‘Good buying opportunity for Bitcoin?’ Analyst reveals long term plan you can follow

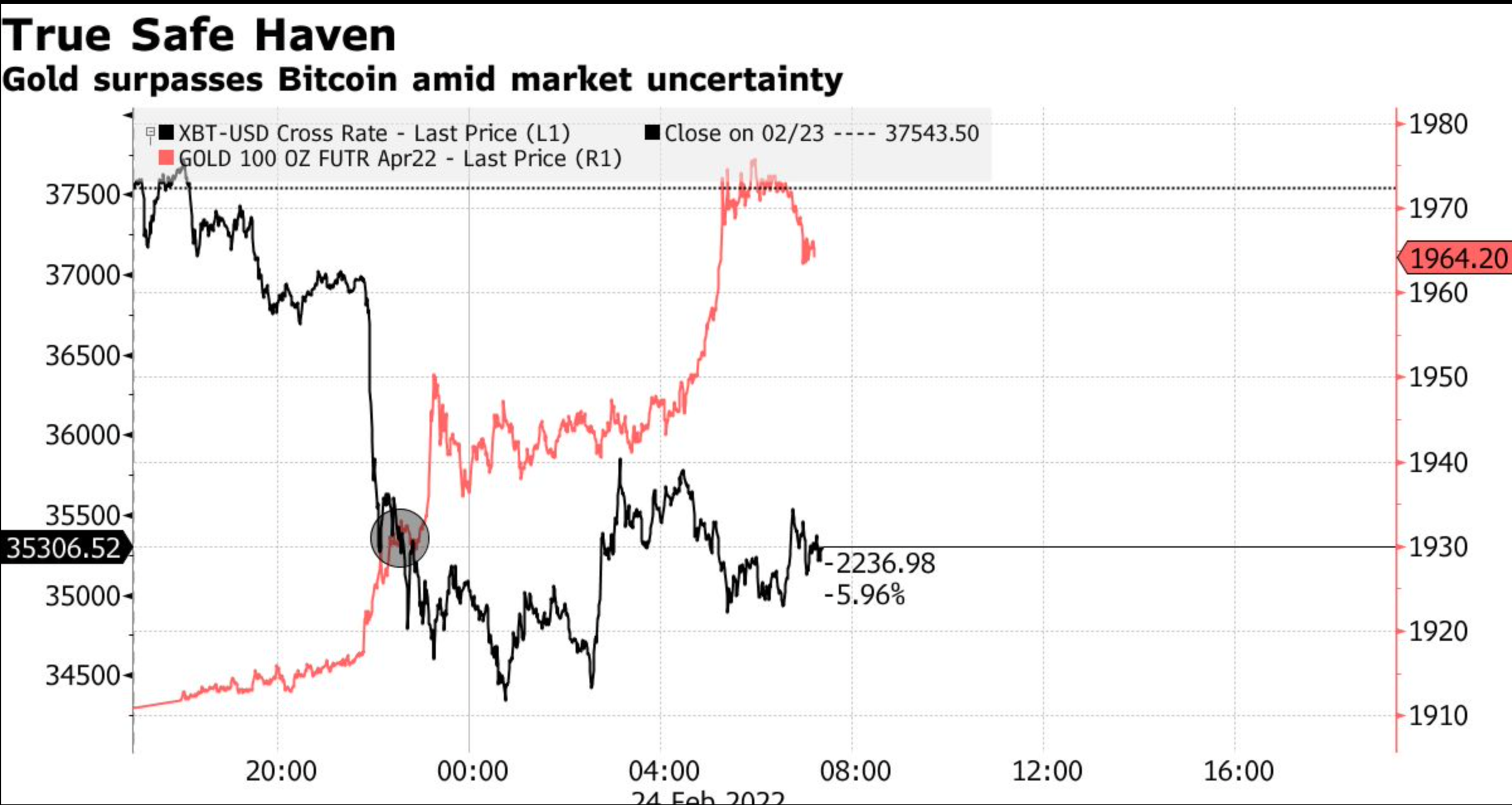

The cryptocurrency market has suffered quite a bit following the recent tension between Russia and Ukraine. Amidst this ongoing struggle, the crypto market cap lost almost $200 billion. However, at press time, the market did rebound. It was up by 7%. Nonetheless, uncertainty still prevailed. In fact, Bitcoin’s long-time rival, Gold made impressive strides.

Defining moment

Bloomberg’s senior commodity strategist Mike McGlone shared his analysis concerning the king coin in an interview with Scott Melker, the host of Wolf of all Streets podcast. He highlighted that the traditional markets were overdue for a pretty significant correction. And, this has also been felt in the crypto market. Following the Russia-Ukraine news, both the equity and crypto markets took a heavy blow on 24 February.

Nonetheless, this could prove to be a ‘defining moment’ for the digital asset,’ McGlone asserted. Despite the risks, he believed, this dip was a “very good buying opportunity” for long-term investors who had left funds on the side. Commenting further, he noted,

“The key thing to point out here is cryptos and Bitcoin are still risk assets and they’re giving up back a lot of gains. I still think there is more pain there. I don’t think Bitcoin gets much below $30,000 its holding good resistance around $40,000.

I think this is ultimately going to be a very good buying opportunity for Bitcoin for longer-term traders. It’s going to be looked back upon in history as a defining moment.”

However, it’s interesting to note that at the back of Ukraine’s conflict one asset was a clear winner.

Goal or Gold?

Gold moved up the charts while most of the other assets were losing value. In fact, the price of gold climbed to a 13-month high on 24 February.

Source: Bloomberg

Gold here was a clear winner. In fact, it seemed primed to cross $2000 per ounce. Gold traded as high as $1,974 on 25 February, the most since September 2020. Here, McGlone reiterated,

“Gold is way overdue for an enduring breakout above $2,000 an ounce, we’ve been calling for this for too long, unfortunately, this is how it works, markets take you down to the mat, make you not believe, and then it breaks out, so it’s way overdue.”

Meanwhile, Tom Essaye, a former Merrill Lynch trader portrayed Gold as a mature asset.

“Gold is doing exactly what it should be doing right now, but it’s a much more mature asset and it’s got a proven history in these types of conflicts of how it trades.”

He further added:

“This is the first time Bitcoin has ever encountered a potentially major global conflict, and I would expect that the declines will continue as long as stocks are under pressure.”

Interestingly, at the time of writing, Gold stood at the first spot in the ‘Assets ranked by Market Cap‘ list. For reference, Bitcoin was at the #9 spot.