This jump makes Uniswap [UNI] the talk of the town, but hurdles lie ahead

![This jump makes Uniswap [UNI] the talk of the town, but hurdles lie ahead](https://ambcrypto.com/wp-content/uploads/2023/03/Uniswap.jpg.webp)

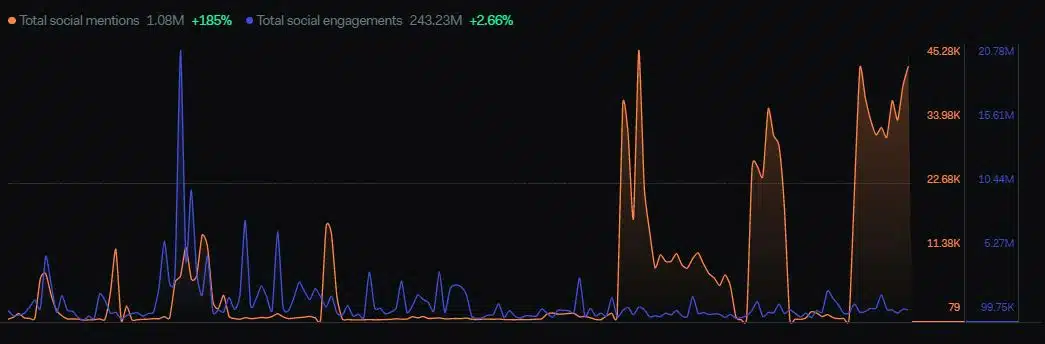

- Uniswap’s social mentions rose to its highest in two months.

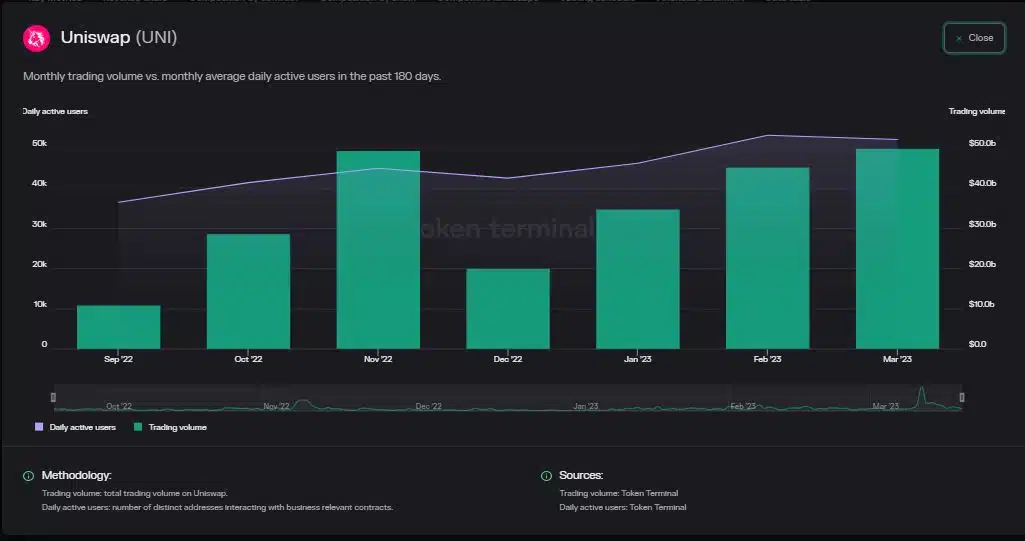

- The monthly trading volume in March hit almost $50 billion, an increase of 8%.

Uniswap [UNI] became the talk of the town as the social activity for the decentralized exchange-based token skyrocketed. According to analytics firm LunarCrush, the total number of social mentions for UNI rose to nearly 42k at the time of writing, the highest in over two months.

How much are 1,10,100 UNIs worth today?

In contrast, the total number of mentions for Bitcoin[BTC], which recently posted its best performance since June 2023, was just 17k.

What’s driving the hype?

Uniswap recently expanded to other layer-1 blockchains in a bid to improve accessibility and liquidity for its users. Last week, Uniswap V3 was launched on the BNB Chain and Avalanche [AVAX], allowing users a faster and economical option to Ethereum[ETH].

The cross-chain compatibility is one of the major requirements of the DeFi landscape. The launch was expected to boost the growth of Uniswap as well as the blockchains. Naturally, it got a thumbs-up from the crypto and DeFi community.

Additionally, the monthly trading volume on the DEX has been rising steadily. The volume in March alone hit almost $50 billion, an increase of 8%.

The bulk of the volume was dominated by stablecoin pairs, after centralized exchanges temporarily suspended USDC trading following the collapse of Silicon Valley Bank. Even now, data from CoinGecko showed that USDC/WETH and USDC/USDT accounted for over 55% of the total trading volume in the last 24 hours.

UNI faces big test

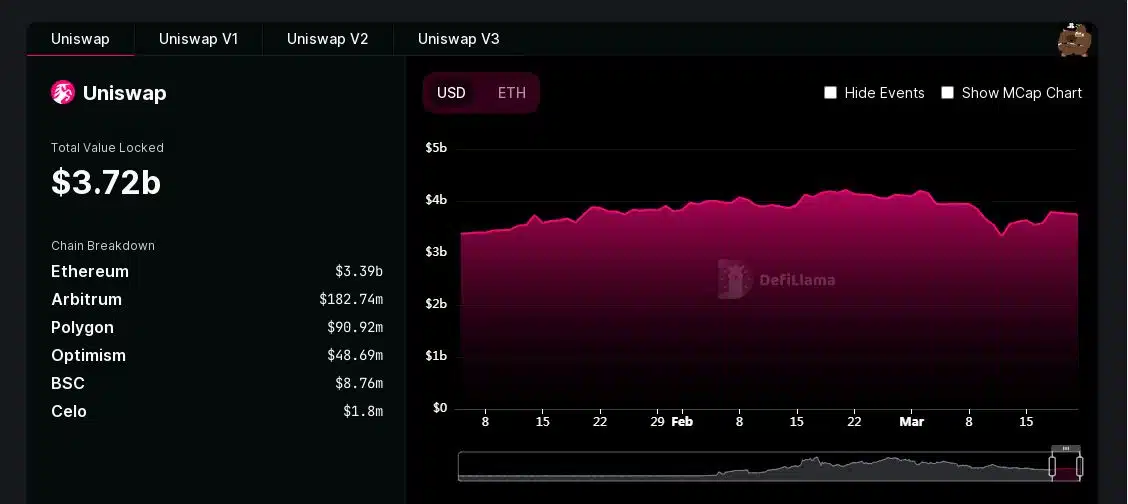

Uniswap witnessed a promising recovery in the total funds deposited on its smart contract as well. Since the USDC de-pegging episode, the total value locked (TVL) rose by more than 12% to $3.72 billion at press time.

After an extended period of decline, UNI rebounded from the support at $5.384 on 12 March. Since then, it logged gains of 14% until press time value of $6.11.

Read Uniswap [UNI] Price Prediction 2022-23

The Moving Average Convergence Divergence (MACD) was still in the negative territory, indicating that bears were in control. The Relative Strength Index (RSI) dropped below neutral 50, which pointed towards increased selling pressure. The On Balance Volume (OBV) was in a downtrend as well.

At the time of writing, UNI faced support at a level which served as a strong barrier for the bears in the past. It remains to be seen whether the coin will move upward after testing this level.