Altcoin

THORChain up 14% in a day – Is $10 possible for RUNE?

RUNE surges with bullish trends, strong TVL, and upcoming validator changes.

- RUNE leads the top 100 coins by market cap.

- The network activity in THORChain is growing.

THORChain [RUNE] has recently experienced a surge in price and activity, making it a cryptocurrency worth watching.

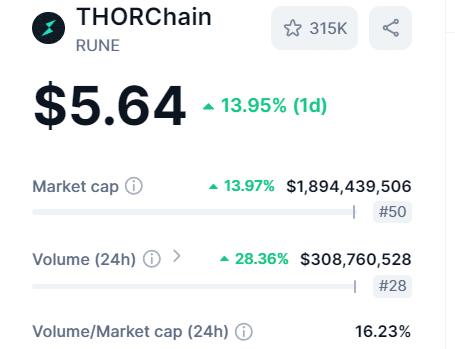

As at press time, RUNE was trading at $5.64, reflecting a 14% increase in the last 24 hours. Trading volume also surged by 28%, exceeding $308 million.

With over 336 million tokens circulating out of a total supply of 414 million, RUNE boasts a volume-to-market cap ratio of 16%, making it a strong investment option with good liquidity and growing interest from traders.

RUNE intense upward drive

RUNE has shown strength over the past 20 days, maintaining an upward trend. As at press time, today stands out as its best-performing days since mid-May 2024, when it experienced similar gains.

The token recently broke above a key resistance level of $5 on the daily timeframe, but questions remain about whether this momentum will continue.

RUNE’s price bottomed out on the 5th of August, mirroring a general market crash. Aggressive buying began around the 6th of September, pushing RUNE higher.

Over these 20 days of bullish activity, the Bollinger Bands, which had tightened, opened up again, signaling increased volatility and potential for further upward movement.

Additionally, the MACD (Moving Average Convergence Divergence) lines flipped bullish, showing that buyer momentum remains strong.

For traders, a potential buying opportunity may arise if the market retraces to around $5.10, as corrections often follow such significant moves.

However, if RUNE fails to hold above $5, further price action should be observed before making any decisions. Despite the need for caution, several factors continue to support RUNE’s bullish outlook.

Network statistics

One key metric driving RUNE’s value is its total value locked (TVL), currently standing at $853M. This figure has been steadily recovering since June 2023 due to various developments in the THORChain network.

The chain’s annual revenue exceeds $100 million, a strong indicator of its growth. Meanwhile, there were over 31K swaps, $126 million on-chain trading volume and $304K in total earnings in the last 24 hours.

Additionally, THORChain continued to improve its decentralization efforts. THORChain announced plans to explore decentralized finance (DeFi) on Bitcoin, further supporting its upward momentum.

Recently, THORChain reached an all-time high with 111 nodes and 107 million RUNE tokens bonded, representing 32% of the circulating supply.

Every three days, new validators are added, and old nodes are removed, ensuring a truly decentralized liquidity network.

As the 120-node limit approaches, a potential “bond war” could further increase activity and push RUNE prices higher.

THORChain new burn mechanism

Lastly, THORChain acknowledged the contributions of its developers, highlighting the decentralized governance of the network, where nodes make decisions, and developers implement them.

Pluto, on X, noted one of the latest developments is the implementation of V136 and ADR 17, with 1 basis point of system (1bps) income now being burned every block.

Read THORChain’s [RUNE] Price Prediction 2024–2025

This burning mechanism reduces the supply of RUNE, which could lead to higher prices if demand remains strong.

Considering these factors, RUNE has the potential to rise even further, with price projections suggesting it could reach $10, representing an 87% return on investment for those looking to capitalize on its current growth.