Tether: With UST gone and USDD struggling, is USDT next in line

With UST mixed into the dust and USDD struggling to keep up; could Tether be the next in line for the stablecoin massacre? The crypto market volatility has ramped up pressure on stablecoins recently after Celsius froze account transactions. The coming days are showing trader pain with the market struggling badly under tightened monetary conditions.

The struggle is real!

The global crypto market took a huge hit in the past week after falling well below the $1 trillion market cap. This led to rampant price dips across major cryptocurrencies with BTC falling to $20K, ETH to $1k and so on.

“Confidence in cryptos remains depressed and some traders are worried that Tether could suffer a similar fate as Terra’s UST stablecoin,” Edward Moya, senior market analyst at Oanda, said. “Too many institutional crypto investors are down massively, and they are worried that if this part of the crypto ecosystem collapses, Tether will crash.”

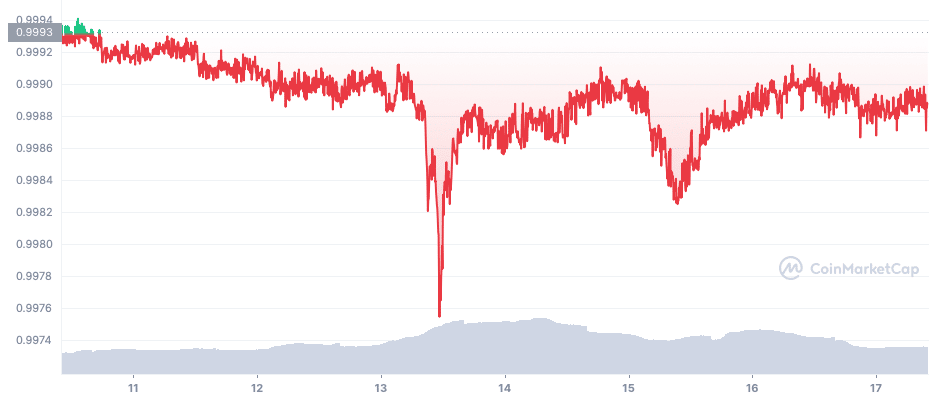

Even stablecoins incurred tremendous hits with large-scale withdrawals from both corporate and retail investors. Following the weak market sentiment, Tether’s market cap started falling dramatically. Tether said on 15 June that it had exited its position with Celsius “with no losses” and denied any exposure to troubled crypto investment fund Three Arrows Capital.

Over $3 billion has been wiped off from Tether in the past 96 hours alone. In fact, at $69 billion, Tether’s market cap is at an eight-month low. Per Santiment, Tether’s continued drop in the percentage of ownership from large addresses is visible across on-chain data. Addresses holding $100k to $10m in USDT have dropped 50.5% of their coins since their peak hold of the supply in June 2019.

Tether rubbishing rumors

Recent online rumors have targeted the holdings under Tether. The largest stablecoin in the market, Tether, uses a combination of different assets to maintain its peg to its US dollar. Tether reported in May that it had cut its commercial paper by 17% to $19.9 billion from $24.2 billion the previous quarter. It also increased the amount of US Treasury bills from $34.5 billion to $39.2 billion.

Tether addressed recent rumours that its portfolio of commercial paper is “85% backed by Chinese or Asian commercial papers and being traded at a 30% discount”. In the same blog post, Tether announced that

“Over 47% of total USDT reserves are now US Treasuries and that commercial paper makes up less than 25% of USDT’s backing. Tether can report that its current portfolio of commercial paper has since been further reduced to 11 billion (from 20 billion at the end of Q1 2022), and will be 8.4 billion by end June 2022.”