This year in crypto – Spot Bitcoin & Ethereum ETF approvals, ‘Trump pump,’ etc.

- Bitcoin and Ethereum Spot ETFs were major catalysts for crypto prices and holders’ conviction

- Rising DeFi popularity might catch participants by surprise next year

The past year has been highly eventful. From Bitcoin’s [BTC] halving to the Ethereum [ETH] Spot ETF approval, from the quantum computing threat to Bitcoin briefly seizing headlines, here are some of the year’s big highlights.

This year in crypto

The biggest development by far was the Bitcoin Spot ETF approval. This came after some false alarms caused massive BTC price volatility, such as the one from Cointelegraph in October 2023. On 10 January 2024, the U.S. Securities and Exchange Commission (SEC) announced the approval of Spot Bitcoin exchange traded products, or ETFs.

Crypto Twitter went haywire, and investors were delirious at the idea of BTC being open to millions of mainstream investors. The emergence of BlackRock and Fidelity as two of the largest ETF funds was also a major boost to sentiment. They currently hold 550k and 200k BTC, respectively.

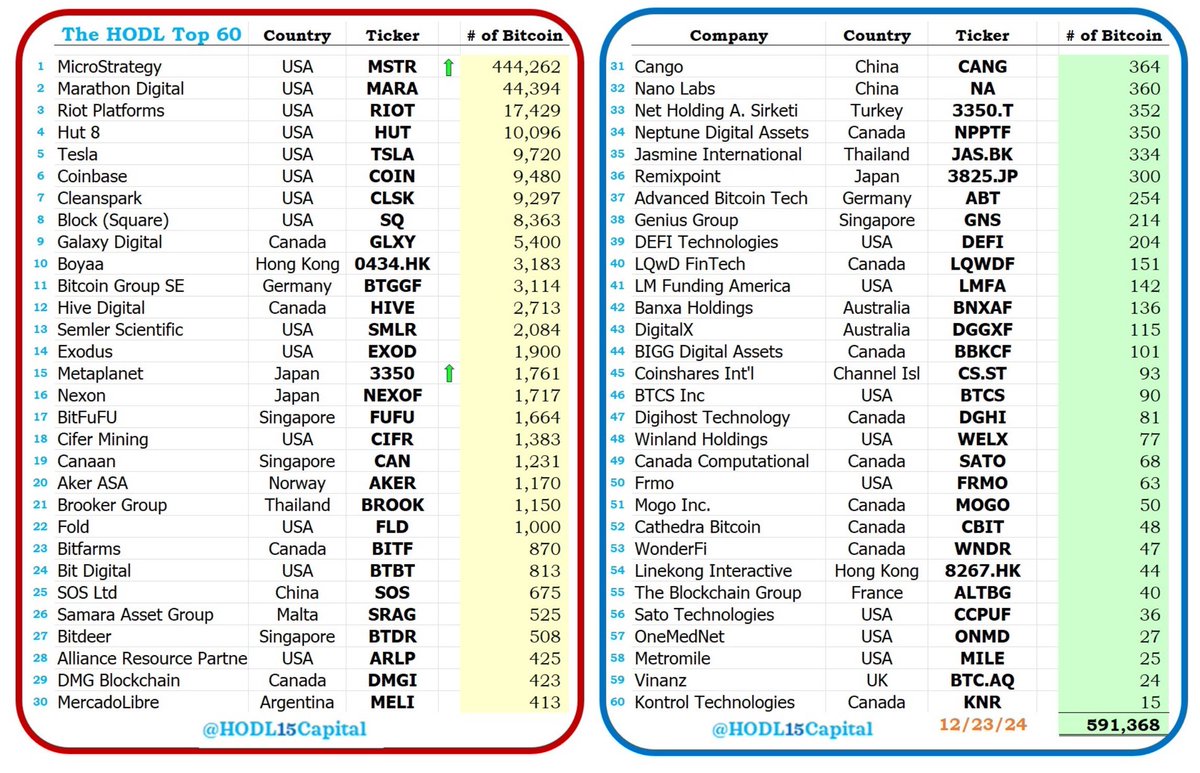

From being a niche asset class, BTC is now open to the public. The funds are regulated and managed by some of the largest entities in the financial world. Michael Saylor, Co-founder and former CEO of MicroStrategy, has also been relentlessly buying Bitcoin. Other companies are beginning to stack BTC too.

Source: Michael Saylor on X

The Ethereum Spot ETF approval was also a boost to the industry.

U.S. Presidential elections bring crypto to the fore

The 2024 presidential campaign spurred many debates about either candidate and the kind of administration they would bring. Trump’s embrace of crypto, his appearances at industry events, and his campaign promises made his administration’s pro-crypto position clear. This boosted crypto sentiment massively.

In fact, the President-elect even made promises to make the USA the crypto-capital of the world. Policy reformations would probably be introduced to bring regulatory clarity. Trump also made public the intention to fire SEC Chair Gary Gensler, a known crypto critic with a tendency to be aggressive in his oversight of crypto. Gensler would be stepping down on 20 January, Trump’s inauguration date.

Whether he follows through on those promises remains to be seen.

Polymarket and other markets gain prominence

Election time saw the cryptocurrency-based prediction market Polymarket gain popularity. It allows users to gain or lose from the outcome of world events. During these elections, it massively favored Trump to be the victor, which turned out to be accurate.

Read Bitcoin’s [BTC] Price Prediction 2025-26

In late September, Trump and his three sons announced World Liberty Financial, a decentralized finance (DeFi) money market platform. Enthusiasts see this as a positive development, while critics brought the obvious conflict of interest to attention. WLF’s purchase of crypto tokens such as Chainlink [LINK] and Aave [AAVE] were transparent due to the nature of the blockchain, boosting these tokens’ prices.

Source: DeFiLlama

The DeFi ecosystem in general has also been thriving. The DeFi revival is apparent from the rising total value locked (TVL) across different chains. It was at $120 billion, at press time, closing in on the $170 billion high it made in late 2021 during the last cycle.

Finally, Uniswap [UNI], the world’s largest decentralized exchange (DEX) on Ethereum, set records in November. Its monthly trading volume for a Layer-2 solution hit $38 billion, surpassing the $34 billion high it set in March 2024.