The how and why of MANA’s projected 20% run-up on the charts

Decentraland’s price is currently coiling up above a crucial support level, suggesting the possibility of a move higher. The big picture also seemed to show the formation of a bottom reversal pattern. This lent credibility to the probability of a bullish breakout from the alt’s ongoing consolidation.

MANA awaits a catalyst

MANA has tagged the $2.20-support level thrice since 10 November, giving rise to a triple tap setup. This technical formation is similar to the triple bottom setup, but the central tag usually deviates below the base. The setup also forecasts a trend change favoring the bulls.

After the third retest of the $2.20-barrier, MANA’s price kickstarted a consolidation, with the same stuck under the $2.83-hurdle at press time. The longer this coiling up continues, the more explosive a breakout will be.

Therefore, investors can expect at least a 20% run-up to $2.83. In a highly bullish case, the crypto could revisit the $3.49-resistance barrier, pushing the total gains to 46%.

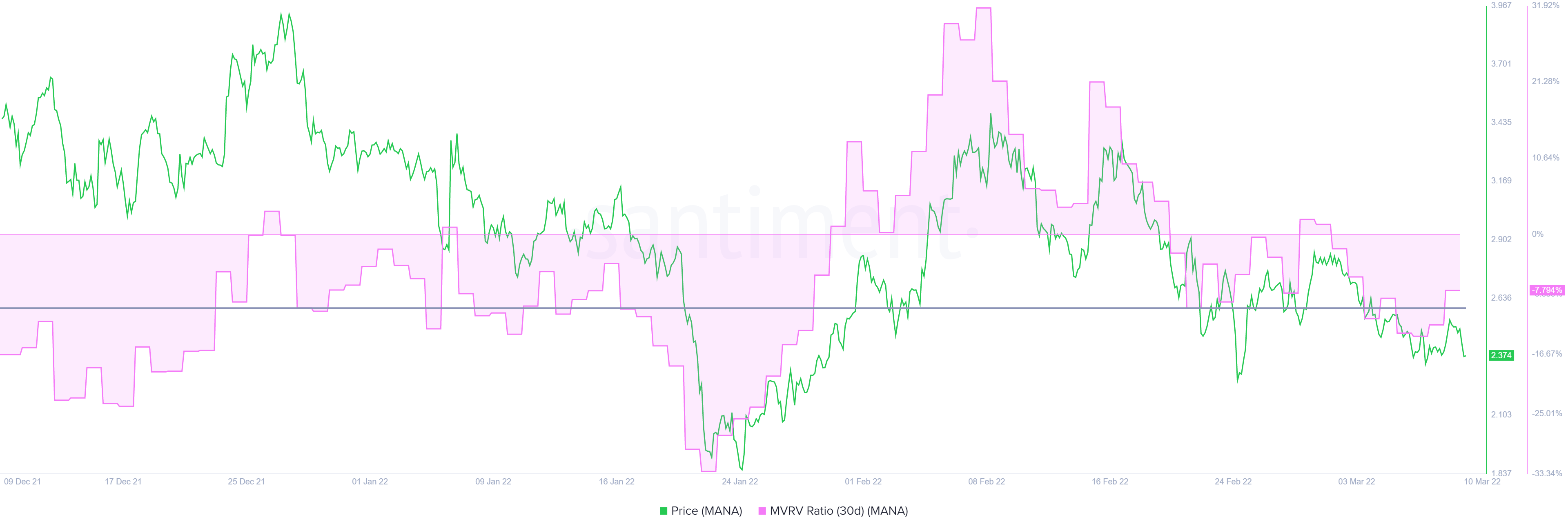

Supporting this optimistic outlook for Decentraland’s price is the 30-day Market Value to Realized Value (MVRV) model. This indicator is used to assess the average profit/loss of investors who purchased MANA tokens over the past month.

A negative value below -10% indicates that short-term holders are at a loss and is typically where long-term holders tend to accumulate. Therefore, a value below -10% is often referred to as an “opportunity zone.”

