Switzerland’s Zurich Cantonal Bank unveils Ethereum, Bitcoin trading options

- Zurich Cantonal Bank (ZBK) is the latest bank to offer ETH and BTC trading

- Will ZBK’s move tip rival banks to follow suit and drive accelerated crypto adoption?

Zurich Cantonal Bank (ZBK), the fourth-largest Swiss bank handling $290 billion in assets, is the latest player from tradeFi (traditional finance) to offer crypto offerings.

The offer will only cover Bitcoin [BTC] and Ethereum [ETH] trading through its mobile app. According to the bank’s latest statement, users can trade 24/7 using the app.

“We enable you to buy and sell Bitcoin and Ethereum and store your security-relevant access data. Place your orders for cryptocurrencies around the clock via your eBanking or your ZKB Mobile Banking app, quickly and easily.”

The bank reportedly partnered with Deutsche Börse-owned Crypto Finance AG for brokerage services and has created its custody solution. This will enable it to secure users’ crypto assets.

Swiss TradFi welcomes BTC and ETH

Since the United States’ approval for Spot BTC and ETH ETFs (exchange-traded funds), the two leading digital assets have seen more interest from traditional finance players.

ZBK’s move echoes Switzerland’s attitude towards BTC and ETH and positions the bank as a top choice for crypto users in the country.

Nevertheless, with one of the sector’s favorable regulations, ZBK’s move cements Switzerland as one of the top crypto hubs in Europe.

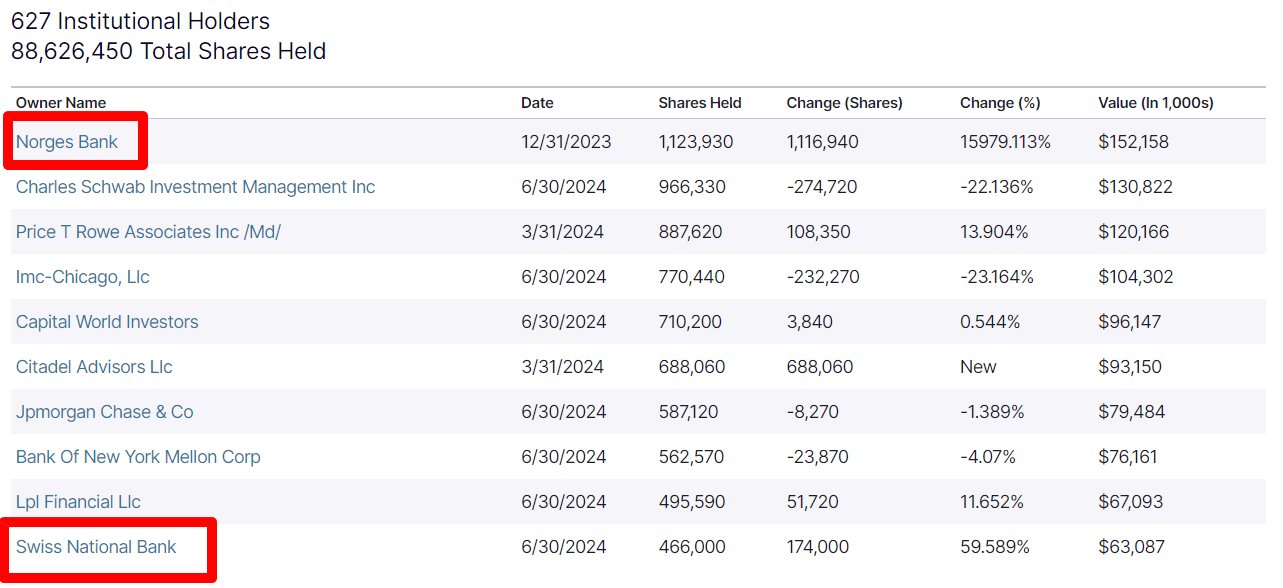

For example – In August, it was revealed that the Swiss National Bank held MicroStrategy shares, which alluded to an indirect exposure to BTC. According to Sunny Decree, a Swiss BTC analyst and investor, Swiss National Bank held about 500 BTC as of June too.

“The Swiss Central Bank has indirect Bitcoin exposure through MicroStrategy ($MSTR), with approximately 500 BTC.”

The increasingly favorable regulatory stance and greater BTC exposure could encourage rival banks to provide crypto offerings in Switzerland and broader Europe. If so, this could trigger an institutional FOMO and drive wide adoption.