The ill fate of CEXes: Hacks, regulations and the path ahead

- Hackers are targeting CEXes, replacing users’ addresses with their own, risking financial losses.

- Negative sentiment and regulatory pressure impact CEXes, driving users towards decentralized exchanges.

The failure of FTX and relentless attacks from the SEC have intensified the challenges faced by Centralized Exchanges (CEXes) in recent months. However, CEXes now face a new threat as hackers shift their focus toward exploiting users on these platforms.

Is your portfolio green? Check out the BNB Profit Calculator

What the hack?

According to data from X-explore, certain users’ deposit and withdrawal addresses on CEXes were replaced by hacker-controlled addresses. This was done using malware explorer extensions. These malicious extensions can manipulate web browsers and exploit vulnerabilities, allowing hackers to intercept and modify critical information.

Since June 2022, there were numerous attacks targeting popular exchanges such as Binance, Stakecom, and Bitso. These attacks exploit vulnerabilities in the exchanges’ APIs, with hackers altering deposit and withdrawal addresses. Users unwittingly deposit funds into hacker-controlled addresses, leading to potential financial losses.

1/?Many users' deposit and withdraw addresses in the CEX have been replaced by the hacker address because of malware explorer extensions. There have been hundreds of attacks on Binance, https://t.co/bsZOzOhmvl, Bitso and other 10+ CEXs since June, 2022. @WuBlockchain @evilcos

— X-explore (@x_explore_eth) June 8, 2023

The impact on CEXes could be significant. Users who fall victim to these attacks may lose trust in the platforms’ security measures and may hesitate to continue using them.

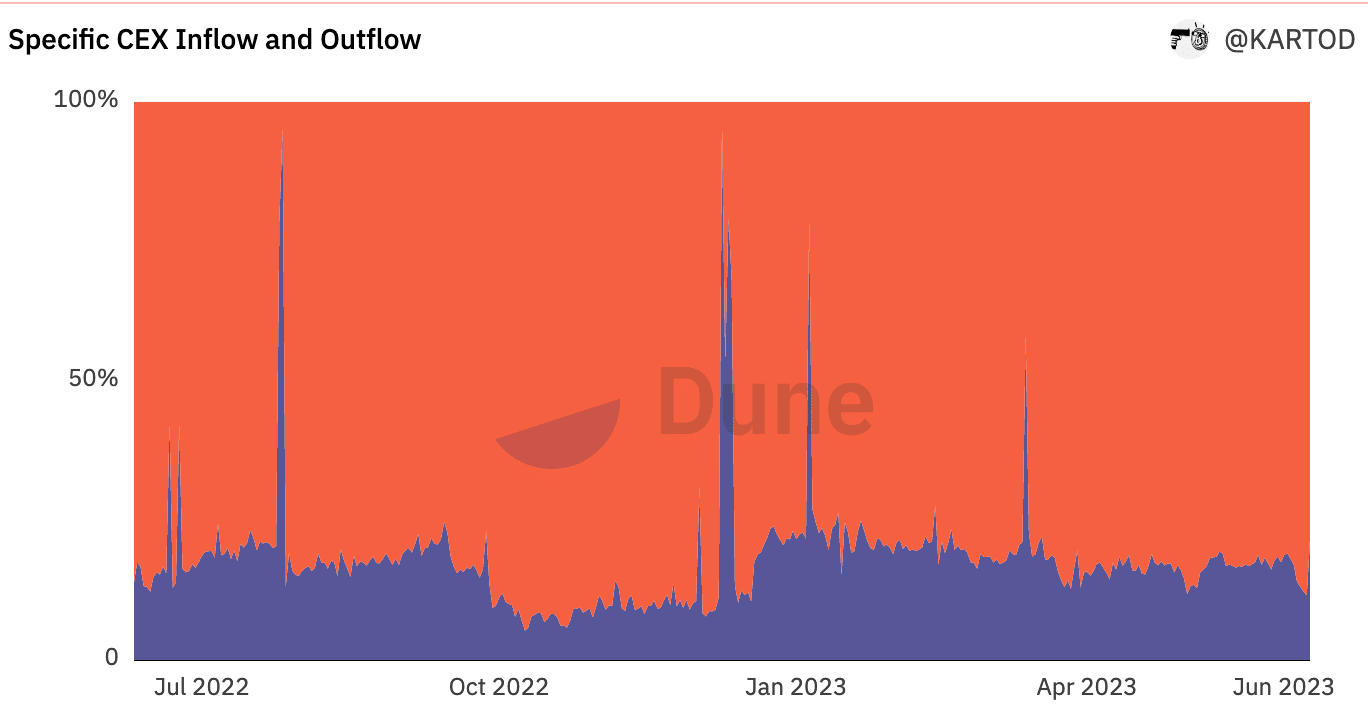

Concerningly, amidst these events, the withdrawals from centralized exchanges have started to surpass the number of deposits, indicating a trend that could affect the liquidity and stability of these exchanges.