Currently, the 30-day MVRV for MANA is hovering at around -7.8% after recovering from -14% over the past week. This may be a sign that an accumulation from long-term holders is ongoing.

A comprehensive picture

The net realized profit/loss (NPL) is another on-chain metric that can be used to gauge the potential sell-side pressure. This index calculates the average profit/loss of coins that change addresses daily.

The first time the asset changes hands, NPL assumes that the address has acquired the token and considers it as sold the next time it is moved to a different address. Therefore, a spike in this value suggests potential profit-taking, and the magnitude of the spike indicates the number of coins sold.

On 10 March, NPL spiked to 16.26 million, indicating massive yet potential profit-taking. While at the moment it might seem bearish, it reduces the possibility of a sell-off. Combining the consolidation and MVRV with NPL paints a comprehensive picture, one that indicates a bullish outlook for MANA’s price.

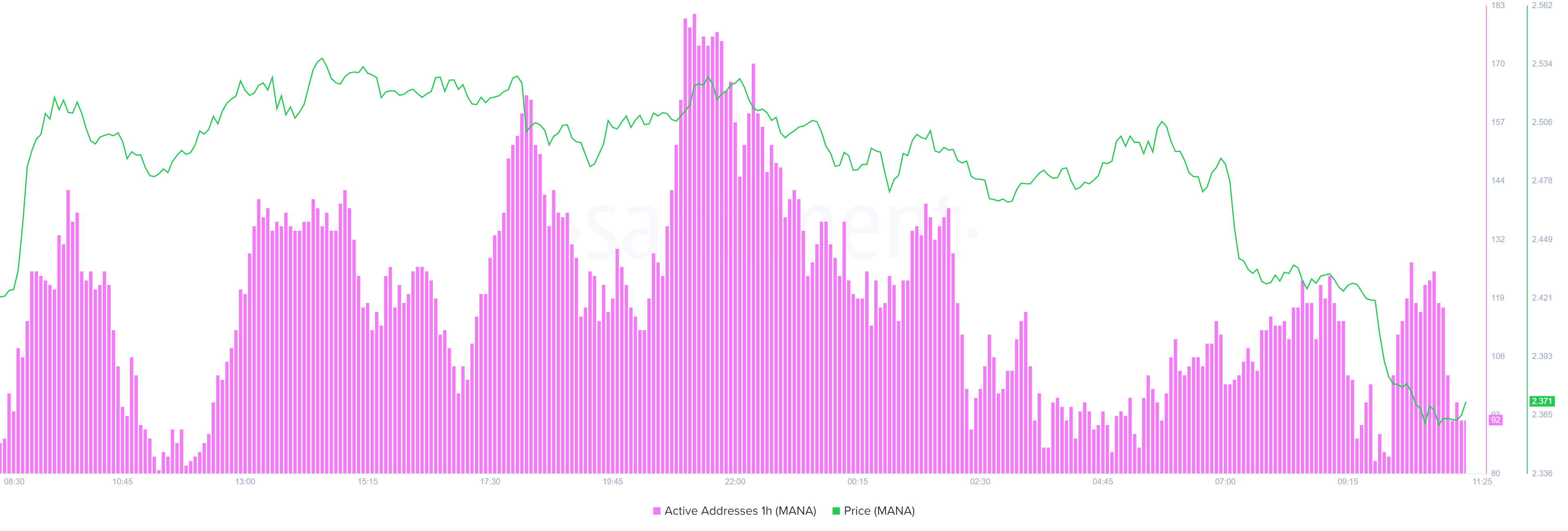

Finally, the 1-hour active addresses metric shone the spotlight on a positive spike, adding weight to the already bullish outlook. This on-chain indicator has produced a higher high, suggesting an increase in interest from investors. A surge in this index suggests retail participants are optimistic on MANA at its press time price levels.

To conclude, MANA’s price looks ready for a move higher, with the likelihood of it heading lower pretty marginal. However, a decisive close below $2.20 will invalidate the bullish thesis and open the road to further downside.