This is how the market could unfold for Bitcoin, Ethereum, Cardano this week

Losing sight of the bigger picture can always lead to hasty decisions in the crypto industry. It usually happens in the short term and the consequences are usually felt weeks later. Speaking of the market, Bitcoin and other alts are currently on a strong bullish run. Ethereum, Cardano, and other Alts were improving their market value as well but, it might be time to catch a breath.

In this article, we will try to analyze if a potential drop could unfold itself over the current week (However, it is important to understand that the corrections could be lagged or invalidated as well owing to the current volatility).

Why should the market correct?

Bitcoin crossing above $40k-$42k was a crucial moment in the recovery. It essentially confirmed the presence of strong bullish momentum, but strong rallies should facilitate a healthy market structure as well. Now, Bitcoin did decline for 4 days straight between 31st July-3rd August but it formed a lower high before moving above its immediate top.

Yet, there were certain signs already indicative of a potential correction going forward.

BTC/USDT on Trading View

On the 12-hour chart, there is a clear bearish divergence forming at the moment, which ideally might take Bitcoin down to $40k-$42k. Bearish divergences on a longer time frame are stronger signals that unfold over time. A significant on-chain signal was also observed.

The current Realized Cap of Bitcoin is significantly lower than the range witnessed during the early bull run of Q1. This is either a strong bullish false, as fewer investors might be moving the price up, or a consolidating process to push the realized cap higher on average.

Either way, there are strong signs of a correction period.

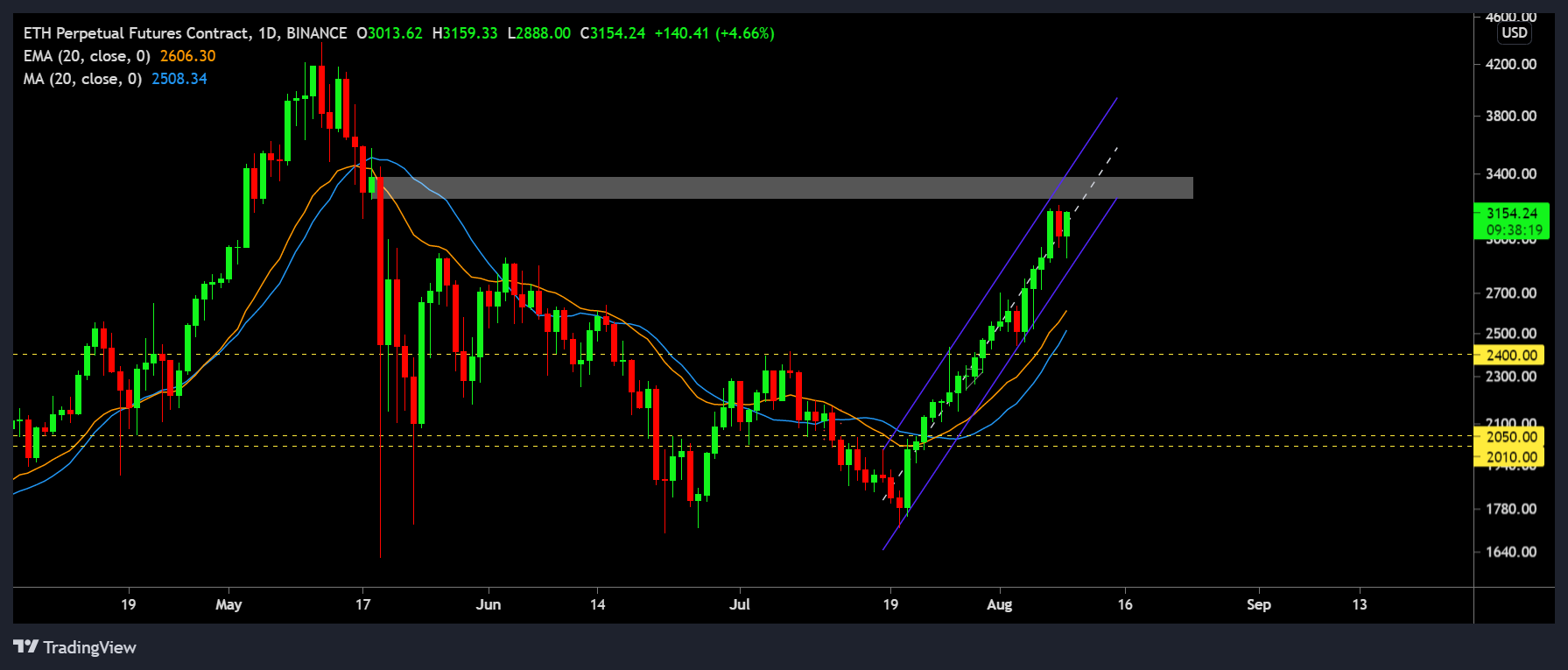

ETH/USDT on Trading View

Currently, Ethereum is one of the top assets, that is not looking at strong resistance immediately. ETH’s path to $4300 is currently easier than BTC’s path to $64,000 but ETH has climbed since 21st July without recording one lower high in the charts.

On-chain, its active addresses were not ranging at a congestion rate at the moment. There are functionality transactions with NFTs and DeFi resurgence but organically, ETH’s had neutral signals.

Cardano is potentially facing strong resistance at $1.50 and it is presently backing its price rise with very little trading volume in comparison to the activity in April-May.

ADA/USDT on Trading View

Does analyzing only Bitcoin, Ethereum and Cardano make sense?

In the short term, it might be more variable, but on a longer time frame, yes. The trio currently makes up more than 77% of the total crypto market cap. A drop in their liquidity will automatically decline the collective market’s value.

Bitcoin has opened its 4th consecutive week on a green candle which was lasted witnessed during January-February. It happened only once through the bullish rally of Q1-Q2. The January’s 4 week-streak was met with a red, only time will tell what unfolds over the next couple of weeks now.