Word on the street

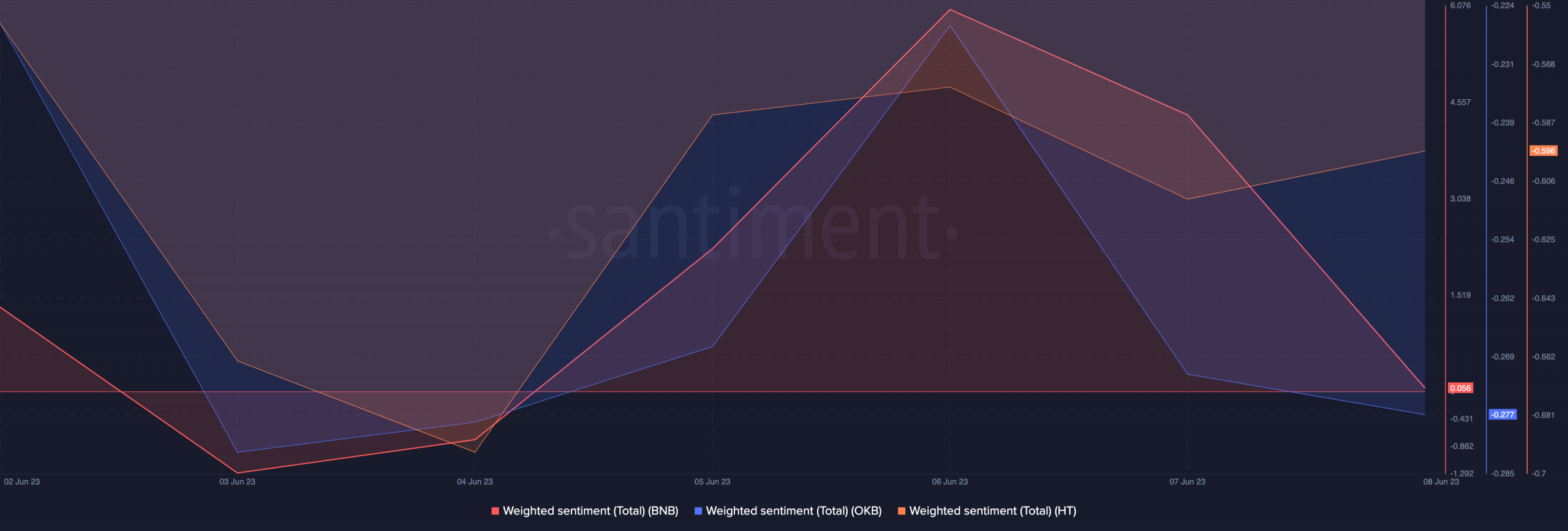

Moreover, the negative sentiment towards centralized exchanges is growing among the crypto community. Santiment’s data revealed a notable shift in overall weighted sentiment for CEXes like Binance, OKX, and Huobi.

The repeated regulatory actions, including ongoing lawsuits by entities like the SEC against major exchanges like Coinbase and Binance, further erode public confidence in these centralized platforms.

The continuous regulatory scrutiny of CEXs has the potential to disrupt the broader cryptocurrency industry. The increased regulatory pressure could lead to stricter compliance requirements and potential limitations on the operations of CEXs, which could have ripple effects throughout the ecosystem.

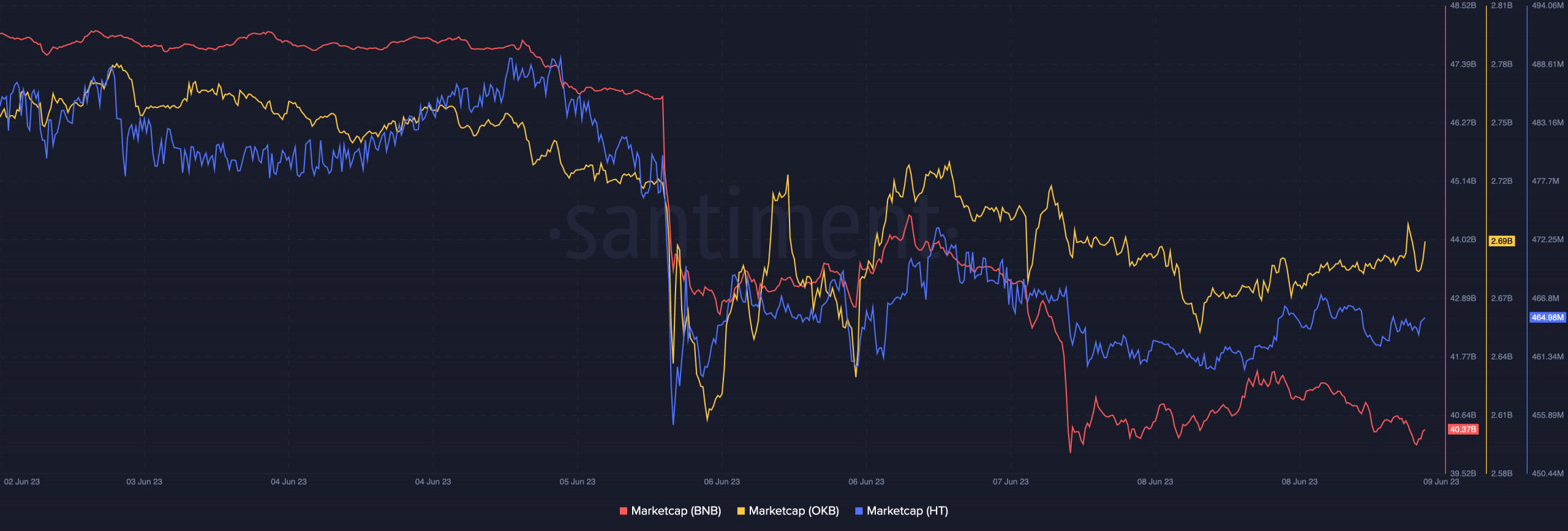

As a consequence, the market capitalization of tokens associated with CEXs, such as BNB, OKB, and HT, witnessed significant declines over the past month. Investors are becoming wary of the risks associated with these tokens, leading to a decrease in their value.

Realistic or not, here’s BNB’s market cap in BTC terms

If the situation does not improve for CEXs, decentralized exchanges may benefit from an influx of users who lost faith in the security and reliability of CEXs.