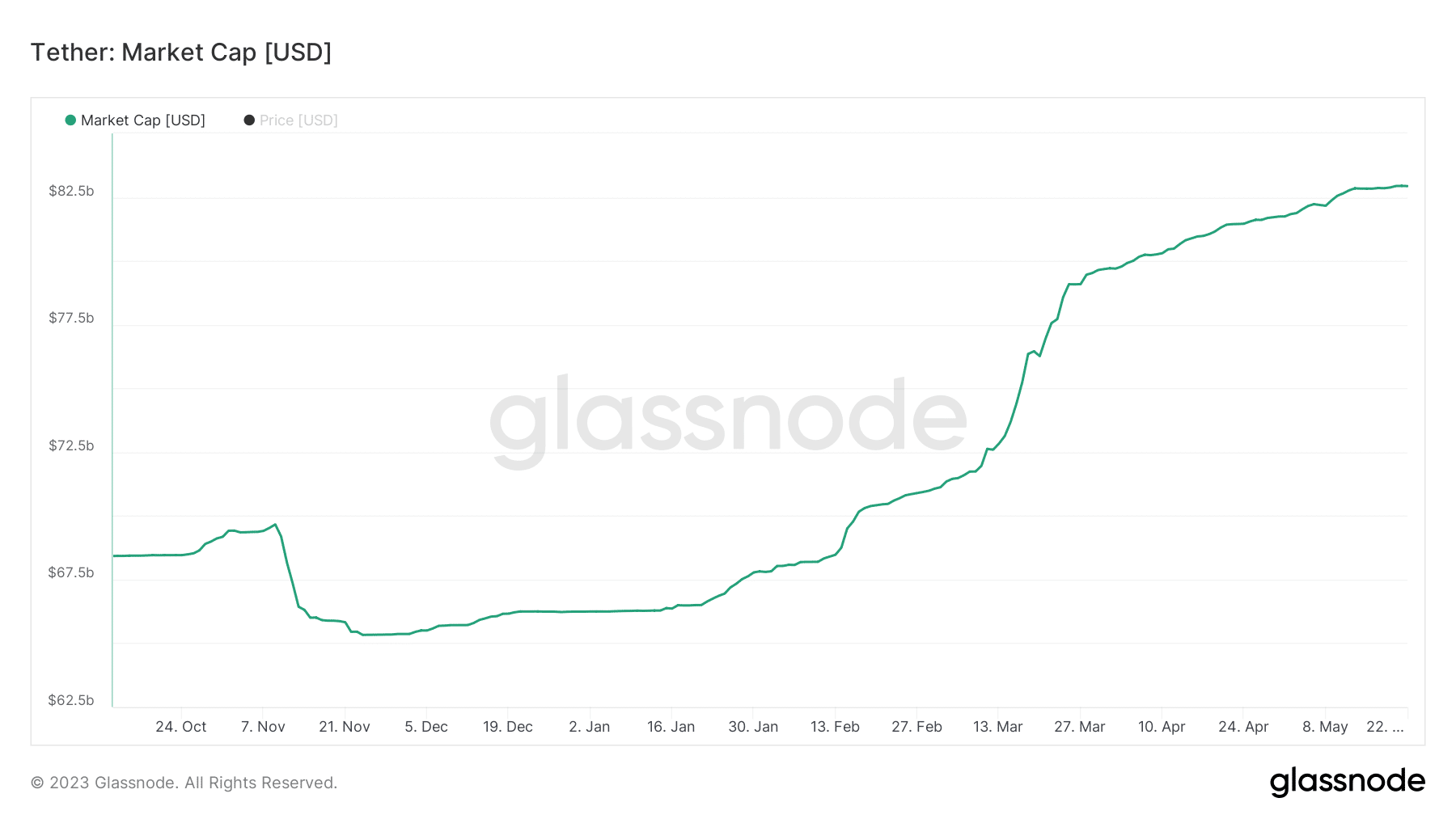

The ‘why’ behind Tether’s market cap surge

- USDT has added $11 billion to its market valuation since the banking crisis of March.

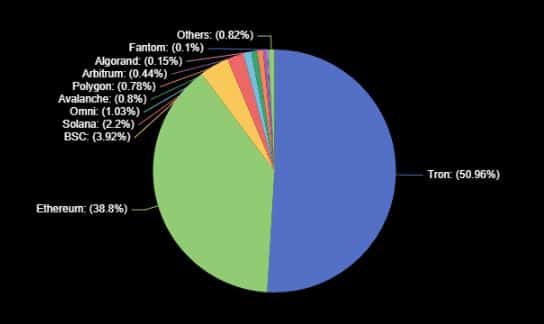

- More than 50% of all USDT tokens were issued on Tron.

