This 2020 factor could be the key to Bitcoin reclaiming the $60k level

Bitcoin’s past week of decline has been analyzed again and again: the why, the how and how long. Quite a few factors have been deemed responsible for its drop. From weak market sentiment to over-leveraged trades, every reasoning is backed by an argument. Yet, there is a particular influence, or simply the lack of it, which may have rolled the dice on BTC’s calamitous month.

How is no one talking about Institutions?

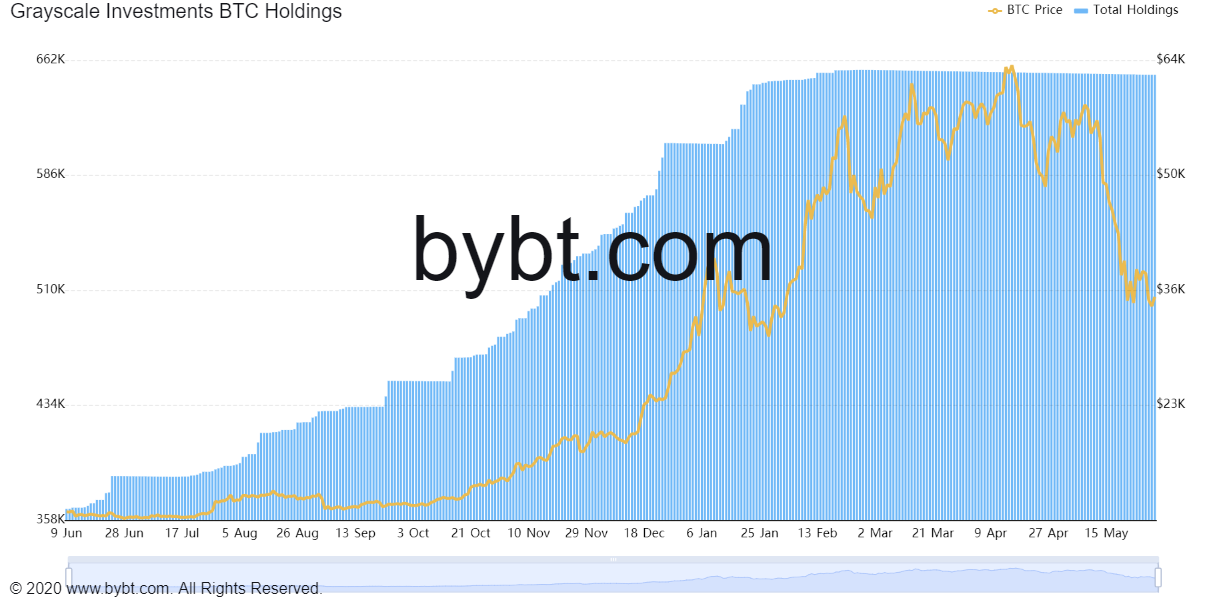

Say what you may, Institutions made their presence known towards the end of 2020. Whether it was Grayscale’s aggressive accumulation or MicroStrategy’s massive BTC buy, its impact was evident. From 1 October 2020 to the 3rd week of February 2021, Grayscale’s BTC holdings increased from 449.8k BTC to 655.47k. Then, the spending suddenly came to an abrupt halt, and a significant weekly correction of 21% was observed.

Many analysts speculated that Grayscale stopped adding to their BTC holdings as GBTC premium was exhibiting negative rates. Now, Since 25 February, GBTC premium is yet to record a positive rate. On 14 May, it reached an all-time low of 21.23%.

The drop in GBTC discount suggested that institutional demand has softened in the market considerably since February.

BTC/USDT on Trading View

Coincidentally, the price action for Bitcoin hasn’t been great either. Bitcoin registered a high of $57,780 on 21 February, following which only an 11.14% rise was observed over a month. The momentum had visibly tapered down.

Therefore, it can be speculated that the decrease in Institutional spending may have halted BTC’s rally following Q1 2021. Retail traders haven’t been able to inject substantial momentum to the rally, as leveraged trades rekt the price’s value off late.

What can be taken as positive for Bitcoin?

There is no way of confirming a correlation between Bitcoin bull-run and Institutional spending. However, both have occurred in the same period, so an argument can be made based on influence. One of the positives that can be taken out of the current market is that Grayscale could start accumulating at previous prices again, seen during the start of February.

Another inference that can be drawn is that Institutions are currently waiting for the price to drop deeper, before executing another major buy order. Whatever it may be, institutions’ intervention currently looks significant for Bitcoin, if the asset wants to improve and progress higher on another bullish rally.