Terra LUNA update – LUNC reacts to bankruptcy hearing date being revealed

- Terraform Labs gave the community the latest update on its bankruptcy hearings

- Both LUNA, LUNC reacted positively to the news

Terraform Labs’ Chapter 11 bankruptcy hearing is scheduled to commence by mid-September 2024. The firm initially sought bankruptcy protection in January 2024, following the catastrophic collapse of the Terra LUNA ecosystem in 2022. The collapse, driven by the failure of Terra’s algorithmic stablecoin UST, resulted in billions of dollars in losses for investors and a wave of legal challenges for Terraform Labs.

This was first revealed by Terra itself, via its X account yesterday.

A favorable ruling here would allow Terraform Labs to restructure and re-organize the various entities behind the Terra ecosystem. This restructuring could provide a pathway for the company to stabilize its operations and potentially revive some aspects of the Terra ecosystem.

As part of the bankruptcy process, creditors had until 21 August 2024 to submit their Proof of Crypto Loss forms. This step is crucial in determining the extent of the firm’s liabilities and the distribution of any recovered assets. Terraform Labs’ creditors include a mix of retail investors and institutional players who were affected by the collapse.

All the legal challenges…

In June 2024, Terraform Labs and De Kwon reached a $4.7 billion settlement with the United States Securities and Exchange Commission (SEC). Under the terms of this settlement, the firm has been barred from dealing with the crypto-sphere.

That’s not all though as a court order in June also allowed the reopening of a shuttle bridge, enabling the redemption of wrapped assets on the Terra Classic network. These developments provided some relief to investors who had been left in limbo following the ecosystem’s collapse.

The bankruptcy proceedings are evidence of the challenges faced by companies in the rapidly evolving cryptocurrency space. Terraform Labs’ situation highlights the risks associated with algorithmic stablecoins and the broader implications for regulatory oversight in the industry.

The outcome of the Chapter 11 hearing will be closely watched by stakeholders across the crypto landscape, as it could set a precedent for how similar cases are handled in the future.

As expected, the crypto tokens at the centre of this episode reacted to the aforementioned news too.

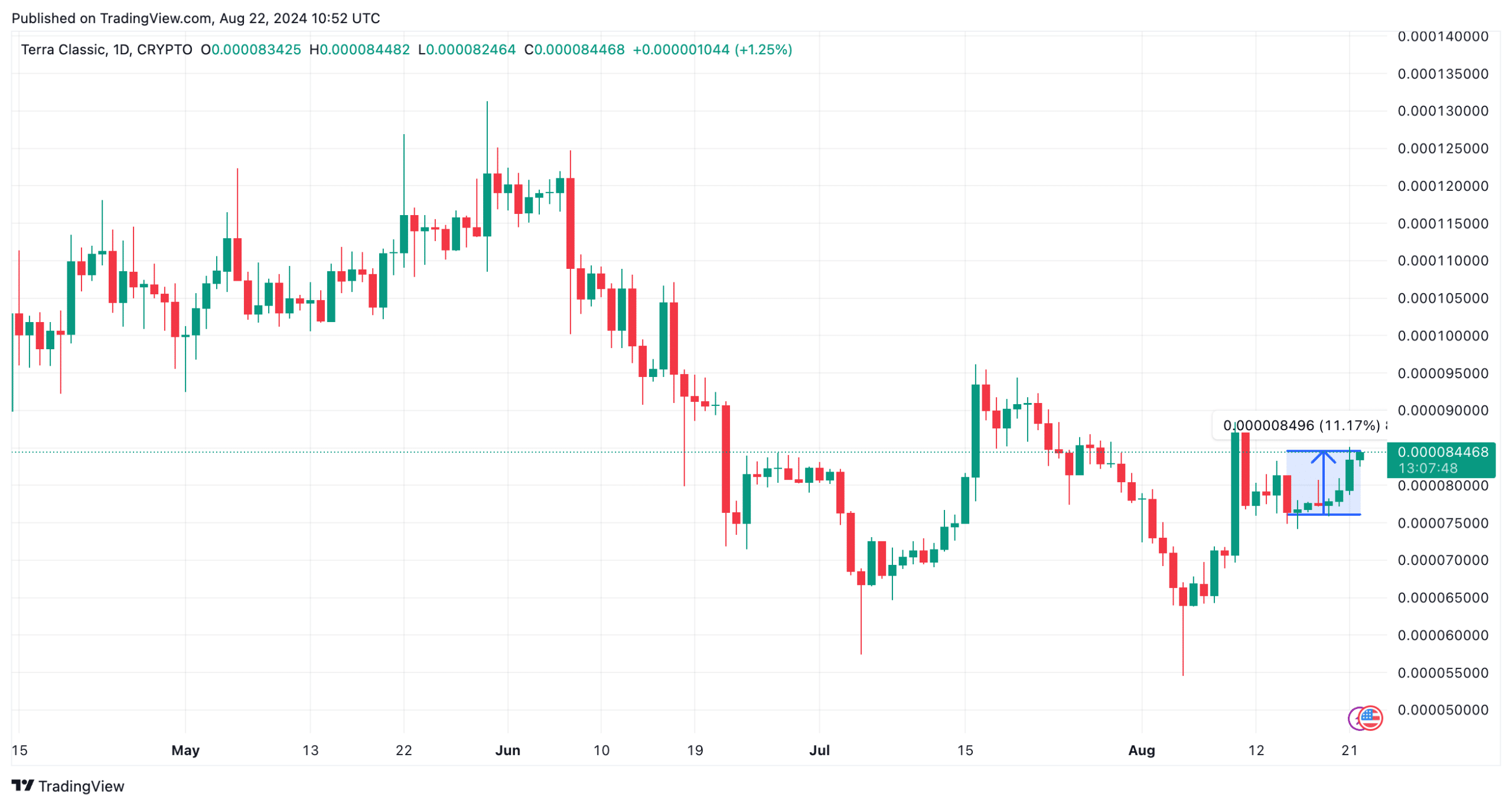

LUNA, for instance, climbed by almost 4% in the 24 hours immediately after the update was first revealed to the community. Similarly, Terra LUNA Classic (LUNC) appreciated by over 5% on the charts too to trade at $0.000084 at press time.