The Japan-crypto link: ‘This could be the start of a global bear market’

- Global markets face turmoil, with cryptocurrencies and major stock indices experiencing severe declines.

- Arthur Hayes predicted that Japan’s yen fluctuations could boost cryptocurrencies.

On the 5th of August, a major upheaval rocked the global economy, with markets including Japan facing a severe downturn.

Cryptocurrencies bore the brunt of this shift, as Bitcoin [BTC] and other altcoins plunged by double digits amid widespread risk aversion.

This dramatic decline in the crypto sector mirrored the broader financial instability.

Japan’s Nikkei index experienced its most significant drop in decades and European stocks falling sharply, marking their worst performance in two years.

Meanwhile, the Bombay Stock Exchange in India closed with a drop of over 2,000 points.

Expressing concerns on the same, the head of strategy at Astris Advisory in Tokyo Neil Newman to CNN noted,

“That was a crash. It smelled like 1987. Today was relentless. It was unusual because there was the absence of a rebound at the end of the day, which you would normally see due to short covering.”

Adding to the fray was, Andrew Lokenauth, who said,

What’s behind the global bear market?

There are speculations that the turbulence in the U.S. financial markets could be influencing Japan’s economic conditions.

For those unfamiliar, the Federal Reserve’s upcoming decision on potential interest rate cuts in September has intensified market volatility, contributing to a widespread sell-off.

Shedding light on the same, Japanese Central Bank Governor Kazuo Ueda said,

“If the economy and prices move in line with our projection, we will continue to raise interest rates.”

A declining Yen could benefit Bitcoin

Needless to say, Arthur Hayes, co-founder of BitMEX had a unique perspective to share when he said that the yen’s fluctuations could influence tech stock prices and U.S. debt dynamics.

He also indicates that if U.S. policymakers respond to Japan’s rate changes as he anticipates, it could have a positive effect on cryptocurrency markets.

Well, this isn’t the first time Hayes has connected Japan’s economic movements with cryptocurrency price trends. Previously, in his blog titled ‘Easy Button,’ he noted,

“I think that a USDJPY surge towards 200 is enough to put on the Chemical Brothers and “Push the Button.”

“Chemical Brothers” refers to the U.S. and Japan, while “Push the Button” means printing money or ‘injection of liquidity.’

Here, Hayes predicted that a weakening yen could trigger currency conflicts between Japan and China, potentially leading the U.S. to intervene by devaluing the dollar.

This could boost dollar-based assets and possibly spark a crypto boom.

What’s the present data telling us?

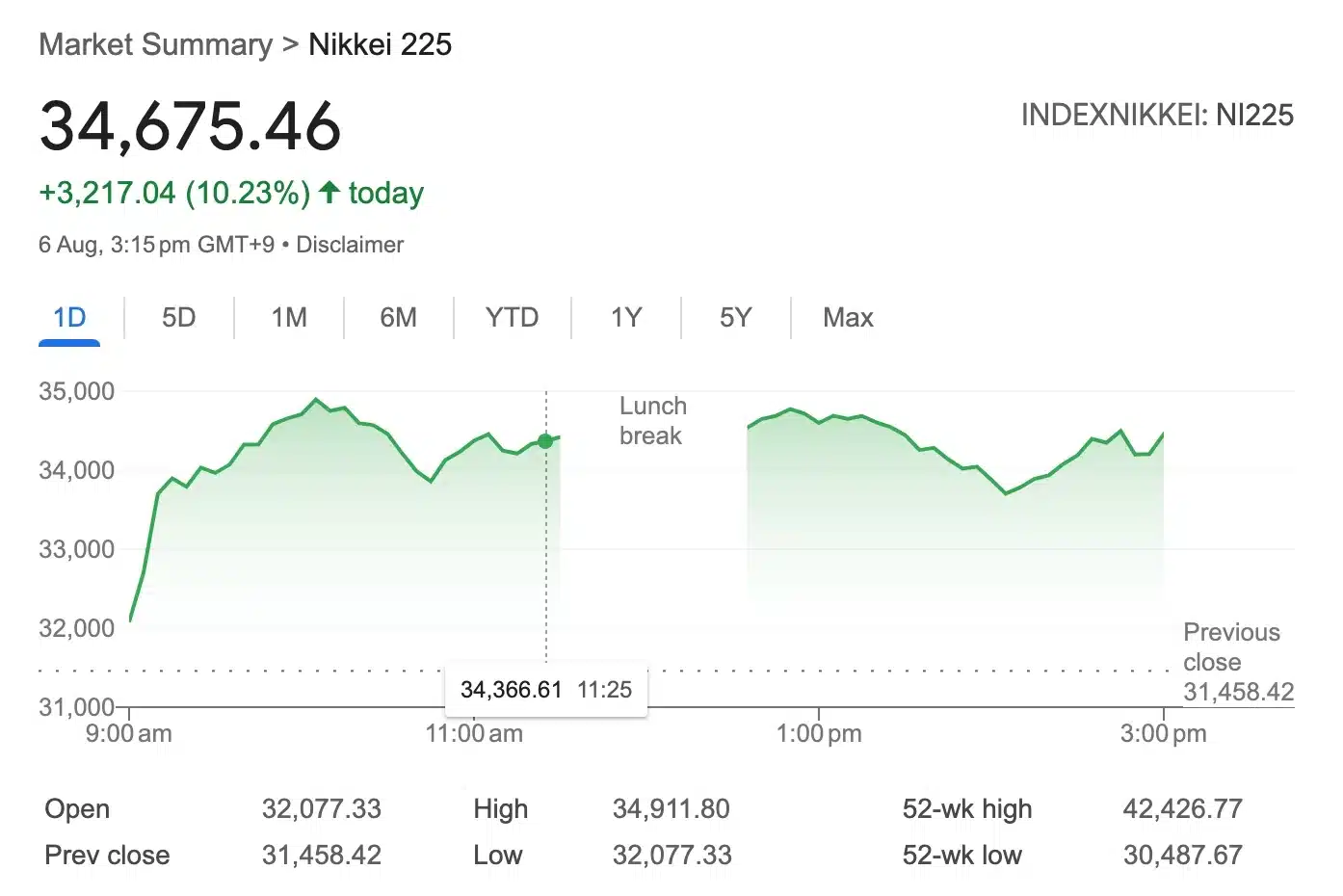

As of now, the Nikkei 225 has rebounded impressively, surging over 10% just a day after experiencing its largest two-day drop on record.

In contrast, the global cryptocurrency market has also seen a notable uptick, with its market cap rising to $1.95 trillion—a 4.86% increase in just 24 hours as per CoinMarketCap.

These sharp fluctuations underscore the current volatility in the economic landscape, as markets react to impending Federal Reserve decisions on interest rates.