This is how RUNE reacted to THORChain’s latest launch

- THORChain’s launch allows users to lend their native Layer 1 assets, like BTC and ETH, to borrow TOR.

- After a short decline, RUNE’s price regained upward momentum.

THORChain [RUNE] recently decoupled from the market as it enjoyed a comfortable bull rally over the past two weeks. Investors were actually expecting the token to rally further, as it was awaiting a major launch.

Realistic or not, here’s RUNE market cap in BTC’s terms

However, that was not the case, as the price witnessed a correction.

THORChain’s lending protocol is live

On 21 August, THORChain announced that its lending protocol went live. With the launch, users could lend their native Layer-1 assets, like Bitcoin [BTC] and Ethereum [ETH], to THORChain and borrow a USD-denominated debt.

The new debt denominator is named TOR, and debt can be repaid in any THORChain-supported asset, including stablecoins.

Lending is live.

Params, Disclosure, Risks, How-to Thread

?

— THORChain (@THORChain) August 21, 2023

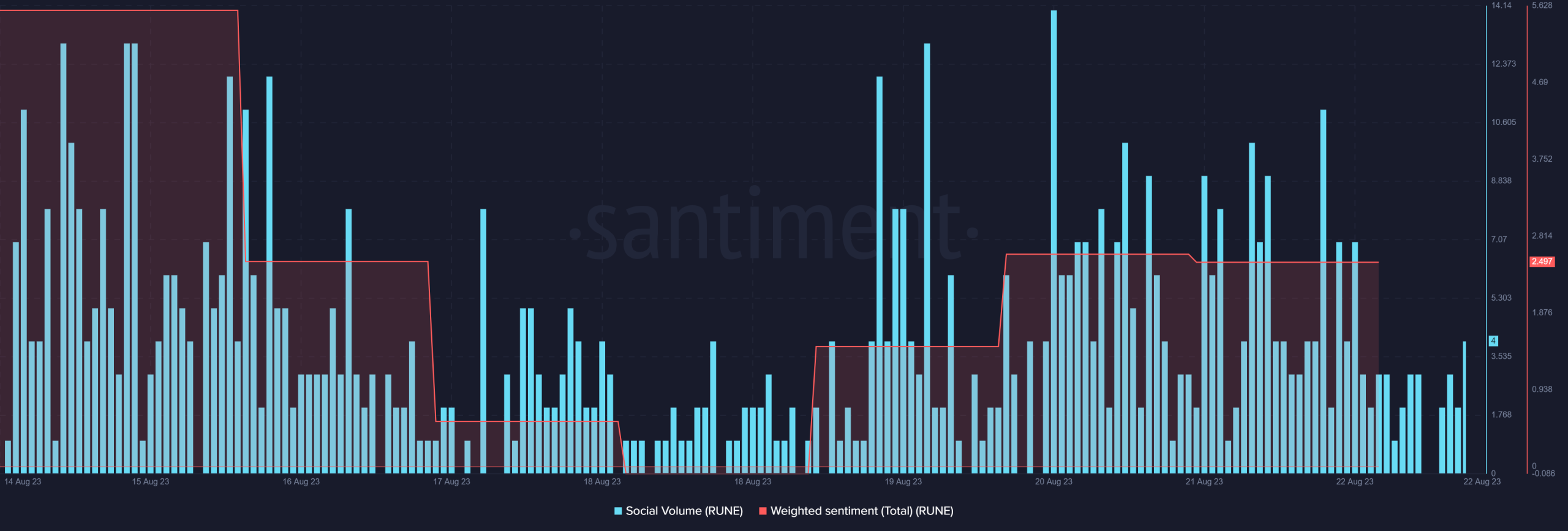

The release made THORChain a hot topic of discussion, as evident from the rise in its social volume. However, its weighted sentiment dropped during that period.

RUNE’s response was surprising

Though the launch had the potential to fuel RUNE’s ongoing rally, the ground reality turned out to be different. As reported earlier, there was a chance of a price correction. This turned out to be true, as on 21 August, RUNE’s price declined for a couple of hours.

Nonetheless, the token later stabilized and again gained upward momentum.

According to CoinMarketCap, RUNE’s price has increased by more than 5% in the last 24 hours. At press time, it was trading at $1.68 with a market capitalization of over $572 million.

