Terra Luna Classic

Terra Classic token LUNC rallies +23%: More volatility ahead?

The deep pocket of liquidity at $0.0001 could be swept before a bearish reversal.

- Terra Luna Classic posted strong gains on Saturday, managing to flip the structure bullishly.

- A price dip appeared imminent due to rising bearish sentiment and long liquidations building up.

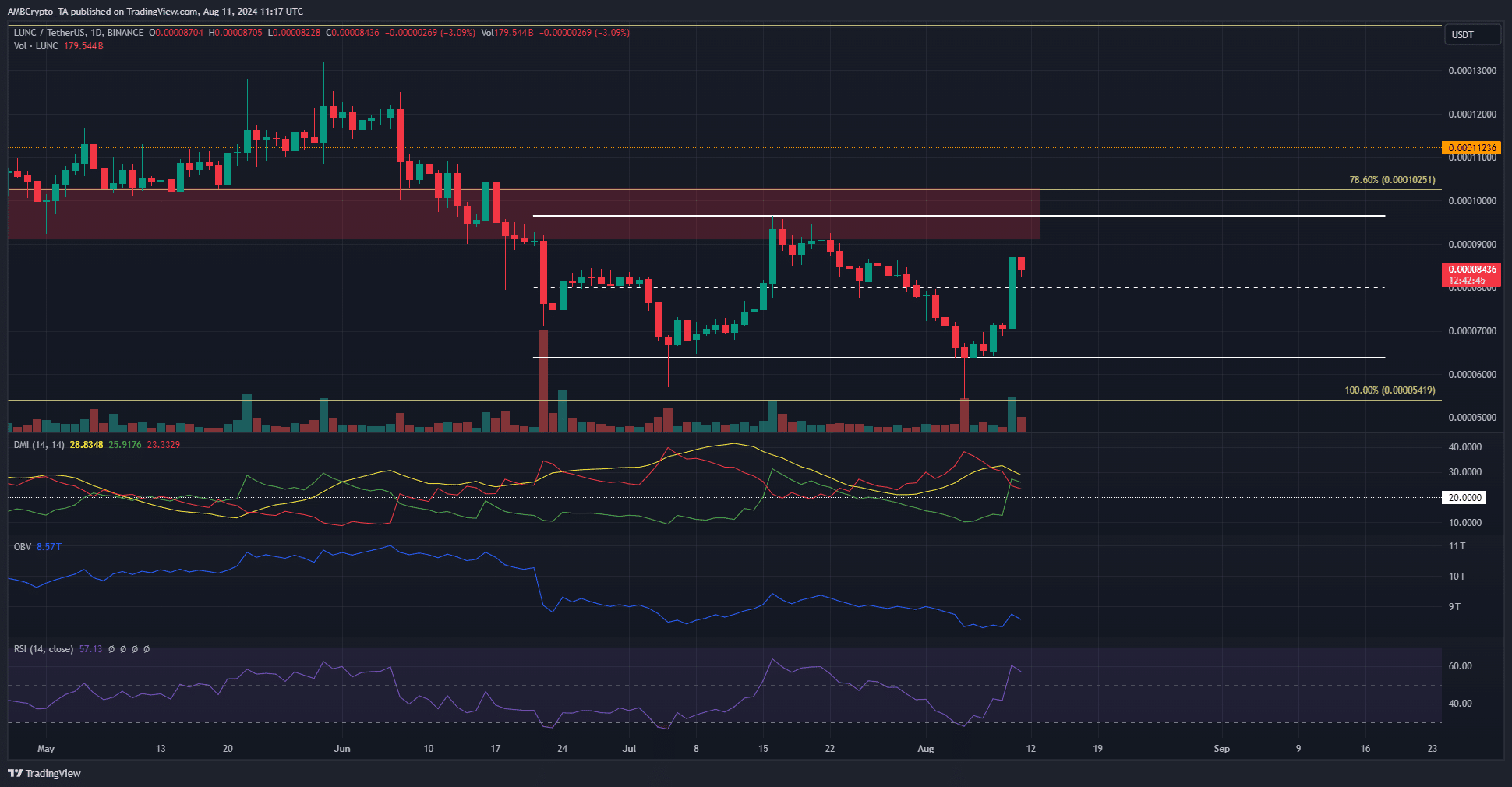

Terra Luna Classic [LUNC] prices surged on Saturday, the 10th of August, by 23.3% from the day’s open to the day’s close. This move happened with a spike in trading volume, and the range highs appeared to be the next target.

Yet, the short-term trend of Bitcoin [BTC] alongside the build-up of long liquidation levels suggested that LUNC might see some losses and volatility soon.

Open Interest soars as prices break the mid-range level

In the 1-day timeframe, LUNC managed to make a bullish structure flip after moving past $0.000087 the previous day. The recovery from the range lows saw the RSI also jump above neutral 50.

Yet, the OBV has not made a significant uptick. It needs consistent buying volume to do so, and this was not present. The DMI reflected the confused trend of Terra Luna Classic, which is typical of a range formation.

Source: Coinalyze

The Open Interest rocketed higher from $8 million to $21.1 million, showing speculators were eager to gain some profits during LUNC’s move higher. Over the past few hours, the OI has plateaued and the funding rate has grown more negative.

This indicated a growing bearish sentiment.

Will Terra Luna Classic manage to test the range highs?

Source: Hyblock

According to the liquidation heatmap, the answer is yes. There was a deep pocket of liquidity at $0.0001 that could be swept before a bearish reversal. This lined up with the range highs in the technical chart.

Source: Santiment

The weighted sentiment went into positive territory again, showing online engagement was bullish. Yet, the social volume did not grow noticeably despite the price gains.

This was a hint that LUNC lacked hype, which could hamper its bullish ambitions.

Source: Hyblock

Another impediment in the near term was spotted in the liquidation levels heatmap. Due to the price jump, the liq levels delta was massively positive.

Realistic or not, here’s LUNC’s market cap in BTC’s terms

In turn, this could see long positions squeezed to force liquidations.

The $0.0008 level is a short-term target, lining up with the mid-range support level. Whether the bulls can sustain the rally after this support retest or not depends on whether BTC can stay above the $60k mark.