Tether, Bitfinex accused of market manipulation – What’s going on?

- Plaintiffs accuse Tether and Bitfinex of using USDT to manipulate crypto prices.

- Despite fluctuations, USDT traded at $1.00 with bullish RSI at 58.

In a surprising development, plaintiffs in a long-standing class-action lawsuit have accused Tether and Bitfinex of engaging in a misleading scheme to manipulate cryptocurrency prices.

What’s the allegation all about?

The amended complaint alleges that the companies used USDT, Tether’s dollar-backed stablecoin, to artificially influence market dynamics.

Expanding on the same, a legal document filed by plaintiffs in the Southern District of New York noted,

“Keeping their identities secret, Defendants [Tether and Bitfinex] made massive, carefully timed purchases of crypto commodities to signal to the market that there was enormous demand and thus cause the price of those commodities to spike.”

In simple words, plaintiffs alleged Tether and Bitfinex used billions of dollars in USDT to buy cryptocurrencies. However, contrary to Tether’s claims that each USDT was backed one-to-one by U.S. dollars, the Plaintiffs argue this was not the case.

In this case, the main plaintiffs are American cryptocurrency traders Matthew Script, Pinchas Goldshtein, Jason Leibowitz, and Benjamin Leibowitz. Additionally, several other civil class action lawsuits and their plaintiffs have joined the litigation.

They claim Tether and Bitfinex misrepresented the backing of USDT, which constitutes a violation of both the Commodities Exchange Act (CEA) and the Sherman Antitrust Act.

The story so far…

This is the third complaint in the case overseen by U.S. District Judge Katherine Polk Failla, beginning in 2019 with an amended complaint in 2020.

The proceedings faced setbacks, including the removal of the original plaintiffs’ counsel, Roche Freedman, due to controversies over alleged frivolous lawsuits.

Despite objections from Tether and Bitfinex’s legal team against additional amendments, Judge Failla approved the plaintiffs’ June request to amend their complaint, illustrating ongoing legal challenges and complexities in the case.

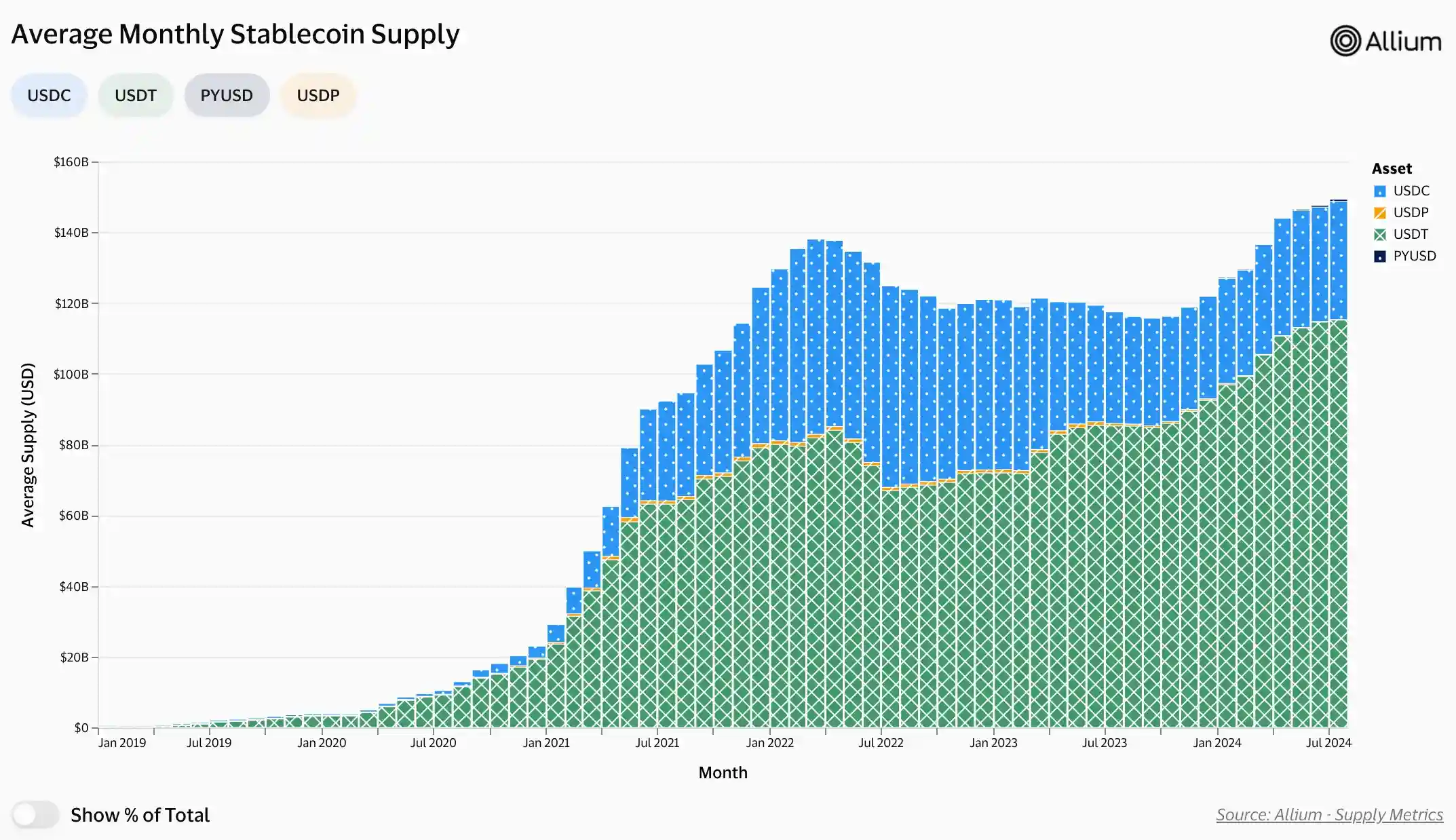

These events aligned with Tether’s declining market share on Centralized Exchanges, falling from 82% to 74% in 2024 according to Kaiko.

Visa’s on-chain analytics data, revealed that USDT had an average supply of $115.17 billion in July, compared to Circle’s USDC, which had an average supply of $33.46 billion.

Additionally, this also conceded with Tether plans to halt USDT redemptions on major blockchains by September 2025.