This is the single biggest determinant of the Bitcoin market’s fortunes

Bitcoin and the larger cryptocurrency market have grabbed quite a few eyeballs over the past few months and years. Thanks in part to its staggering price performance and its recognition by renowned institutions world-over, slowly and steadily, cryptocurrencies today are more mainstream than ever.

However, look closely and you’ll find that to be somewhat of a simplification. Going mainstream would suggest that something is universally known and popular among all demographics. Is that the case with Bitcoin? Well, recent reports would suggest otherwise.

A few months ago, a survey by Blockchain Capital found that 56% of the people in the 18-34 years age group and 57% of the 35-44 years age group answered in the affirmative when asked whether Bitcoin will be used by most people in the next 10 years. What does this entail? Well, it means that the younger generation is more optimistic about the prospect of cryptos in the future, something in line with surveys that have found that the same demographic is the asset class’s most-popular proponent.

While what the findings mean for the near-term are often highlighted, what often gets forgotten is what this means for the future. Above all, the aforementioned findings mean that inflows to Bitcoin and other cryptocurrencies are very much likely to hike significantly in the next 10-15 years.

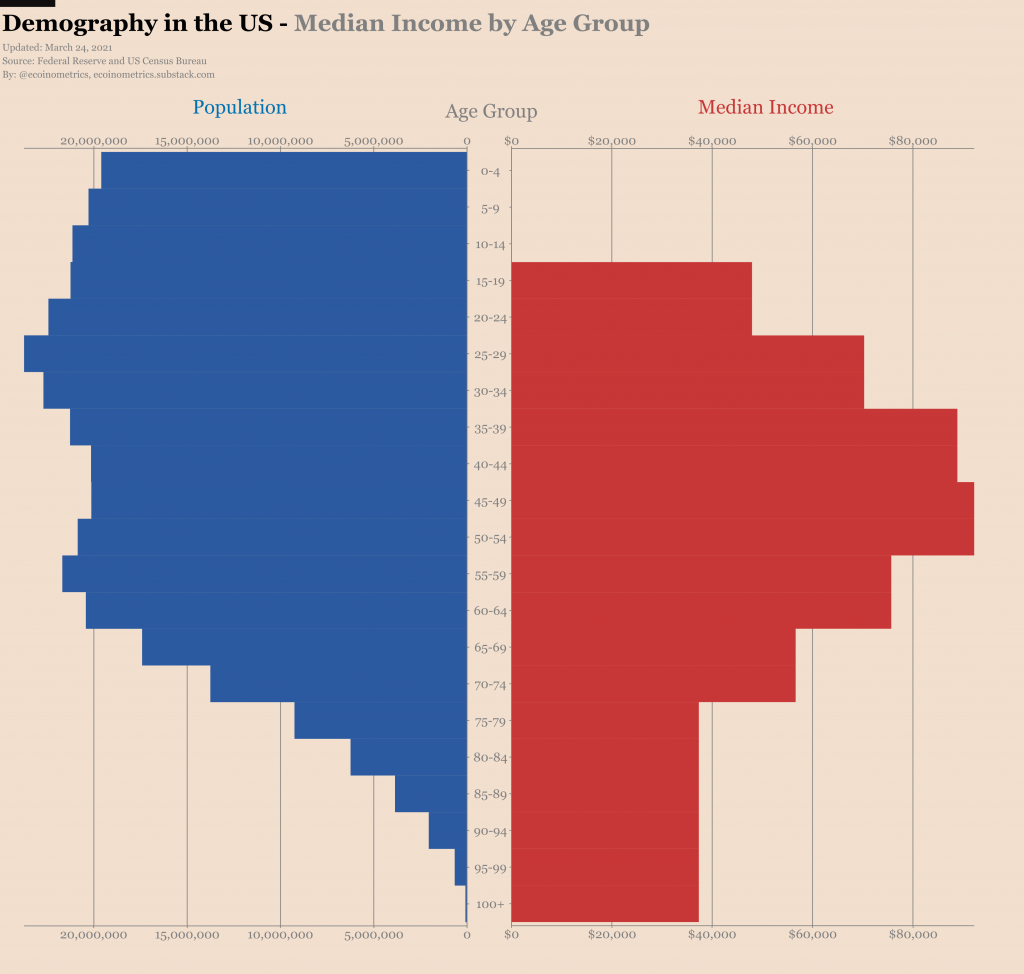

The same was highlighted by Ecoinometrics’ latest report, with the same finding that in the next decade or so, “the large bump of people who are currently aged 20 to 40 years old are going to move into the age zone at which their income is expected to peak.”

Simply put, the demographic with the most interest in Bitcoin and cryptos, in 10 years or so, will have higher incomes and ergo, more money to invest in the asset class. In fact, an argument can be made that even without high incomes, many in this age group will seek to invest in cryptos since their trust in traditional financial institutions and markets is currently at a historical low.

Source: Ecoinometrics

That’s not all, however. While rising income will soon come into play, so will inheritance. The highlighted demographic is expected to inherit as much as $68 trillion in what would be the biggest generational wealth transfer in history. With millennials predicted to hold five times as much wealth as they currently do by 2030, they are all set to emerge as the richest age group since the Baby Boomers.

