The big Bitcoin sell-off? Whales abandon ship as BTC halts at $62K

- Bitcoin’s Accumulation Trend Score was at 0.021.

- This showed that large entities were distributing their holdings or not accumulating more coins.

Bitcoin’s [BTC] Accumulation Trend Score was trending towards zero at press time, signaling an increase in coin distribution by larger entities, according to Glassnode’s data.

This metric measures the activity of different BTC wallet cohorts. It specifically tracks whether they are buying or selling the coin.

When its value is closer to one, it indicates that larger entities or a significant portion of the network are accumulating BTC.

Conversely, a score closer to zero suggests that these entities are distributing or not accumulating. As of this writing, BTC’s Accumulation Trend Score was 0.021.

The move towards this value may be due to the coin’s narrow price movements in the past few weeks. It has continued to face significant resistance at the $63,000 price level.

At press time, the leading cryptocurrency exchanged hands at $62,003, according to CoinMarketCap’s data.

BTC’s on-chain activity in the last month

An on-chain assessment of BTC’s whale activity confirmed the decline in accumulation by its large wallet groups.

According to Glassnode, the number of unique addresses holding at least 1k coins has decreased in the last 30 days. At 2113 at press time, it has dropped by 0.1% during that period.

This fall in whale accumulation on the BTC network mirrors the general decline in activity on the network.

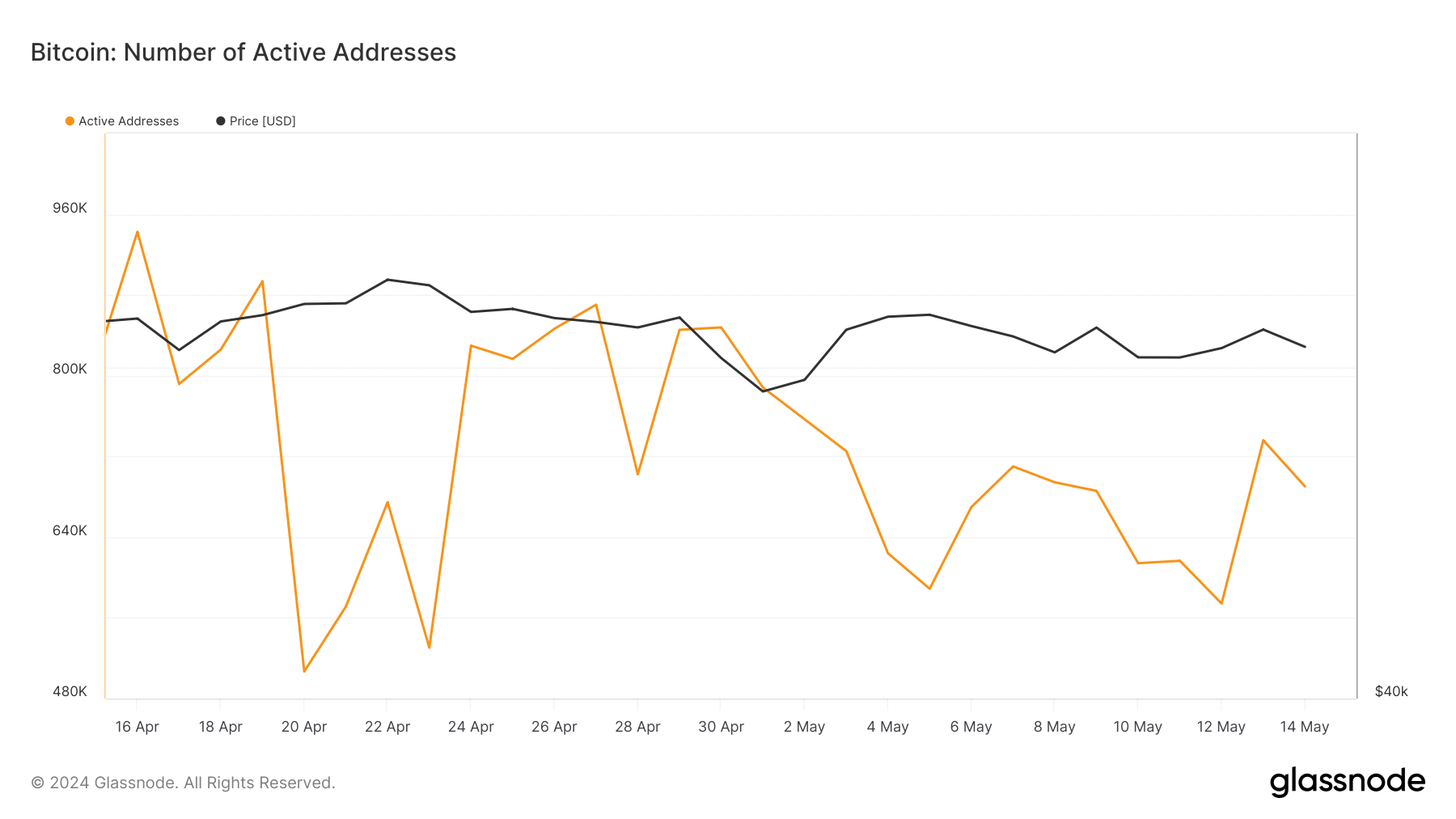

Glassnode’s data shows a 27% decrease in the number of unique addresses active in the network as senders or receivers in the last month.