Tether [USDT], the largest stablecoin in the world by market capitalization, had a successful run in 2023 thanks to a phenomenal rise in the circulating supply.

Realistic or not, here’s USDT’s market cap in BTC’s terms

Since the March banking crisis, USDT has added an astounding $11 billion to its market valuation, bringing the total to $82 billion at the time of publication, as per Glassnode.

The fall of Binance USD [BUSD], alongside USD Coin’s [USDC] depegging, led to a large chunk of investors gravitating towards USDT.

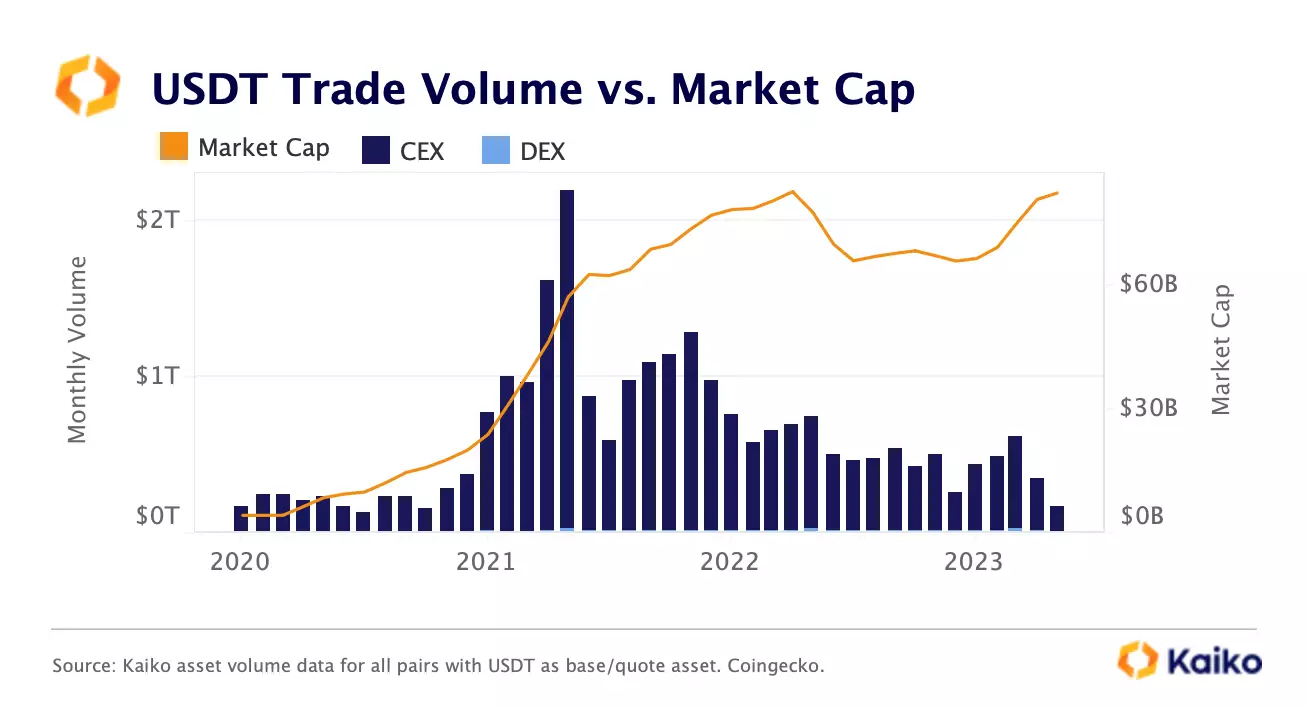

Surprisingly, the surge in market valuation has come despite a noticeable drop in trading volumes across exchanges, seen as one of the primary use cases for stablecoins.

USDT’s market cap and trade volume diverge

According to digital assets market data provider Kaiko, USDT’s market cap has attained all-time highs despite logging six consecutive weeks of depleting trading volume across all categories of exchanges.

Although it was anticipated that USDT would strengthen its market share in stablecoin trading after the macroeconomic triggers in March, Binance’s promotion of TrueUSD [TUSD] as BUSD’s alternative restricted the advances.

While historically, there existed a close link between changes in USDT’s trade volume and its market cap, the correlation has hit zero at the time of writing.

One reason cited behind USDT’s market cap growth could be due to the stablecoin’s huge supply on the Tron [TRX] blockchain. According to DeFiLlama, Tron issued the majority of all USDT tokens in circulation, worth $43.5 billion, compared to Ethereum [ETH], with $33 billion.

Big addresses favored Tron over Ethereum because of the former’s low transaction fees.

