Bitcoin’s post halving history – All the highs BTC’s price can and cannot hit

- A Galaxy Digital report highlighted three different views on the impact of Bitcoin halving.

- Arthur Hayes pinned institutional demand for BTC on sovereign bond market issues.

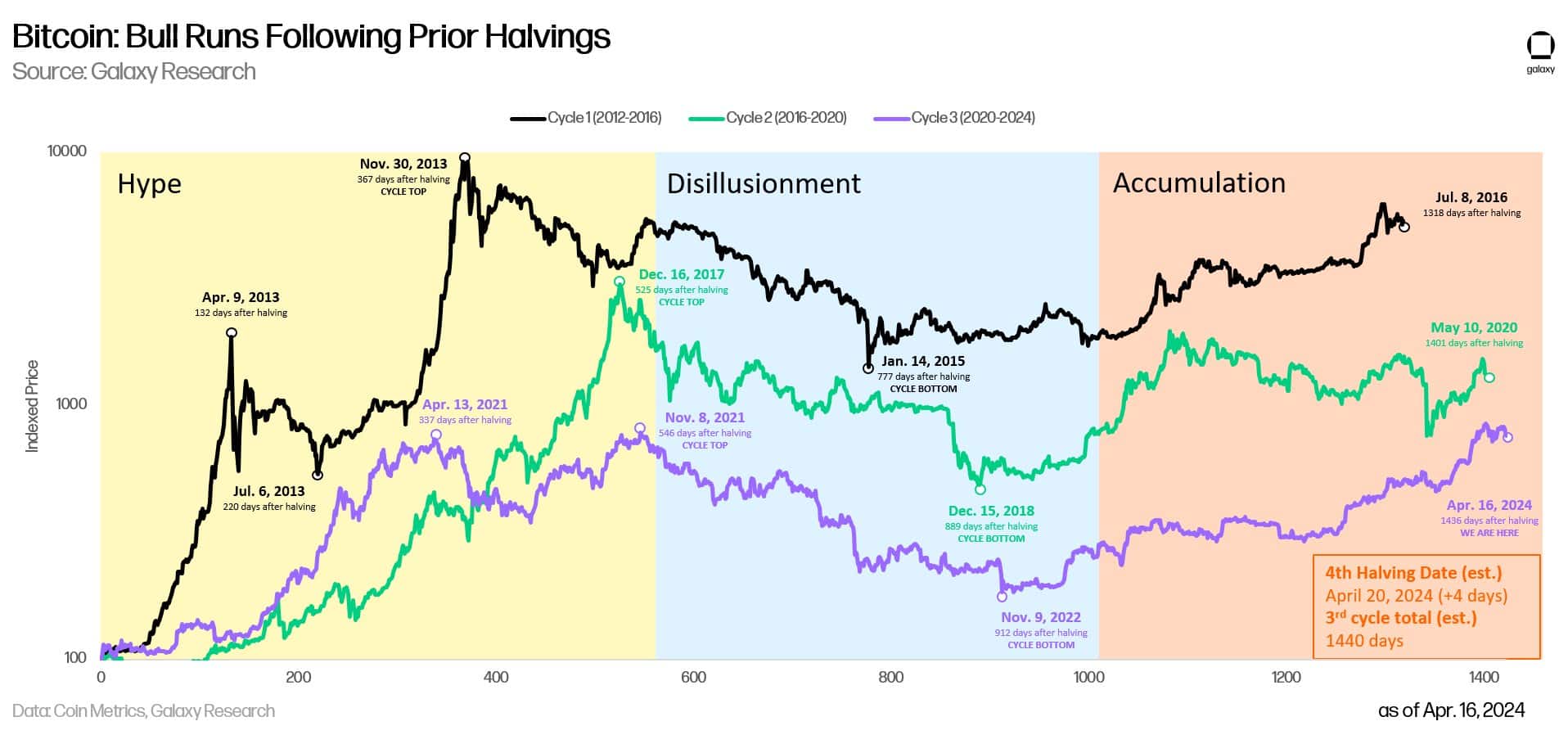

It’s less than two days before the fourth Bitcoin [BTC] halving, and the market is full of bold projections and debate. On one end, a section of the market sees the halving as a bullish case for BTC price action.

Another opposing section deems the halving event to be bearish, while others see it as negligible.

But most analysts agree on one thing — each halving is unique and different.

Unpacking the past two bull cycles, Coinbase Institutional’s statement emphasized the past two cycles’ uniqueness. The statement read,

“Crypto bull cycles hit different. The past two bull markets lasted 3.5 years. We’re 1.5 years in. The past two bull markets saw prices increase 113x and 19x. Prices have increased 4x.”

BTC halving impact: Bullish, bearish, and neutral views

A recent digital asset manager Galaxy Digital report unpacked the three views on the impact of BTC halving.

For the bullish case, the report noted that reducing block rewards by half (halving) causes supply shock, which contributes to price surges.

Additionally, miners’ sell pressure is reduced when their block rewards are slashed by half.

“Reduction in sell pressure from the mining community led to an increase in the value of Bitcoin following the November 2012, July 2016, and May 2020 halvings and could do the same following the fourth halving.”

On the contrary, the bearish view sees the next halving event as a “sell-the-news” event. In the current cycle, for the first time, BTC is trading near an all-time high before halving.

So, the bearish group believes the halving has already been priced in. The report noted,

“At this point, prior to the last two halvings, BTC was down 42%+ from its previous all-time highs. Effectively, the bull runs of 2017 and 2020 hadn’t yet begun at this stage in Bitcoin’s supply schedule.”

Additionally, the bears maintain that the post-halving will affect most miners and could make the network less secure.

However, there is a third group of market watchers who deem the halving negligible (neutral). The neutral view believes that the BTC price is affected by demand and overall macro conditions.

On the neutral view, the report read,

“Bull markets following halvings are much more related to changes in demand and not supply and could even be more correlated to things like global market liquidity, central bank rates, and other macro conditions.”

Interestingly, BitMEX founder and CIO of crypto fund Maelstrom, Arthur Hayes, leans toward the neutral view.

In a recent interview, Hayes explained the reason behind institutional allocations to Bitcoin. He stated,

“Why are institutional investors investing in Bitcoin? Because there’s a whole narrative about the destruction of the sovereign bonds market, which started basically as the Fed started raising rates in March 2022. So, there’s a reason people allocate to Bitcoin, not just because Bitcoin exists.”

In other words, several factors could be driving BTC price action before and after the halving event.

So, focusing the price action only on the halving might be limiting, especially if you want to maximize your trade positions or investment returns.