During the same period, there has been a notable fall in new demand for BTC.

According to the on-chain data provider, the number of unique addresses that appeared for the first time in a BTC transaction has decreased by 35% over the 30-day period in review.

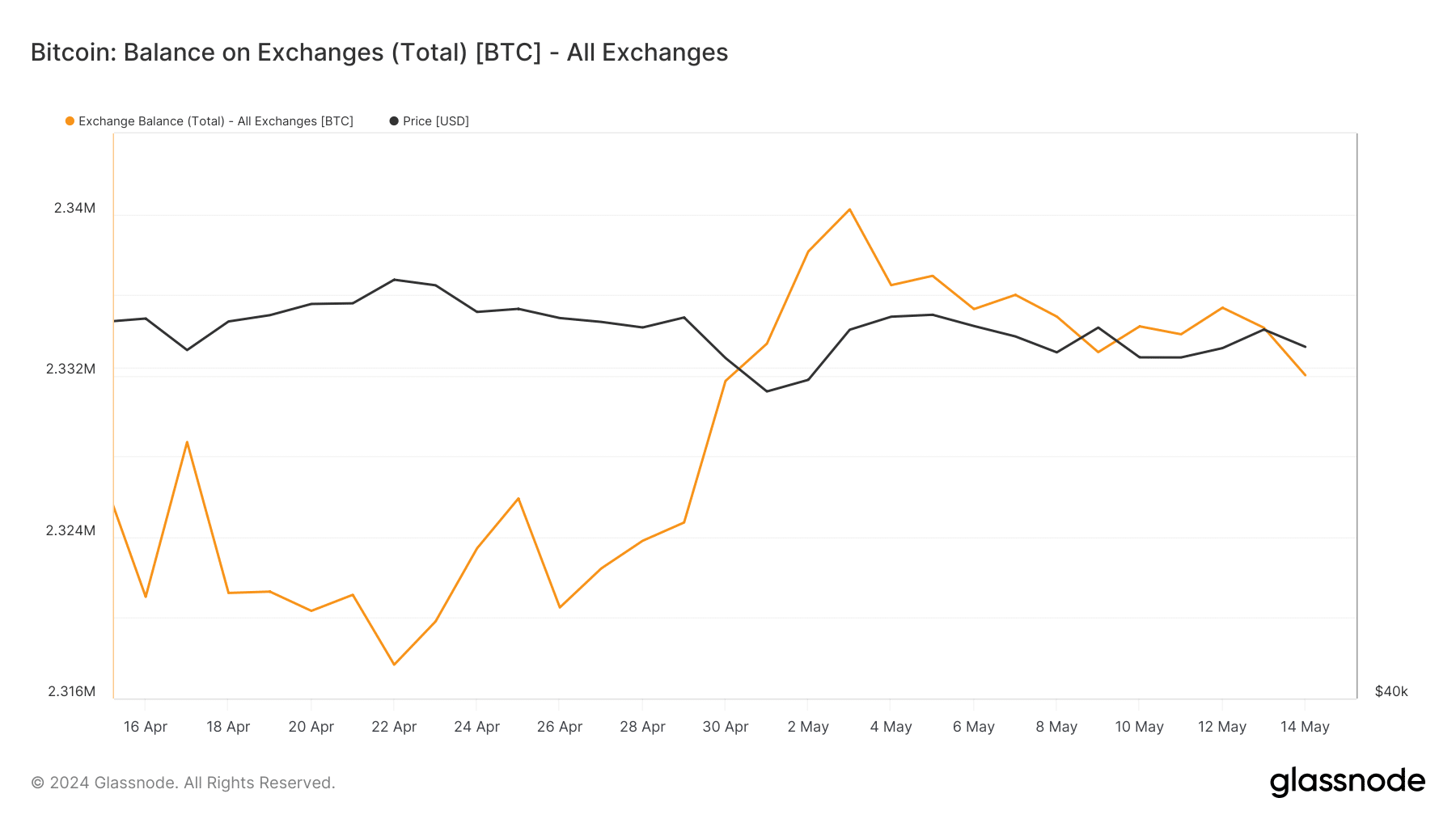

While the daily count of active and new addresses trading BTC has dropped, the number of coins sent to cryptocurrency exchanges has surged.

At press time, 2.33 million BTC were held on exchange addresses, growing by 1% in the last month.

Read Bitcoin’s [BTC] Price Prediction 2024-25

When BTC’s exchange reserve climbs this way, it suggests a hike in the coin’s sell-offs.

BTC bulls may find it challenging to break above the $63,000 resistance level in the short term if general market participants continues to gain momentum while it fails to attract new demand.