Synthetix V3 development: All about the debt pool, legacy market, and more

- Synthetix is set to roll out its V3 feature soon.

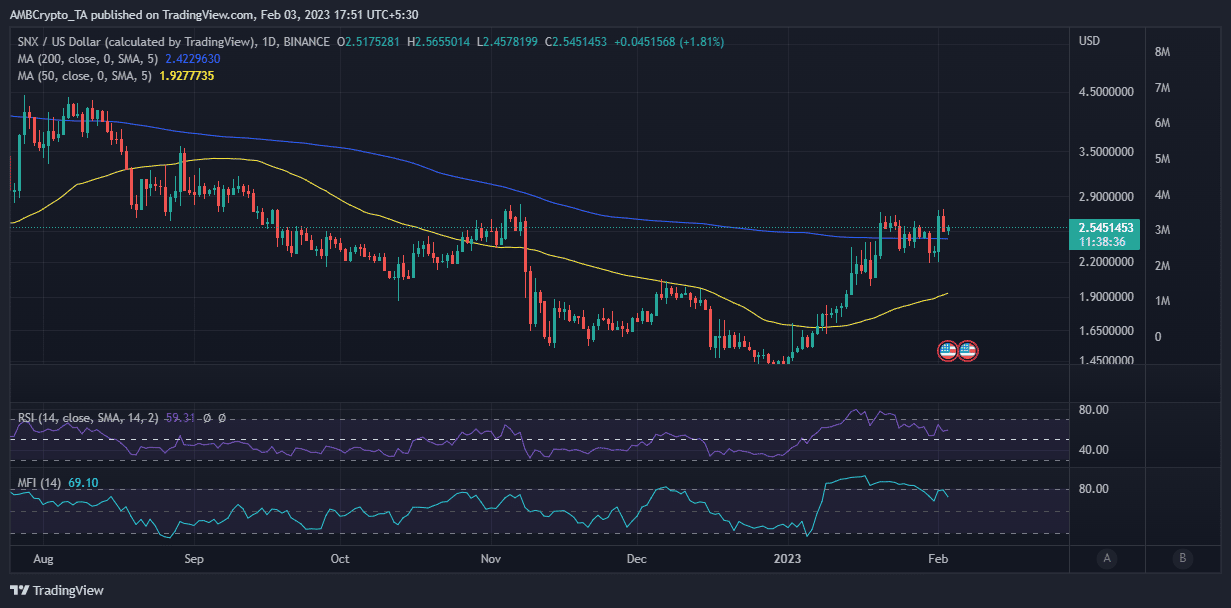

- SNX faced a resistance wall as the bears attempted an assault.

The crypto market has demonstrated a healthy recovery since January 2023, and, as a result, there has been increased activity in the DeFi world. Synthetix is among the companies that are capitalizing on this recovery. Its latest weekly update may offer some insights into what users can expect this month.

Is your portfolio green? Check out the Synthetix Profit Calculator

According to the update, Synthetix is on track to roll out its V3 feature. It will lead to some major changes to the debt pool, which will support unique elements. The rollout will feature one pool that will host a legacy market, including all the offerings already available on V2X.

The Weekly Recap is here!

⚔ Spartan Council & CC updates

⚔ Grants & Ambassador Council updates

⚔ SIP presentation summaryPodcast on ?YOUTUBE?: https://t.co/FX20IsOAfd

Anchor Podcast: https://t.co/ByZZOuut9k

BLOG: https://t.co/5L2WrPsJrK

— SNXweave (@snx_weave) February 2, 2023

Synthetix revealed that even though the initial plans only included one pool in V3, that may change in the future. Once that becomes reality, it will allow stakers to access different pools.

Of course, there was more to the weekly update. For example, debt migration will begin after SIP-255. The latter is in its final review stage and, once rolled out, will enable fee burning rather than distribution.

