This is the extent of Binance’s regulatory woes

- Binance bowed to pressure from regulators, and on-chain activity took a hit.

- BUSD and BSC showed that Binance’s market share had been dwindling extensively.

You might be aware that Binance [BNB] has been going through a rough period due to the regulatory pressure. But chances are that you have not seen the impact that it has had on the exchange. Well, now is as good a time as any to find out.

Read Binance Coin’s [BNB] Price Prediction 2023-24

Binance has been contributing to a substantial amount of prevailing demand for cryptocurrencies, considering its status as the largest crypto exchange. This is especially the case for spot demand.

However, that demand has been declining as users have been hesitant to use the exchange during recent challenging conditions.

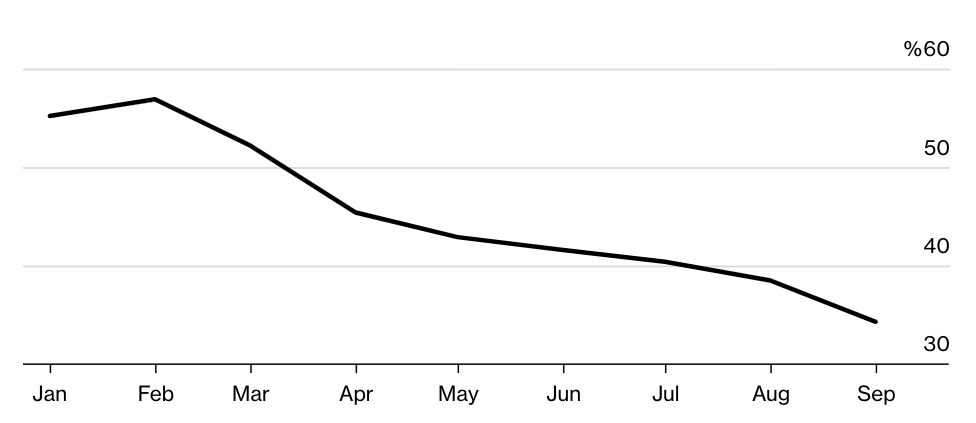

Binance’s market share in the spot market has reportedly been declining for the last seven months. Its spot market share hovered at around 38.5% in August to 34.3% a month later. However, that dip pales in comparison to its January highs at 55.2%.

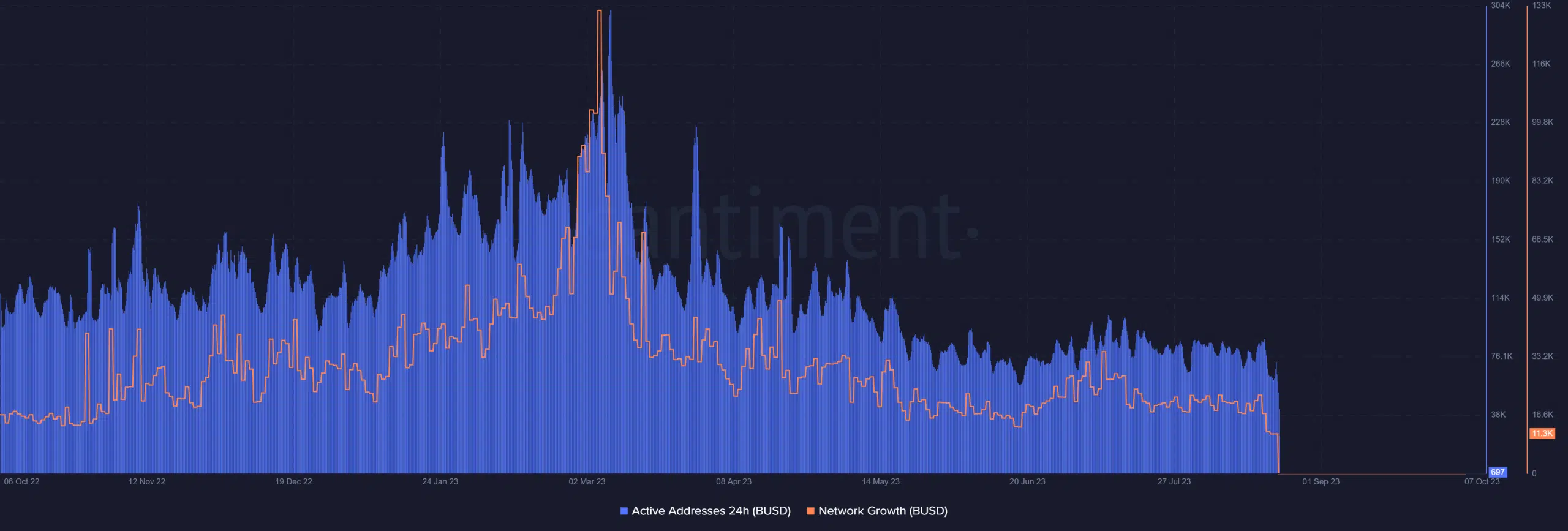

The declining market share was bound to have an impact on Binance’s operations. For example, if we look at Binance USD’s [BUSD] performance on the BSC, we see a substantial decline in the number of active addresses since their peak in March.

