Tether in Q3 – Flaunts strong reserves and reduced risk

- Tether’s reserves included T bills, Bitcoin and Gold.

- USDT remains dominant in the stablecoin market.

A recent report from Tether [USDT] on 31 October provided an attestation of the current state of finance and the backing of USDT.

Tether holds over 80% of its reserve in cash

Tether, the company responsible for the USDT stablecoin, has recently released its financial report for the third quarter of the year.

According to the report, it holds $56.6 billion in U.S. Treasury bills. The T Bills, per the report, have a maturity date of less than 90 days.

Additionally, they have $8.8 billion tied up in reverse repurchase agreements linked to these bills. Another $8.2 billion is invested in U.S. Money Market funds, each valued at $1 per note. Also, it maintains $292 million in cash and bank deposits.

Furthermore, Tether possesses $65 million in the form of Treasury bills from countries other than the United States. In total, the sum of cash and cash equivalents was around $74 billion.

This accounts for 85.73% of its total reserves, amounting to $86.4 billion. Notably, Tether also has holdings of $1.7 billion in Bitcoin and $3.1 billion in gold.

Tether takes some steps back from unsecured loans

The report also revealed that secured loans now account for $5.1 billion of USDT reserves. It is important to note that unsecured loans have decreased by approximately $336 million compared to previous loans.

Tether has also announced that there would be a further reduction in loans by the end of 31 October. An additional $1.1 billion in loans would be phased out, leaving only $900 million in loans as part of the reserves.

USDT’s dominance remains strong

A glance at CoinMarketCap confirmed that USDT continued to dominate the stablecoin sector. The data indicated that its current market capitalization exceeded $84 billion.

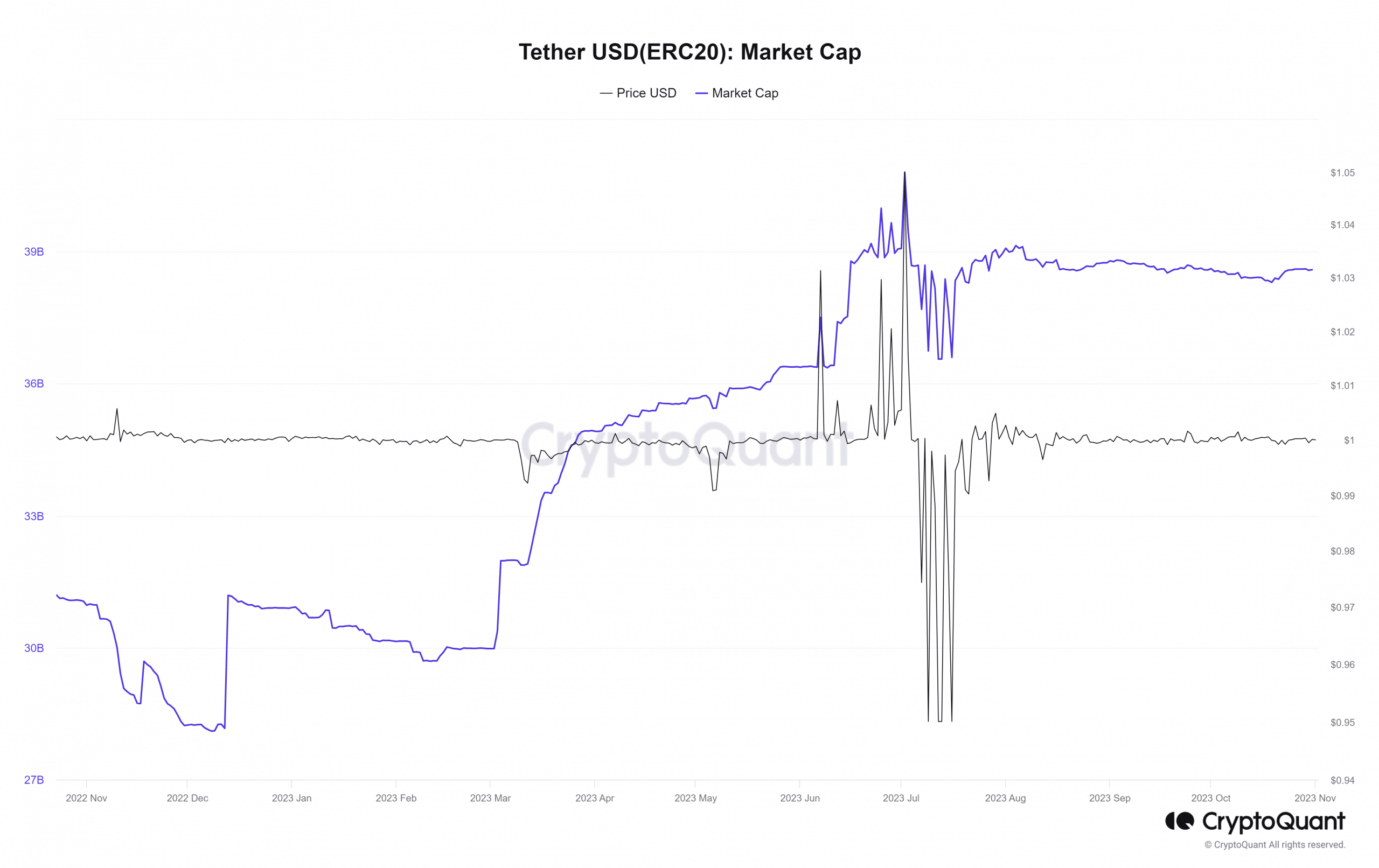

Also, the trading volume in the last 24 hours, as reported, exceeded $27.6 billion. Additionally, data from CryptoQuant revealed that USDT has successfully maintained its peg with no significant deviation.

Furthermore, the daily trading volume was around $39 billion, surpassing the total market capitalization of the second-ranked stablecoin. What also stood out from the report was the reserve maintained outside the US. The move might be due to the regulatory landscape of the country.

![Tron [TRX]](https://ambcrypto.com/wp-content/uploads/2025/08/Tron-TRX-400x240.webp)