‘Thrice since 2023’ – Here’s what this negative reading means for BNB

- CryptoQuant found that Binance’s funding rate has turned negative

- Growing bearish market sentiment means lower demand for BNB’s long positions

According to Cryptoquant, funding rates of Binance have turned negative again. Here, a negative trend in funding rates on Binance usually leads to considerable market movements.

The on-chain analytics platform claimed that,

“Binance Funding Rates Trending Negative. Since 2023, this marks the third time the FR has entered negative territory for an extended period.”

According to Nino, a Cryptoquant analyst, the historical data shows the current market condition has resulted in renewed attention. This would likely pave the way for significant market events.

Notably, funding rates mostly operate as periodical payments for short and long-term traders. This is mostly based on the market difference between perpetual contracts and spot prices.

When there are positive funding rates, long position holders pay short positions. This suggests a bullish market sentiment with investors willing to pay a premium to hold their positions. Conversely, a negative funding rate indicates that short position holders are paying long positions. This usually suggests a market correction or bearish market sentiment.

An analysis of market sentiment

Additionally, the aforementioned analysis claimed that since 2023, this is the third time Binance’s funding rate has turned negative.

This implies that traders are mostly expecting further market downturns. Equally, it also signifies the fears of further dips that are usually associated with September-based Bitcoin Cycles.

However, one of the prevalent issues that has come into light over the past few days is Binance’s association with governments. Two days ago, Binance was accused of freezing accounts belonging to Palestinians on Israel’s request. According to Quantum Ready, most Muslims have already taken off their funds from Binance. He claimed,

“Imagine how many Muslims use Binance. They probably took their funds off because Israel was allowed to freeze gazan accounts.”

Such external forces may have negatively affected the demand for long positions, with sympathetic and fearful traders closing their positions to protect their investments.

What does this mean for Binance Coin?

A negative funding rate is likely to have a major impact on Binance coin (BNB). Reduced demand for funding rate implies that investors lack confidence in the asset’s direction. As shown on the price charts, BNB has fallen over the past 30 days.

At press time, BNB was trading at $535.48 after a 7.62% drop over the past 7 days. This marks a significant decline from its recent high of $598 recorded 2 weeks ago.

The drop is also a sign of the negative sentiment prevailing across the market.

The Relative Strength Index (RSI) at 46 dropped from 62 in the last 7 days too. This alludes to a hike in selling pressure as traders closed their positions.

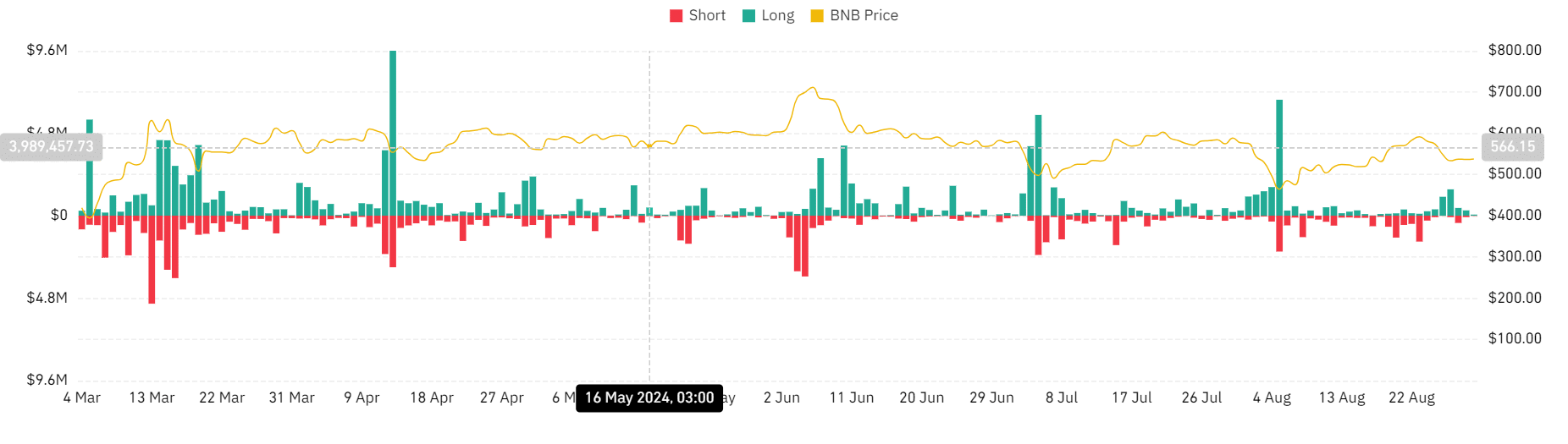

Furthermore, liquidations for long positions surged and remained relatively high over the past week.

In fact, liquidations for long positions hit a high of $1.1 million over the past week – A sign of bearish sentiment.

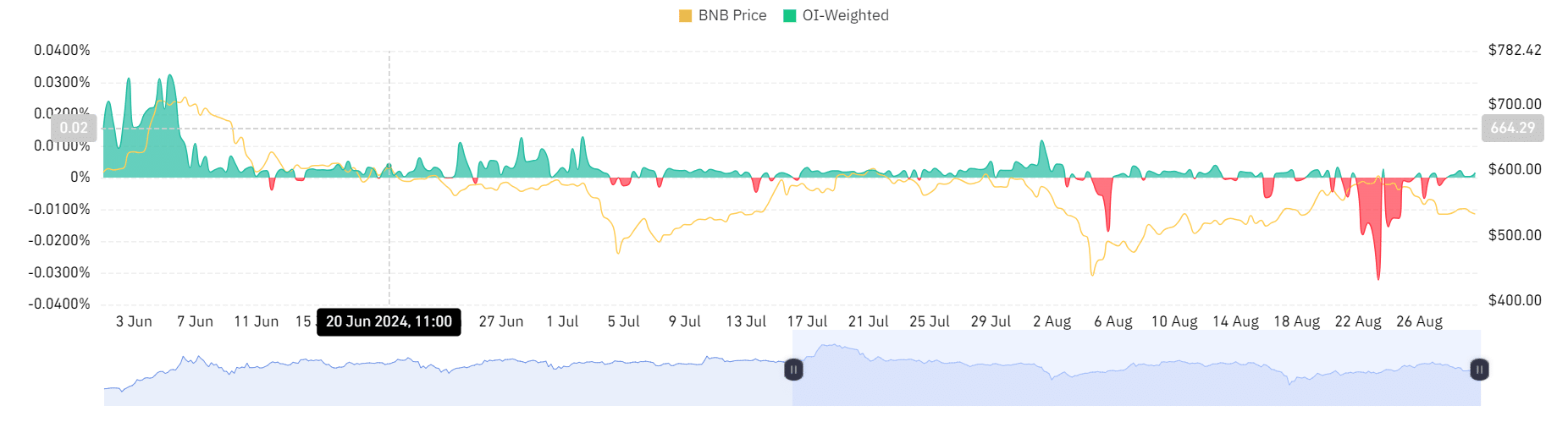

The fall in demand for BNB long positions is further supported by the declining OI-weighted funding rate. A negative weighted funding rate has dominated BNB over the past week. Despite moderate recovery, weighted funding still remained low, with demand for long positions relatively reduced too.

In conclusion, Binance’s negative funding rate has affected its native coin. BNB has seen a decline in demand for long positions, with longs being liquidated to imply bearish market sentiment.

In light of the hike in selling pressure, BNB may drop further to the $523 support level.