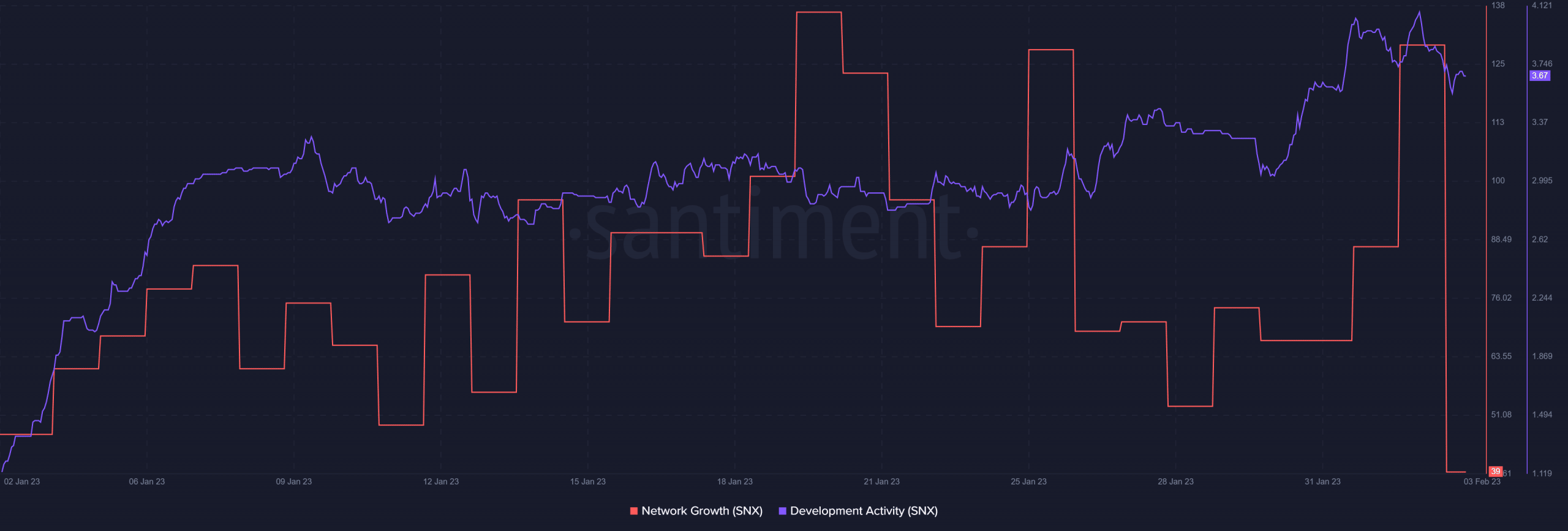

Synthetix has maintained strong development activity over the last few weeks. This is in line with the aforementioned developments. However, this does not translate to steady network growth.

Network growth did show strength during the last four weeks. However, it was also been quite volatile, due to periods of low network activity or low volatility. The network growth metric was down to a four-month low at press time.

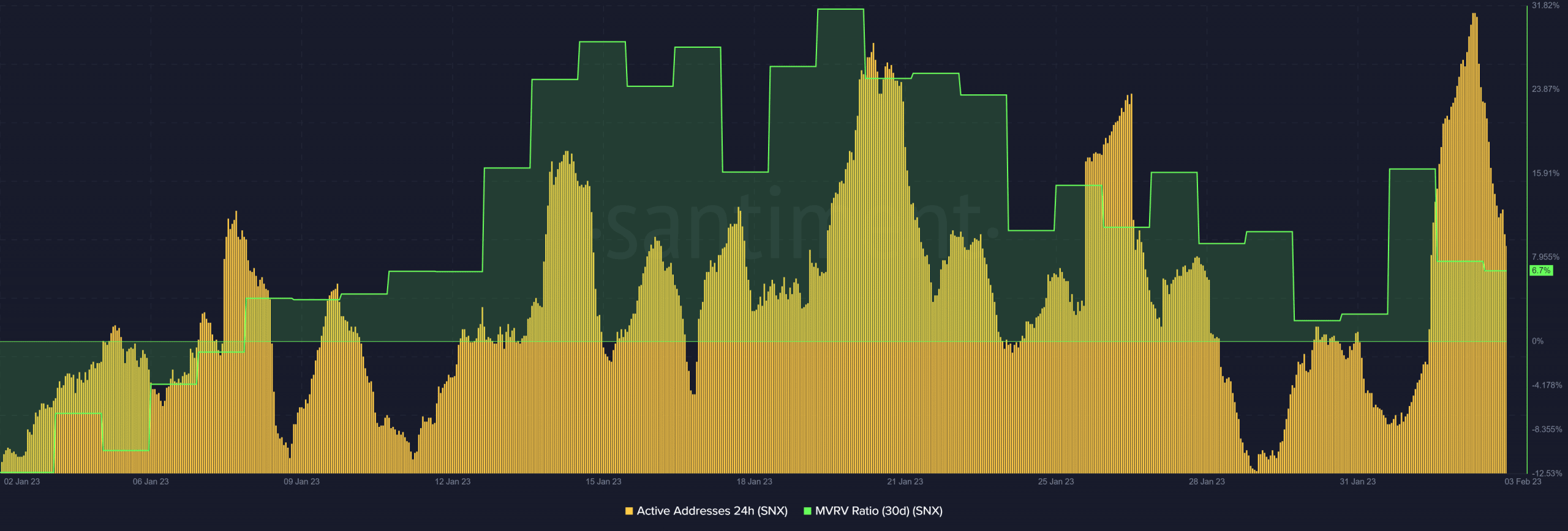

Nonetheless, there was a sharp surge in daily active addresses in the last 24 hours prior to press time.

Despite this surge in daily active addresses, the 30-day MVRV ratio did tank during the last 24 hours. This suggested that sell pressure was more dominant than bullish demand. This reflected SNX’s bearish performance on 3 February after the previous rally that attempted to push past Janaury 2023’s previous high.

How many are 1,10,100 SNXs worth today?

SNX traded at $2.55 at press time after tanking from its weekly high of $2.75. This reflected an increase in sell pressure, which also aligned with the drop in relative strength.

Source: TradingView

It was unclear whether the press time developments would support a surge in demand for SNX. However, the current market conditions indicated a lack of strong bullish pressure to overcome the current resistance.

![Solana [SOL]](https://ambcrypto.com/wp-content/uploads/2025/08/Solana-SOL-1-400x240.webp)