These factors are helping Avalanche, Terra stay afloat in stormy waters

With the market crashing after the news of crypto ban in China hit the floor, Bitcoin saw a close to 10% price drop. On the back of the BTC losses, a market-wide crash began which resulted in most of the top altcoins shedding their prices too. However, some alts showed higher resistance to the crash noting fewer losses and holding better than the rest. Avalanche (AVAX) and Terra (LUNA), the 11th and 12th ranked alts were stellar examples of the same.

Notably, AVAX was only 1.99% down from its price ATH on September 23, while LUNA was merely 21.02% down from its ATH on September 11. While the two alts saw some minor losses they seem to be largely unaffected by the market crash. So why did these altcoins held better?

Good growth trajectories

Both AVAX and LUNA displayed good growth trajectories over the last month. Avalanche’s TVL was up from $312 million on August 18 to $2.6 billion on September 14, while its daily transactions rose from 43,243 on August 18 to 220,222 on September 12.

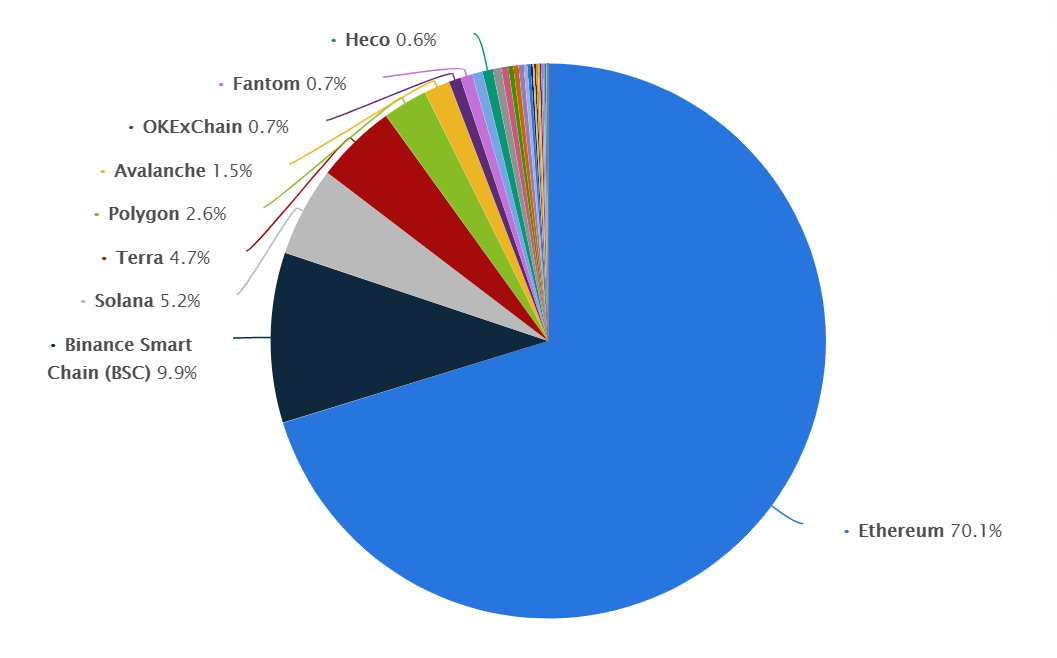

Further, the distribution of total value locked (TVL) in DeFi, worldwide across various blockchains as of September 17 highlighted that AVAX and LUNA covered decent ground. Terra made 4.7% of the TVL, while AVAX’s was 1.5%.

Further, their metrics at large provided a healthy outlook, AVAX’s futures market looked good too as OI on futures and perpetual saw gains. Open Interest change over the last 24-hours for AVAX on futures saw 6.79% gains while on perpetuals OI was up 3.85%.

On the other hand, seemingly, a recent spike in LUNA’s percentage of stablecoin total supply held by whales with more than 5 million USD may have acted as a cushion for the coin during the recent dump. There was a close to 35% rise in the metric on September 19.

Smooth ride up, but what next?

The two altcoins’ rise could also be attributed to external factors such as Terra’s Anchor protocol hitting $4 billion in TVL on September 22, six months after the launch. On the other hand, AVAX’s price has also seen impressive growth since Avalanche completed a $230 million private sale of AVAX tokens.

Notably, both the alts have made a significant uptrend in both market cap and market cap dominance. However, at the time of writing, both AVAX and LUNA saw over 6% price drop in the last day. Seems like the market crash did affect the tokens but just a little late. Nonetheless, the alts still held on to their higher support levels which was a good sign.