Bitcoin

There’s more to Bitcoin Options’ story!

The crypto-derivatives market was largely successful in 2020. While Bitcoin Futures have been in the limelight a lot due to the CME’s growth, Bitcoin Options stole the show with its consistent run throughout the course of 2020. However, its magnification goes beyond the regular interest of traders, with other factors playing a vital role in the process too.

It’s a Numbers Game!

Source: Deribit

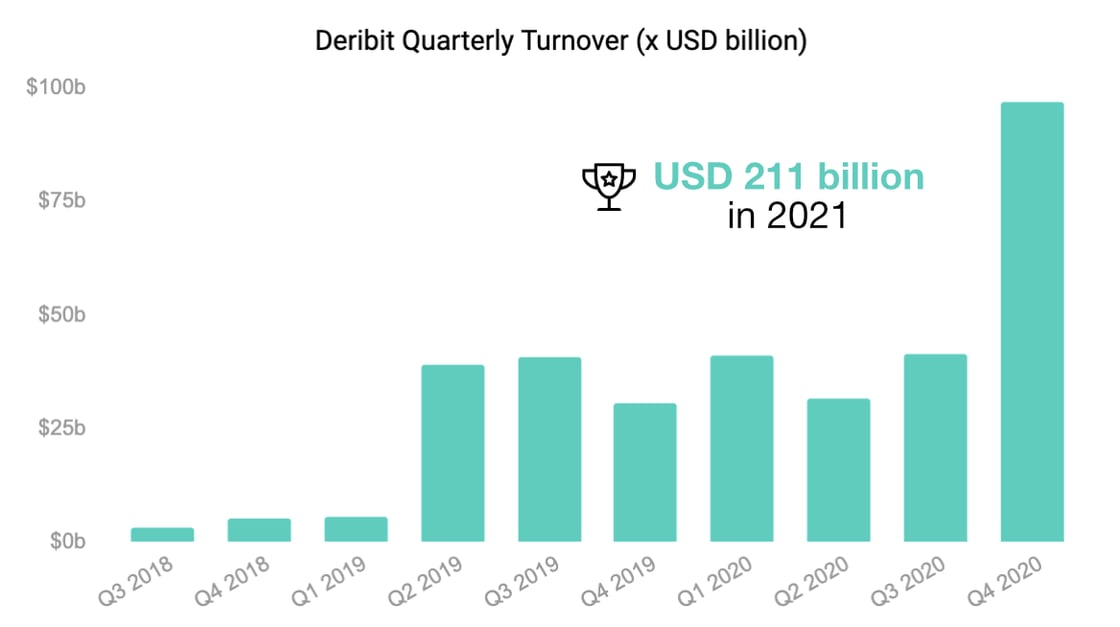

According to Deribit’s latest institutional newsletter, the total notional turnover in 2020 was $211 billion, amassing all contracts and coins. The Bitcoin Options turnover was close to $180-$190 billion. It registered an 82% increase from 2019, a finding that demonstrated the year-on-year rise in the sector.

The last quarter of the year was particularly special as the bull run assisted in extremely high trading activity. Now, on paper, it may seem flawless, but 2020 was much more than that.

The Bitcoin Options market wouldn’t have recorded such high interest and volume if certain things had not gone its way in the market.

Bitcoin Price, Recovery, and Data Advantage

When the attached chart is observed, we can see that Q2 of 2020 wasn’t as impressive as the rest of the quarters. It was on par with the lowest quarter of 2019 and it was all due to the market crash in March. Now, even though Q2 of 2020 was tepid from the perspective of the derivatives market, the price gained bullish momentum in this 3-month period, momentum that set the wheels in motion for the rest of the year.

Bitcoin recovered fast and following its 3rd halving, BTC climbed to the 5-figure value of $10,000 once again. Q3 2020 picked up some of its steam and then, Q4 laid down the best quarter in Bitcoin Options market history.

Although the price of Bitcoin did matter in the derivatives industry, another advantage of Options over Futures is the availability of extra data. Options give the ability to tap into collective sentiment with the help of Implied Volatility.

Source: BNC

Implied volatility for Options in Bitcoin markets has a U-shaped pattern or “volatility smile” skew. It indicates that the volatility of Options improves when the Option becomes highly in the money or out of the money. Such a data set allows traders to estimate the collective sentiment of the market, be it bullish or bearish.

Ethereum Options held the fort when Bitcoin was down

While it is purely based on speculation, the fact is undeniable that ETH Options kept the traders in the market when Bitcoin couldn’t generate massive price movement, and by extension, Options activity. During Ethereum’s rally in August, In fact, ETH Options contract volumes surpassed Bitcoin’s as the world’s largest altcoin attracted better outcomes.

It all worked out in the end, however, since these traders remained in the space when Bitcoin registered its next leg up in the market.