Synthetix: Massive growth noted in these areas, but DeFi performance stagnant

- Synthetix’s trading volume went up considerably in the last few weeks.

- Fees and revenue also increased, but TVL plateaued.

Recently, Synthetix [SNX] got into the spotlight, thanks to its trading volume. Token Terminal revealed that SNX’s trading volume registered a considerable uptick over the last few weeks.

The metric spiked during the second week of February when its price also pumped, reflecting strong investors’ enthusiasm for SNX.

Trading volume on @synthetix_io trending ? pic.twitter.com/W6G32i2p9M

— Token Terminal (@tokenterminal) February 25, 2023

Moreover, recently, Syhthetix successfully deployed its v3 on Ethereum and Optimism, which can result in a further increase in trading volume in the coming days.

As per the official announcement, cross-chain functionality and scaling will become a focus of the core contributors in future upgrades of the V3 core system.

Moreover, as there are presently no markets associated with the V3 deployment, its main function will be to generate a collateralized debt position in the form of a stablecoin denominated in dollars for usage in integrated markets.

The Road to Synthetix V3 has officially begun!

Learn more ?https://t.co/y1CLOG1TRF https://t.co/ZoJukjKQlR pic.twitter.com/6LrCanqZeQ

— Synthetix ⚔️ (@synthetix_io) February 22, 2023

Read Synthetix’s [SNX] Price Prediction 2023-24

Revenue increased, but DeFi’s growth stagnant

Interestingly, as SNX’s trading volume increased, DeFiLlama’s data revealed that the network’s fees also went up. Apart from the fee, SNX’s revenue also increased.

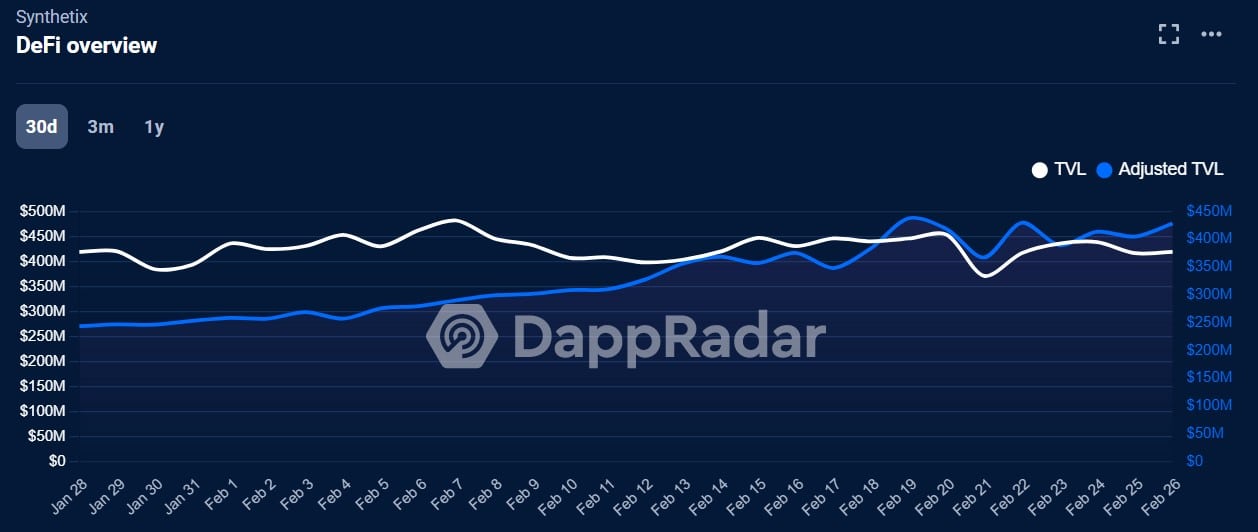

However, while these areas flourished, Synthetix’s DeFi ecosystem seemed to have remained stagnant. Its Total Value Locked (TVL) plateaued over the past few weeks, which suggested a halt in SNX’s DeFi growth.

How much are 1,10,100 SNXs worth today?

Was SNX affected?

As trading volume increased and TVL flattened, let’s have a look at SNX’s on-chain performance to find out whether those updates had any impact on the network.

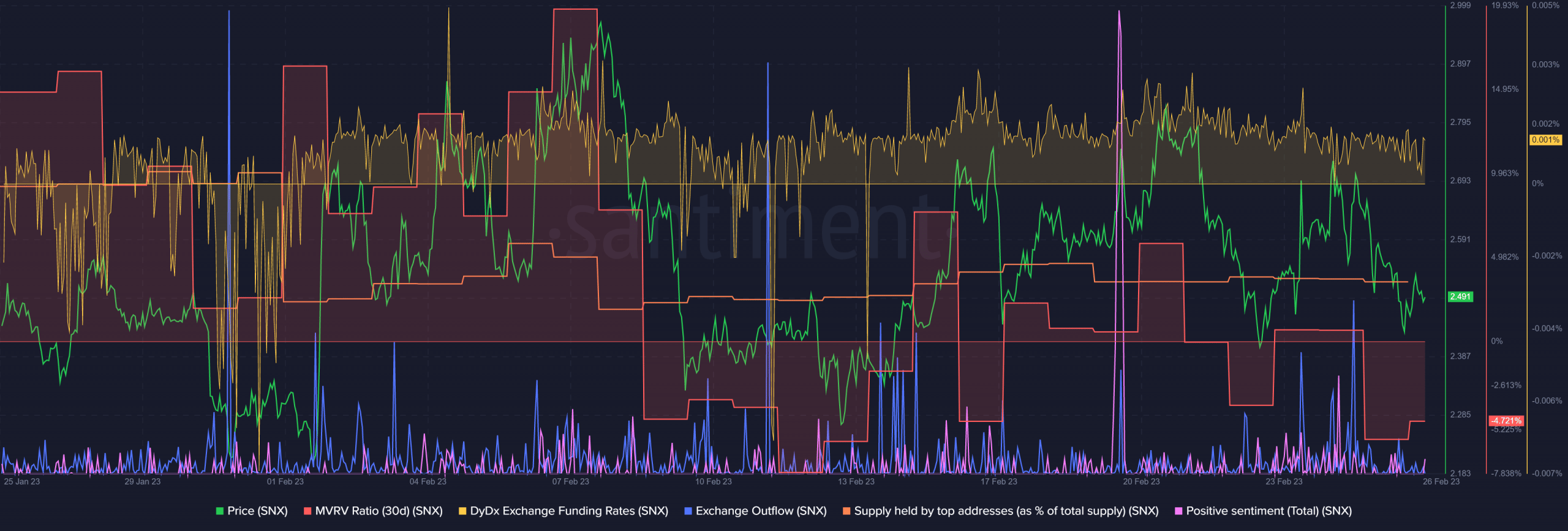

Santiment’s chart revealed that SNX’s metrics were positive and supported the network’s further growth in the coming days.

For instance, SNX’s DyDx funding rate remained consistently high, which signified its demand in the futures market. Not only that, but positive sentiments around SNX also spiked, reflecting investors’ confidence in the network.

Another positive metric was SNX’s exchange outflow, which increased in the last few days.

However, despite these positive updates, Synthetix’s supply held by top addresses registered a slight decline.

SNX’s recent price action favored the bears, which caused a decline in its MVRV Ratio. According to CoinMarketCap, its price declined by nearly 3% in the last 24 hours, and at the time of writing, it was trading at $2.49 with a market capitalization of over $640 million.