This is where your BTC holdings stand after the latest FOMC meeting

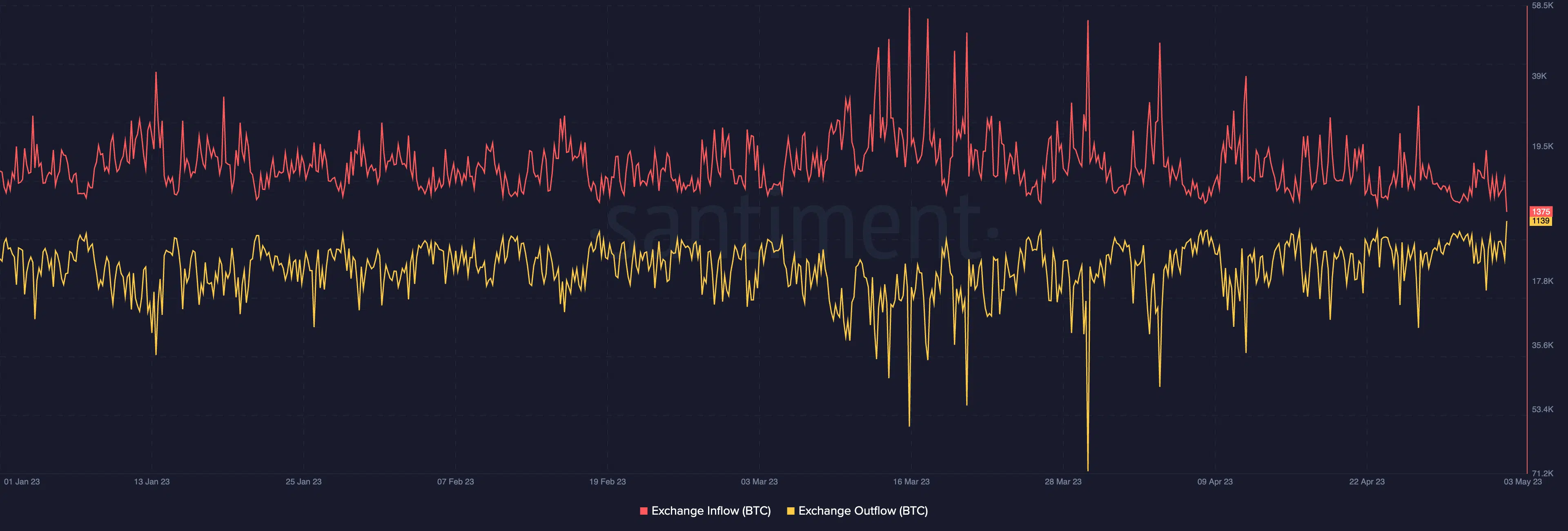

- The month of April saw exchanges witnessing an inflow of more BTC as compared to the outflow.

- The outcome of the latest FOMC meeting did show a slight uptick in the performance of BTC but not enough for a sizeable rally

The state of the cryptocurrency market stood in a frenzy considering the expected outcome of the latest Federal Open Market Committee (FOMC) meeting. Bitcoin [BTC], thanks to its highly volatile nature, seems to be the focus of most traders operating in the crypto space.

The same was highlighted by data analyst Arkham Intel in a thread posted just minutes before the FOMC meeting result.

In 40 minutes, the Federal Open Market Committee (FOMC) will be meeting for the 3rd time this year.

With the FOMC being a major interest point for both short- and long-term traders, we took a look at activity on the Bitcoin blockchain in the run-up to the FOMC meeting ? pic.twitter.com/7haSPKq2GG

— Arkham (@ArkhamIntel) May 3, 2023

Read Bitcoin’s [BTC] Price Prediction 2023-24

The ‘before’ of the event

The thread posted by Arkham Intelligence highlighted three exchanges and activity levels throughout April. Considering the activity levels on Binance, BTC witnessed significant withdrawals and deposits. However, traders and investors showed a higher inclination towards depositing their BTC in the exchange.

Furthermore, OKX witnessed a similar pattern with a massive surge in activity towards the end of April. Considering the activity on BitFinex, it could be seen that on 12 April, the exchange recorded $3 billion worth of BTC inflow into the exchange. Additionally, traders deposited $300 million more than they withdrew.

Bitfinex's tagged wallets recorded by far the greatest consistent USD amounts of withdrawn and deposited Bitcoin.

On 12th April, Bitfinex-related on-chain activity spiked, recording $3B worth of inflows on that day.

In 24 hours, wallets deposited $300M+ more than they withdrew. pic.twitter.com/8TcBgjfKze

— Arkham (@ArkhamIntel) May 3, 2023

The ‘after’ of the event

At the time of writing, the outcome of the FOMC meeting was announced with interest rates up by .25%. As per crypto reporter, Walter Bloomberg interest rates went from 5.00% to 5.25%. Additionally, the revised rate stood at a 16-year high.

FED RAISES KEY OVERNIGHT INTEREST RATE BY 25 BASIS POINTS TO 5.00%-5.25%

— *Walter Bloomberg (@DeItaone) May 3, 2023

Just minutes after the outcome of the FOMC meeting, BTC’s four-hour chart indicated that the king of cryptocurrencies was moving in the green. At press time, BTC was trading at $28,619. The Relative Strength Index (RSI), although at 50.09, did show an indication of moving above the neutral line.

Furthermore, the Moving Average Convergence Divergence (MACD) indicator showed some movement toward the positive. This was because the MACD line stood slightly above the signal line. This could be taken as a very low bullish indication.

Does it all scream bullish?