Kaiko’s analysis also pointed out that, while USDT’s market size and transaction volume no longer correlate, USDC has continued to keep a direct association between the two metrics.

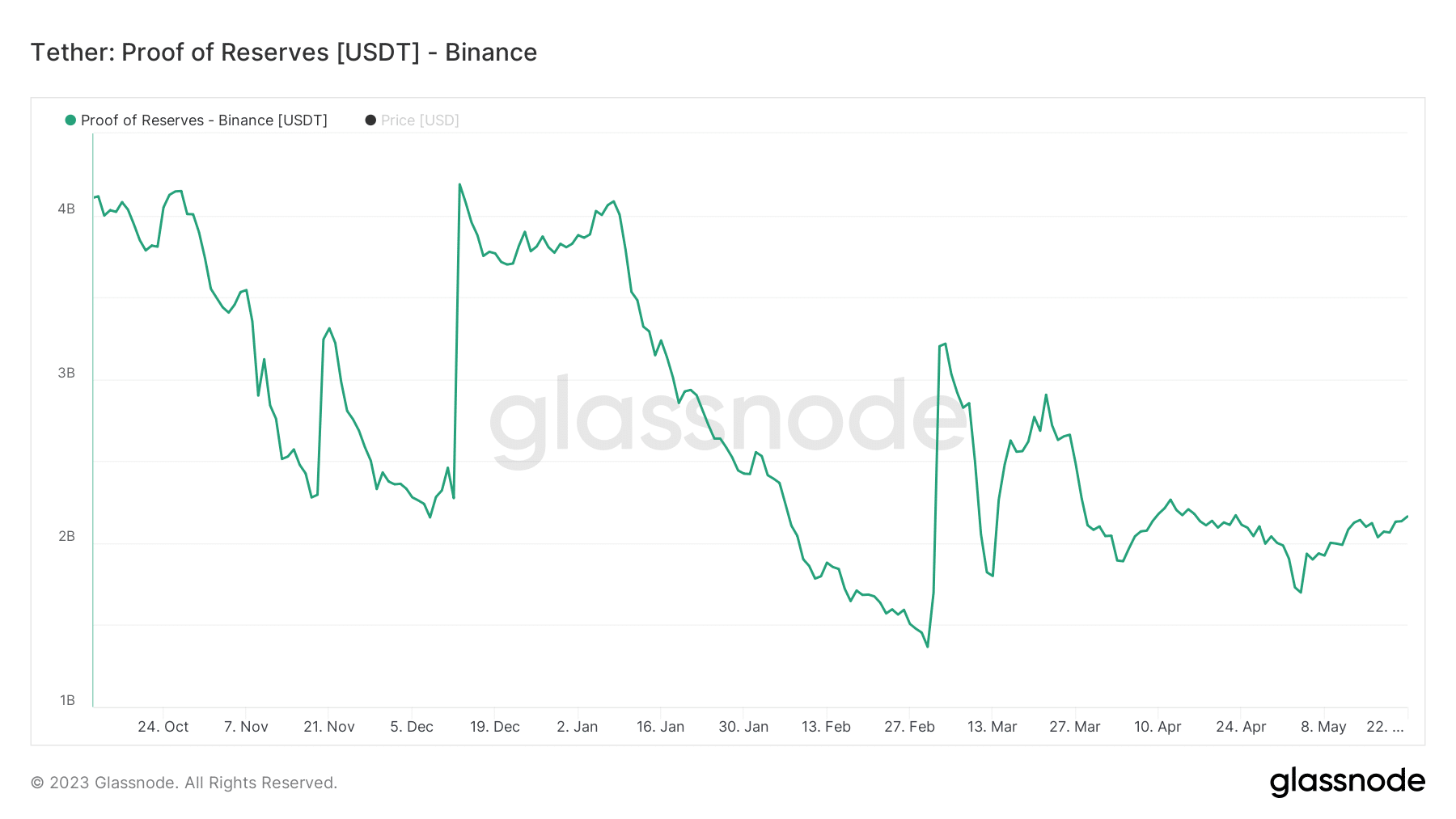

Decline in Binance

Tether’s reserves on the world’s largest exchange, Binance, fell significantly since March, lending credence to the idea of increased adoption of TUSD, as highlighted earlier.

The issuing company behind the stablecoin, Tether, recently revealed its plan to buy Bitcoin [BTC] using its realized profit, in a bid to expand and diversify the reserves backing the stablecoin.

Tether reported a net profit of $1.48 billion in the first quarter of 2023, more than doubling from the previous quarter. The company also added that its excess USDT reserves reached an all-time high of $2.44 billion.

![Ethereum [ETH] targets $1,810 – Will THIS crucial level ignite a breakout?](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-59-400x240.jpg)