BUSD on BSC offers insights into Binance’s woes

We explored the active addresses performance in the last 12 months. The number of active addresses grew substantially from October 2022 to its March 2023 peak. For perspective, active addresses soared above 300,000 and have since then dropped below 100,000.

Network growth has also experienced a substantial dip since March, suggesting that the market might be affected by the impact of Binance’s woes. However, this might not necessarily be due to the regulatory pressure alone.

The same metrics also reflected the slower market conditions across the crypto market as observed in recent months.

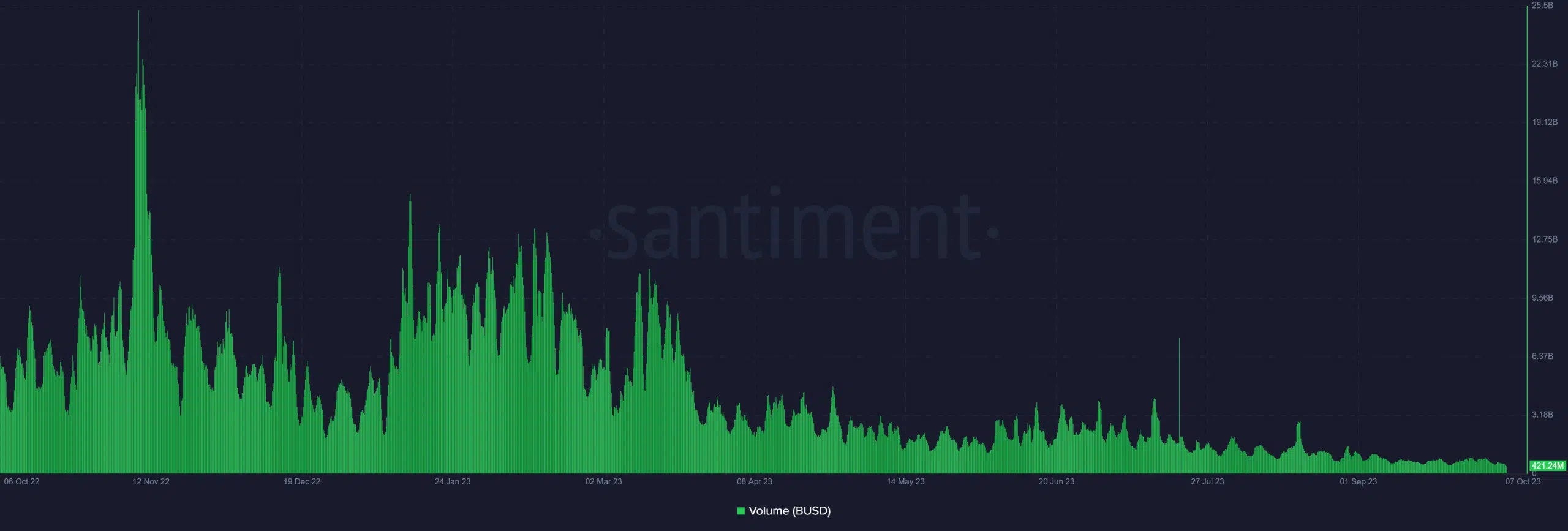

BUSD volumes may indicate something different. It maintained healthy volumes between 0ctober 2022 and March 2023. However, volumes have since then dipped considerably over the last few months.

This is despite periods of substantial short-term market demand for cryptocurrencies between March and September.

Is your portfolio green? Check out the BNB Profit Calculator

The low volume observed with BUSD on the BSC may suggest a definite impact on Binance. The reason could be that the regulatory scrutiny has created a tough environment for Binance to operate in the U.S.

This is one of the regions that has the highest level of crypto adoption in the world. Consequently, the drop in confidence has negatively affected its on-chain volumes.

![Uniswap [UNI] price prediction - Traders, expect THIS after altcoin's 14% hike!](https://ambcrypto.com/wp-content/uploads/2024/12/UNI-1-400x240.webp)