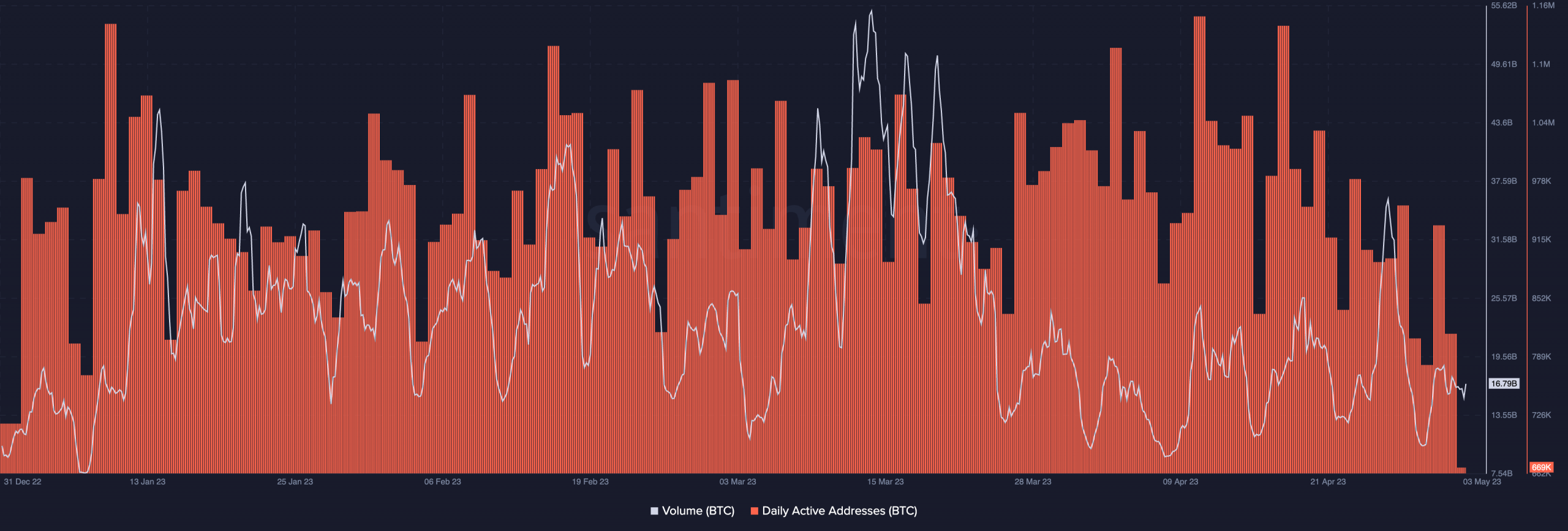

Data from the intelligence platform Santiment showed that at press time, neither BTC’s volume nor the number active addressed surged drastically.

Following the FOMC announcement, BTC’s volume, although witnessed a slight hike, stood at 16.79 billion. Additionally, the number of active addresses also stood at 669,000 at the time of writing.

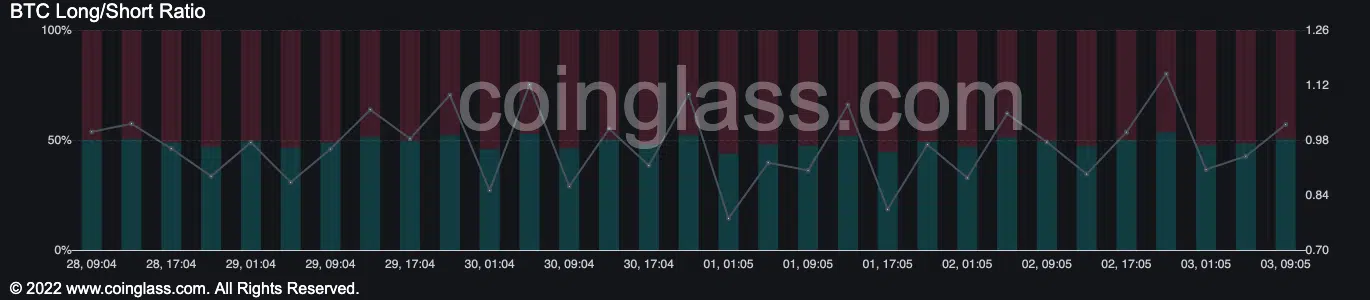

Furthermore, a look at BTC’s long/short ratio over the last four hours showed that a higher number of traders favored longer positions than investors who supported shorter positions. At the time of writing, BTC’s long/short ratio stood at 1.02.

Additionally, a look at BTC’s exchange inflow and outflow indicated that at press time, exchange inflow dominated the outflow, although by a tiny margin. However, this couldn’t be considered a great indication for BTC.

Is your portfolio green? Check the Bitcoin Profit Calculator

If traders continue depositing their BTC in exchanges over the next two or three days, BTC could turn bearish in no time. Additionally, the lack of a strong bullish momentum could also add to a strengthening bearish sentiment.

Despite the aforementioned information, a tweet posted by IntoTheBlock stated that as of 3 May, 68% of BTC holders would make a profit if they sold their BTC at the current price. Additionally, 28% would be selling their BTC at a loss.

Currently, 68% of #Bitcoin holders are in profit pic.twitter.com/ba8UqpxZKq

— IntoTheBlock (@intotheblock) May 3, 2023

Furthermore, considering the king coin’s movement over the last seven days, BTC didn’t particularly show any signs of moving in either direction. However, the risk of a sizable downside persists especially with the lack of bullish momentum in the BTC trading cycle.