The A to Z of Bitcoin’s Order Book Depth and what it means for the market

Over the past decade, the cryptocurrency industry as an asset class has come a long way. The likes of Bitcoin and Ethereum are no longer frowned upon with a sense of disapproval, despite the crypto-market being relatively new. Hence, it is imperative to evaluate the evolving maturity of the asset class.

While there are multiple ways to approach such an evaluation, CoinMetrics’ latest report looked into the order book depth of both Bitcoin and Ethereum to estimate the health of the crypto-market structure.

What is Bitcoin Order Book and Depth?

For any cryptocurrency or traditional stock exchange, the order book is basically a ledger where all the buy orders and sell orders are registered, recorded, and executed. Order Book Depth indicates the number of price levels available for the asset at any particular time during a trading session.

Hence, a deeper order book depth suggests that there are abundant price levels for investors to close their bids or asks. And, higher market depth also means there is greater liquidity.

Now, initially, market slippage was a commonality among large bids and asks orders as investors would lose capital via slippage. Slippage happens when desired orders do not have the right price range on the order book. However, over time, BTC and ETH’s market depth has improved immensely.

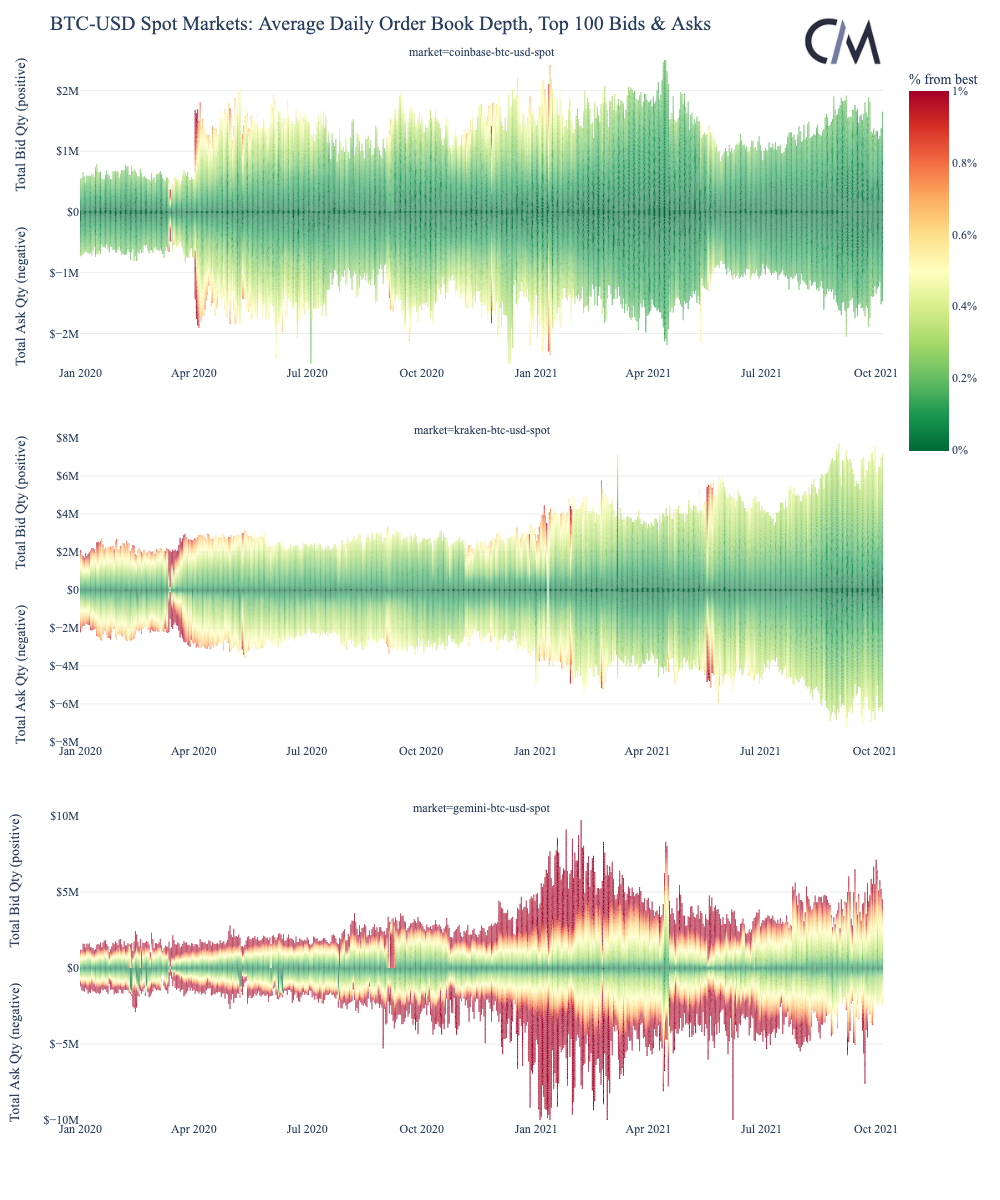

Coinbase, Kraken, and Gemini Order Book Depths

As can be illustrated in the attached chart, the average daily market depth and distance between the best bid/offer or BTC-USD has drastically reduced over the past few years. Over the last few months, the top 100 bids and asks on Coinbase exchange have been met within 0.2% of the best bid/ask price.

Similarly, on Kraken, $6 million worth of order book depth lies under 0.5% of the best price, which is a commendable average.

For Ethereum, all the three exchanges saw similarly improved market depth. It was also surprising since ETH also experiences high trading volumes on DEXs such as Uniswap. The fact that such levels of market depth are maintained, despite the fall in liquid Ethereum (due to ETH 2.0 staking), is a massive positive.

How does Order Book Depth help in the long term?

It goes without saying that better market depth is directly suggestive of higher market liquidity for Bitcoin and Ethereum. By extension, this fuels more credibility in the larger financial ecosystem. An improved order book would only lead to greater expansion and adaptability of the asset class as institutions will be willing to invest in these digital assets.

Improving market depth also makes it difficult for manipulation tactics. This, because it improves price discovery and reduces the chances of high intensive arbitrage trading between exchanges.

Overall, Bitcoin and Ethereum’s market stance only improves with better Order Book Depth. This is a continuous process for the future.