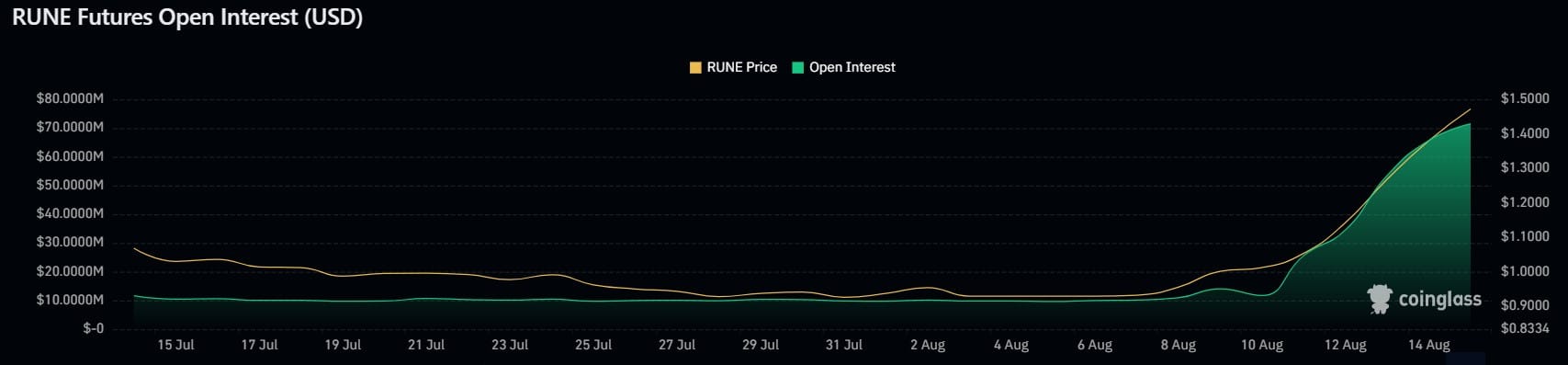

In another spot of good news, RUNE’s Open Interest increased while its price went up. A hike in this metric suggested that the press time price trend might continue longer.

How much are 1,10,100 RUNEs worth today?

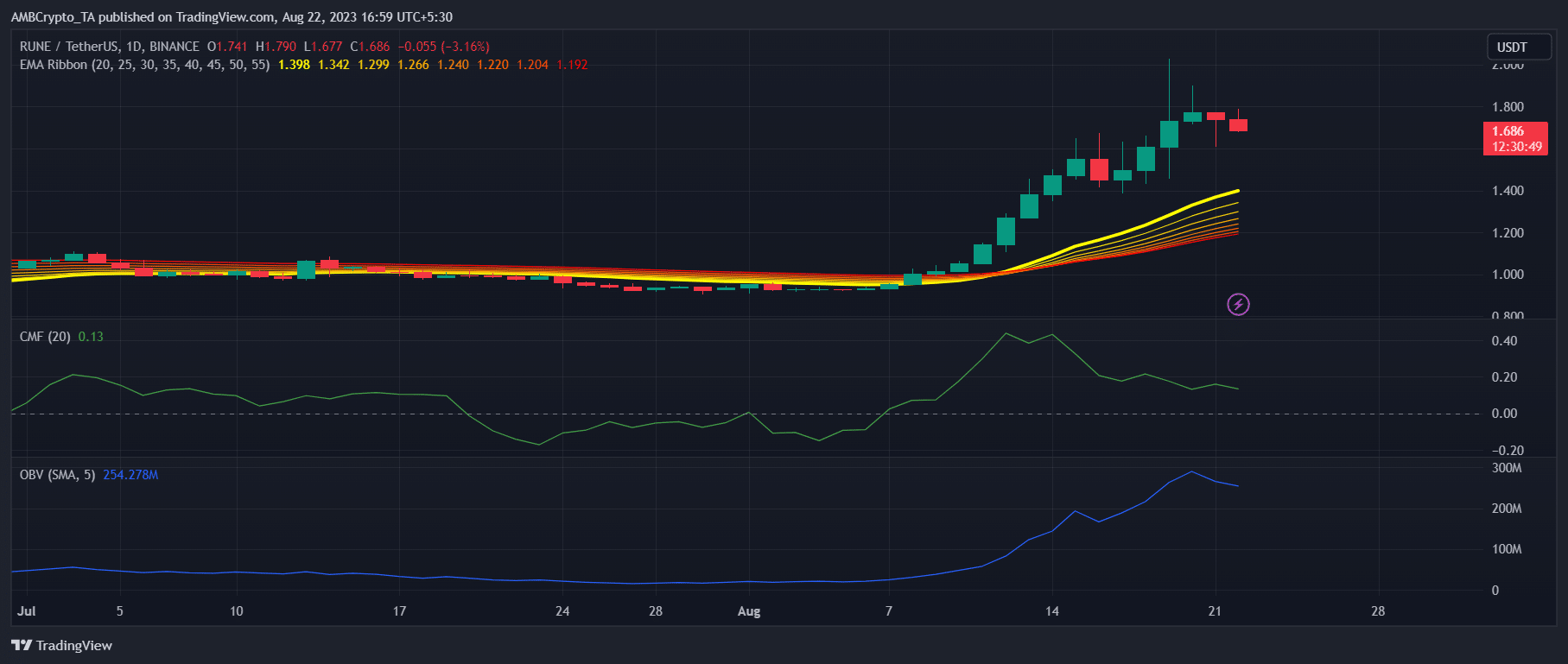

However, CryptoQuant’s data revealed that THORChain’s Relative Strength Index (RSI) was overbought, which was bearish. On top of that, both the token’s Chaikin Money Flow (CMF) and On Balance Volume (OBV) registered downticks. This could prevent the token’s price from going up any further.

But, the Exponential Moving Average (EMA) Ribbon revealed a clear bullish upper hand in the market, as the 20-day EMA was above the 55-day EMA.

![Solana [SOL] gains on Ethereum [ETH] but faces sell-off risks](https://ambcrypto.com/wp-content/uploads/2025/04/5B92B32E-5F8B-49F6-94A3-D0086EF6CCA2-400x240.webp)