The fate of Lido on Solana might be at jeopardy – here’s why

- The team behind Lido on Solana sought a $1.5 million lifeline from the Lido DAO to secure its future.

- Solana faced the specter of declining activity and a potential hit to SOL’s price.

The fate of Lido [LDO] on Solana [SOL], a significant player in the staking market, teeters on a financial precipice as a recent proposal to the Lido DAO has laid bare the team’s need for more funds.

Is your portfolio green? Check out the SOL Profit Calculator

Seeking financial lifeline

The P2P team behind Lido on Solana has, in their proposal, detailed the remarkable strides they’ve made in product and business development. Yet, their cry for help echoes loudly as they’re requesting a financial infusion of $1.5 million from the Lido DAO to sustain their efforts and catapult Lido on Solana to greater heights.

The P2P team revealed that between 2022 and 2023, they’ve invested around $700,000 in Lido on Solana, primarily in development and support. Unfortunately, their revenue to date has only amounted to approximately $220,000, resulting in a substantial loss of $484,000.

With aspirations to command more than 1% of the Solana staking market, develop and implement new competitive features, and launch consistent, rational marketing initiatives, the P2P team lays out a detailed plan for the $1.5 million they seek.

A substantial portion of this sum, $200,000, is earmarked for a developer retainer, with $600,000 annually allocated for establishing robust marketing channels. Additionally, $100,000 annually will fund a customer support service that meets industry standards.

Sunset looms

However, if the Lido DAO fails to grant their financial plea, the P2P team proposed initiating a sunset process akin to what transpired with Lido on Polkadot and Kusama. The timeline for this process would unfurl initially with new staking deposits not being accepted.

After which, Voluntary node operators would off-board from the pool. Finally, the front-end support would cease, and unstaking would be exclusively possible through the command line interface (CLI).

Realistic or not, here’s SOL’s market cap in BTC’s terms

Impact on Solana

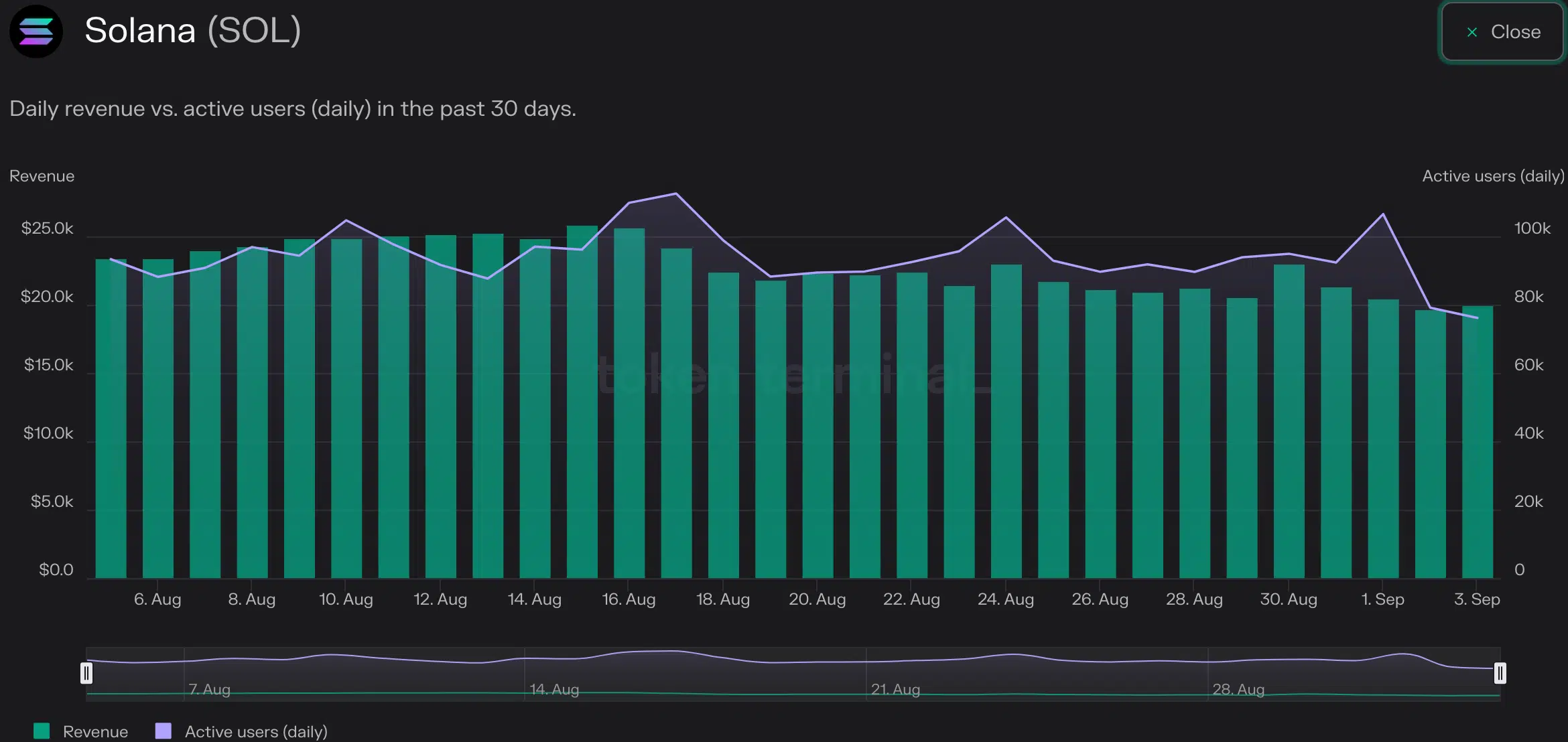

The repercussions of this decision would ripple through the Solana ecosystem. At press time, Solana witnessed a decline of 15% in active users over the last week. Coupled with that a 4.4% reduction in revenue generated was also observed.

The price of SOL, Solana’s native cryptocurrency, could also bear the brunt of this development. At the time of writing, SOL was trading at $19.53, marking a 1.26% dip in the last 24 hours.