Imagine that – $68 trillion. At the time of writing, Bitcoin’s market cap was just under $1 trillion, well below Gold’s market cap of $10-$11 trillion. Now, no one expects these millennials to invest all that money into cryptocurrencies, but it’s worth pondering over what the impact on the market will be if this age group invests just 5% of that money into this asset class.

With fresh money flowing into the market in such volumes, the value of cryptocurrencies like Bitcoin will skyrocket, pushing the cumulative market cap closer to Gold’s. Ergo, in many ways, more than even institutional entry, this could be the single biggest determinant of the market’s fortunes.

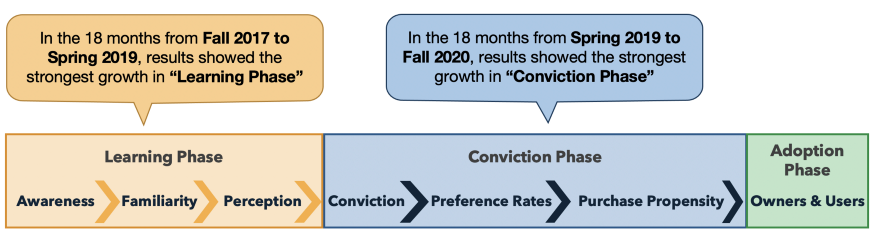

This assertion can be backed up by the other finding made by Blockchain Capital’s crypto-adoption report. According to the same, we are well past the “learning phase,” with the “conviction phase” gaining momentum of late. Thanks to a host of factors including institutional entry, generational wealth transfers, and changing demographics, we will soon be upon the “adoption phase,” meaning greater inflows into the market owing to growing awareness.

Source: Blockchain Capital

When talking about age groups and changing demographics, however, it’s worth talking about a recent FCA report that claimed that young traders are investing in Bitcoin for the “thrill.” Such a blanket assertion, according to Panxora’s Gavin Smith, is incorrect. He told AMBCrypto,

“…. the younger generation of investors is hungry for information and knowledge that will help them manage the risk in their portfolios, unlike older generations of investors who often rely on a 3rd party to make their decisions for them. There are a number of studies that show the time to invest in riskier assets is when an investor is young because they can carry losses for longer if the investment performs poorly for a while.”

It’s no surprise, therefore, if changing demographics emerge to be the next big tailwind for Bitcoin and the rest of the crypto-market.

![Polygon's [POL] short-term momentum faces strong resistance HERE](https://ambcrypto.com/wp-content/uploads/2025/03/Polygon-Featured-400x240.webp)