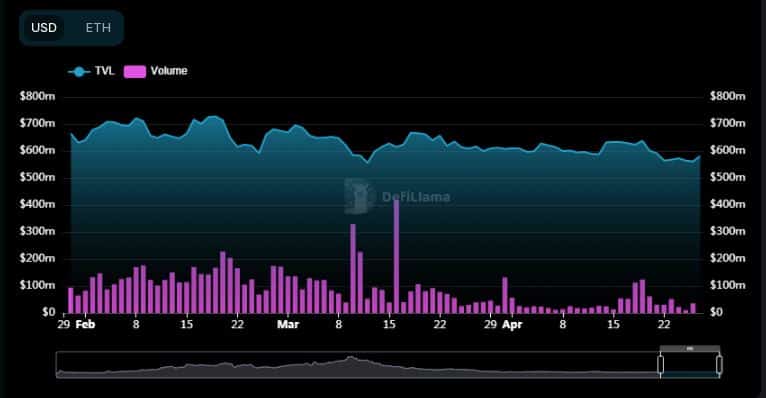

- The volume recorded on the DEX in the last 24 hours was $35.6 million, representing a decline of 40%.

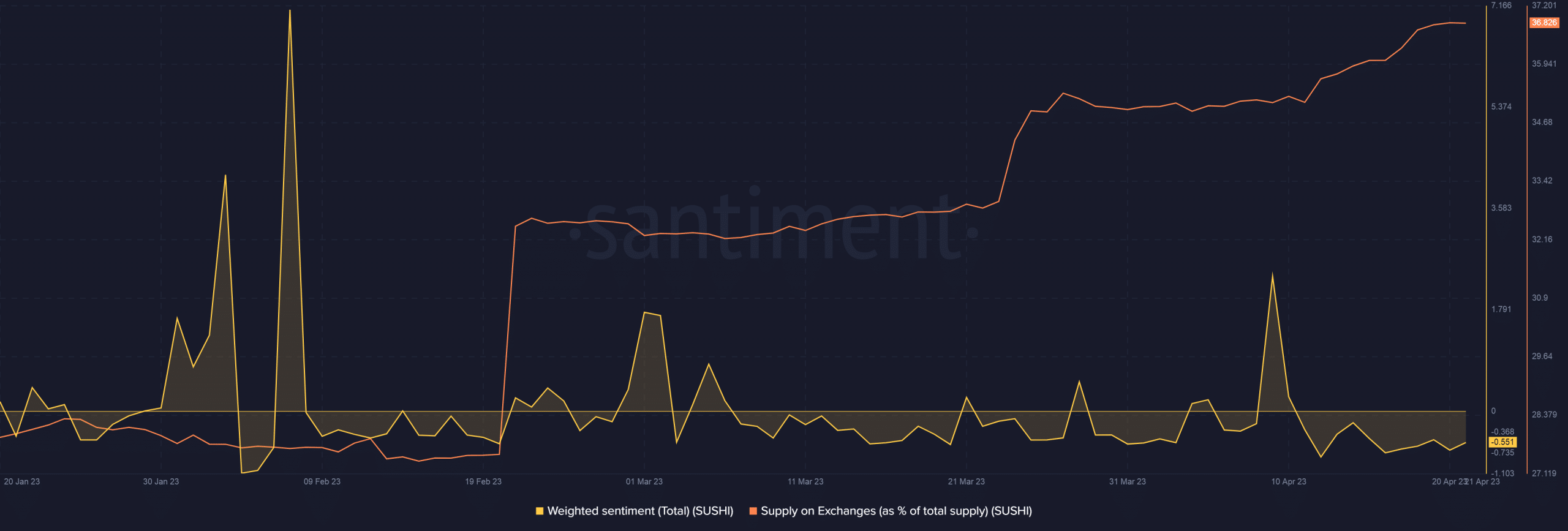

- SUSHI’s supply on exchanges was on an upward trend since last month.

After taking steps to neutralize the impact of the recent RouteProcessor2 exploit, decentralized exchange (DEX) Sushiswap [SUSHI] shifted its focus to a new tokenomics model, one that will promote the adoption of Uniswap [UNI] v3.

Realistic or not, here’s SUSHI’s market cap in BTC terms

SushiSwap CEO Jared Grey took to Twitter on 26 April to lay down the DEX’s roadmap. The plan is to increase SushiSwap’s market share, address governance-related issues and improve security.

We've spent the past four months building additional tokenomics models to strengthen our proposed model & we're planning a complete overhaul of our Chef contracts to give the tokenomics the best chance of success. 8/

— Jared Grey (@jaredgrey) April 26, 2023

Sweeping changes expected?

According to Jared Grey, the team has been working on the proposed tokenomics for the past four months, and it was expected that the model will soon be put up for final discussion and voting. The changes will involve a complete overhaul of the protocol’s smart contracts.

Grey said that V3’s enhanced capital efficiency and improved tokenomics will help SushiSwap grow its market share and appeal significantly. To facilitate the deployment of Uniswap V3, the DEX built a new route processor, version 3, and stealthily launched it on some networks.

It is to be noted that the recent hack exploited a vulnerability in version 2 of SushiSwap’s Route Processor, which led to the siphoning of $3.3 million worth of funds. SushiSwap then launched a claims portal, allowing victims to reclaim the whitehacked funds.

Moreover, in order to boost cross-chain volume, SushiSwap was making improvements to its UI/UX and upgrading its cross-chain swap interface.

Trading volume plunges

SushiSwap’s trading volume dropped significantly in April, weighed down by the double whammy of regulatory concerns and the recent exploit. At press time, the volume recorded on the DEX in the last 24 hours was $35.6 million, representing a decline of 40%, per DeFiLlama.

The total value locked (TVL) on the protocol fell to $584.48 million, down by over 8%.

How much are 1,10,100 SUSHIs worth today?

Declining appetite for SUSHI?

Following Bitcoin’s [BTC] dramatic flash crash on 26 April, SUSHI’s price slipped below $1 briefly. However, it recovered to $1.04 at press time, data from CoinMarketCap showed.

The sentiment towards the coin has been in negative territory ever since the details about the hack were made public. The supply on exchanges was on an upward spiral since the last month, which was a reflection of declining investor appetite for SUSHI.