Ties with LUNA plunged AVAX into a $60m loss- Decoding the mystery

It is no longer news that investors in Terra’s LUNA have been counting their losses since the collapse of the token following the depegging of the UST Stablecoin. Speaking on its own woes, the founder of Avalanche Foundation and the CEO of Ava Labs, Emin Gun Sirer in a recent interview with Forbes stated that the foundation has lost $60m following the failure of the Terra ecosystem.

He explained that the Avalanche Foundation had entered into a partnership with Terraform Labs which was aimed at improving interoperability between the two networks.

As a result of this investment and ensuing loss to the Avalanche Network, its native coin, AVAX has struggled with warding off bears since the fall of LUNA.

Let’s take a closer look into how this token has fared since 8 May when Terra’s LUNA started to fail when its stablecoin lost its $1 peg.

17 days of pain

It has been a long 17 days of red candlesticks for the AVAX token following the collapse of LUNA. Standing at $54.3 on the day UST lost its peg, the AVAX token has since declined by 47%. Standing at $28.66 at press time with a 9% decline in trading volume in the last 24 hours.

The overall bullish correction of the crypto market was unable to save the price of the token. With no recovery in sight for the LUNA token, AVAX might be a long road from reaching its ATH of $146.22.

Movements on the price chart pointed at severe bearish bias for the token since the fall of LUNA. At 31 at press time, the Relative Strength Index (RSI) has been stuck below the 50 neutral position, deep in the oversold territory since 8 May. On a 50-day EMA, increased selling pressure was also spotted.

Within the period under review, the market capitalization of the AVAX token also suffered a severe decline. In the last 17 days, the market cap dropped by 45% from $14.06b on 8 May to $7.7b marked at press time.

Nothing to see here

A quick consideration of on-chain data revealed that on a social front and in terms of Social Dominance the token maintained a position between the 0.3% – 0.6% index since 8 May.

Although it marked a high of 0.96% on 22 May, a reversal occurred pushing this metric to 0.652% at press time. With regards to the period under review, the Social Volume of the token marked two highs of 771 and 755 on 11 and 22 May respectively.

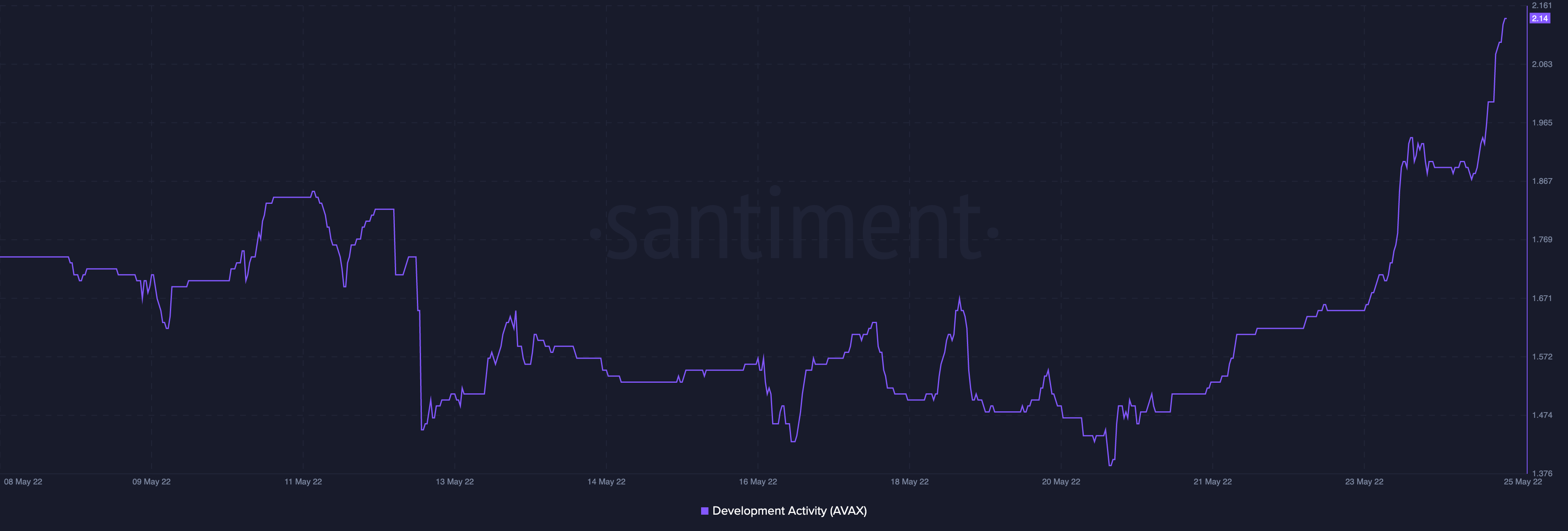

However, on a developmental front, the token has since recorded an uptrend. Standing at 2.14 at press time, this metric grew by 18% since 8 May.

In fact, during the interview, Sirer confirmed that;

“We’ve spoken to [Terra] and they did not dump the AVAX even at their hour of need and so it is currently the most valuable thing they hold [. . .] Quite a substantial percentage of the AVAX is actually locked, so they actually can’t move it.”