SushiSwap’s Q2 report highlights V3 dominance and its surge in…

- Sushi quarterly report shows a surge in TVL, but overall, TVL trends sideways.

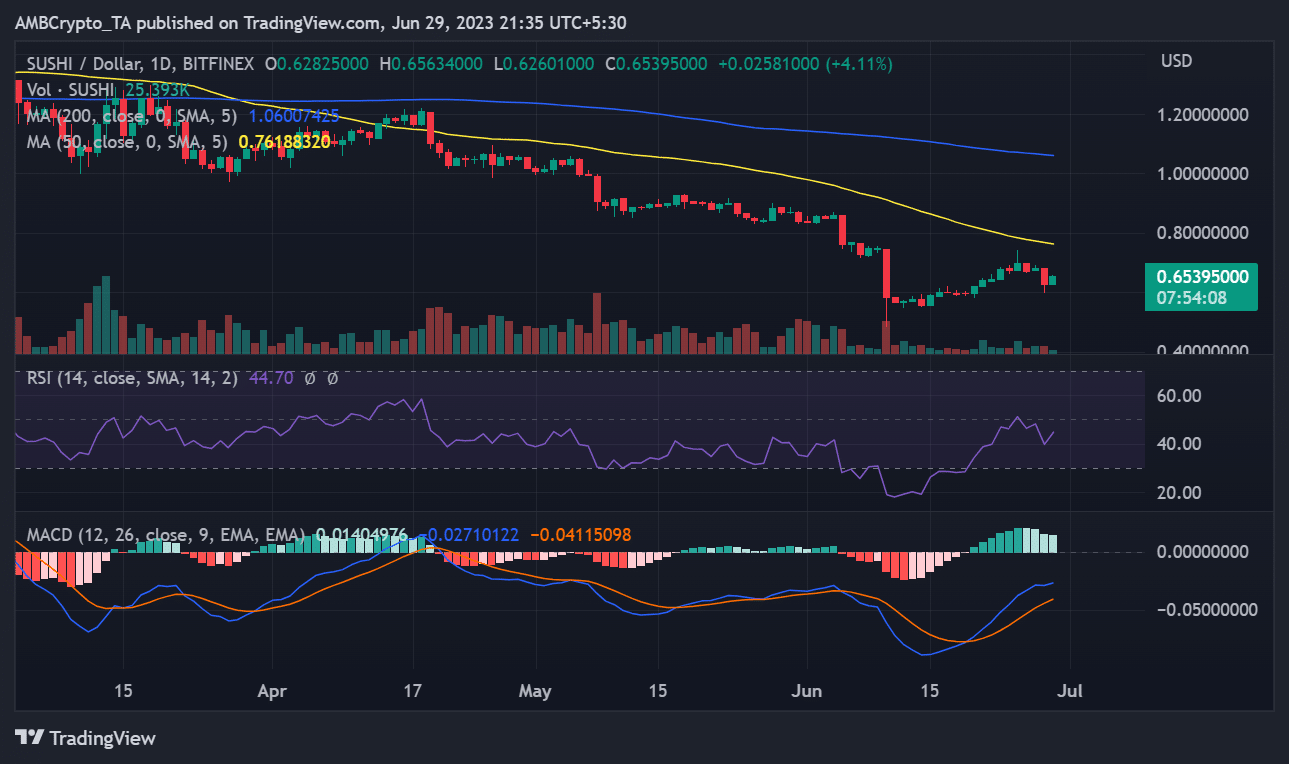

- SUSHI sees over 4% growth as it trades around $0.65.

In a recent update by SushiSwap, the platform shed light on its endeavors as the second quarter drew close. According to their report, the V3 version of their platform experienced an impressive surge in Total Value Locked (TVL).

However, the burning question remains: Has this surge in TVL contributed to overall growth in TVL?

– Read Sushi (SUSHI) Price Prediction 2023-24

Sushi releases Q2 reports

On 28 June, Sushi presented what could be deemed a comprehensive quarterly report highlighting the platform’s noteworthy accomplishments thus far in the year. Within this insightful report, one notable achievement that took center stage was the impact of Version 3 (V3).

The report revealed that V3 had been successfully deployed across 20 networks, with five other networks awaiting integration. This extraordinary reach solidified V3 as the most extensively accessible version of the platform to date.

Furthermore, the report highlighted the remarkable growth exhibited by V3 in terms of Total Value Locked (TVL) and trading volume since its unveiling.

A dive into V3 activities

According to data from DefiLlama, Sushi V3 experienced a remarkable surge in Total Value Locked (TVL) since its initial release. As of this writing, the chart indicated an upward trend, with the TVL surpassing $8 million. Additionally, a glance at the TVL of the entire platform revealed a figure exceeding $440 million.

However, when examining the overall TVL trend, some significant movement in this regard was still to be seen. The chart illustrated a nearly stagnant pattern at the time of writing. Furthermore, despite the impressive growth of V3, the overall TVL remained relatively static.

A closer look at the volume of Sushi V3 also demonstrated a decent level of trading activity. Notably, a spike in volume could be observed on 22 June. As of the time of writing, the volume has exceeded $1.3 million. In contrast, the general volume did not exhibit the same activity level as Sushi V3. As of this writing, the overall volume stood at approximately $19 million.

SUSHI joins the market trend

When examining Sushi (SUSHI) on a daily timeframe, it became evident that the broader market surge had influenced the asset. SUSHI was trading around $0.65 as of this writing, displaying a positive gain of over 4% in value. Nevertheless, it was still trading below its short Moving Average (yellow line).

Source: TradingView

– How many are 1,10,100 SUSHIs worth today

As of this writing, the Relative Strength Index (RSI) line exhibited an upward trajectory. However, it remained below the neutral line, suggesting a bearish trend.