Altcoin

Time for Uniswap to upgrade? Looking at all sides of the coin amidst rising rivalry

Uniswap’s expiration of its V3 license could help other decentralized exchanges get ahead in the race for dominance in the DeFi space. Protocols will be able to copy Uniswap’s source code with no consequences.

– Uniswap’s V3 license expired and this could inspire other copycats and clones to compete with the DEX.

– Development activity of the protocol continued to decline; however, UNI continues to see improvements.

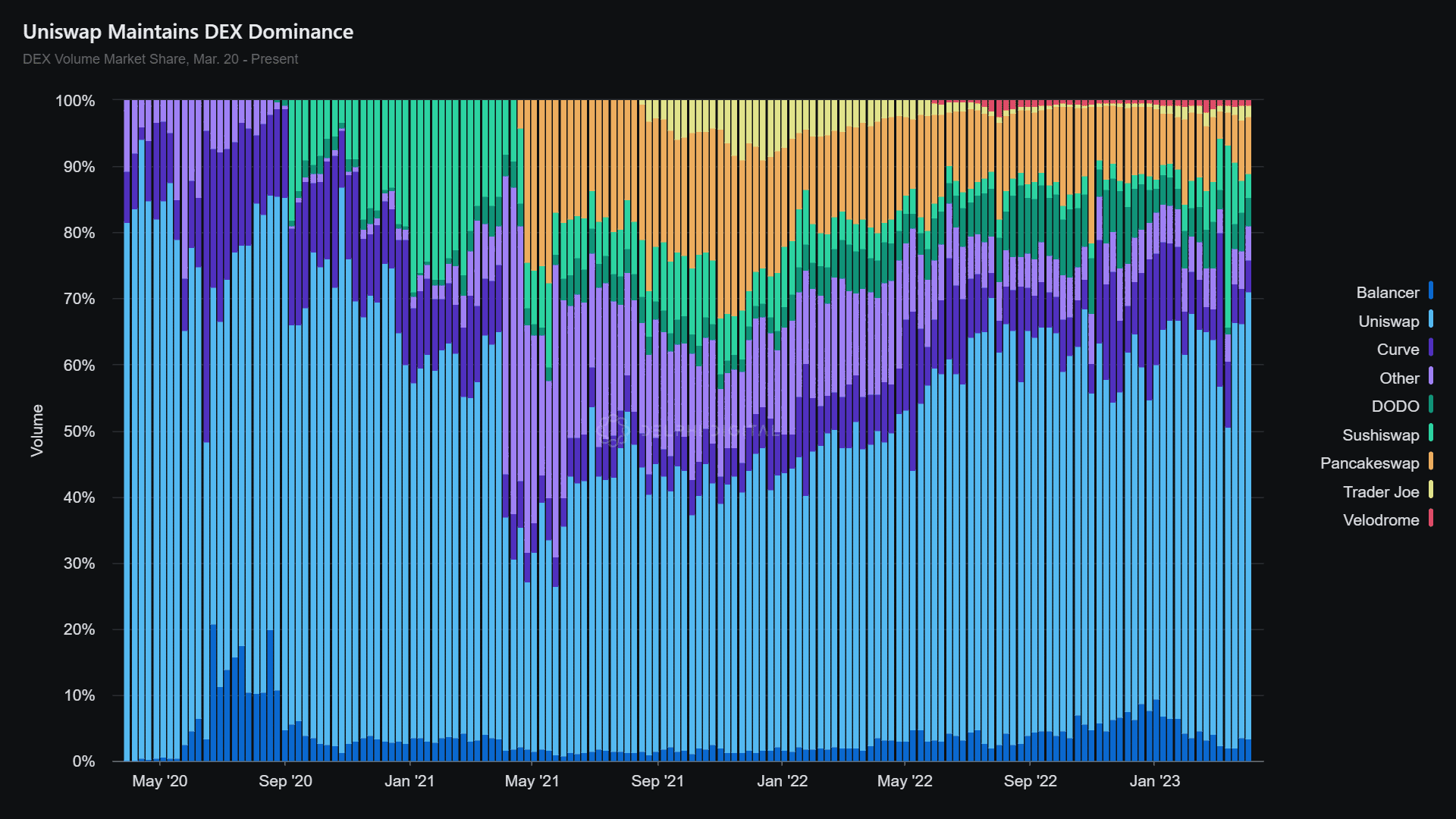

Uniswap [UNI] was enjoying the top spot in the DEX sector for quite some time. After the FTX collapse, many users flocked to decentralized exchanges as they began to lose their faith in centralized exchanges.

Realistic or not, here’s UNI’s market cap in BTC’s terms

Copycats at bay

Uniswap capitalized on this interest and captured 67% of the DEX market share.

However, this dominance of Uniswap could come under threat as Uniswap lost its v3 license.Initially, before launching V3, Uniswap was operating under a Business Source License (BSL). The agreement involved the implementation of copyright laws, granting Uniswap the ability to limit the unauthorized commercial use of its source code for two years.

In contrast, Uniswap’s V2 was launched under the General Public License (GPL) which allowed anyone to clone Uniswap’s source code. This affected Uniswap greatly as one of DEX’s competitors, SushiSwap [SUSHI] took advantage of this and cloned the protocol code to a large extent.

SushiSwap took away a large amount of Uniswap’s liquidity and attracted new users. This phenomenon is also known as a “vampire attack.”

To prevent future vampire attacks, Uniswap started to operate under the BSL. However, the contract was only for two years. After which, Uniswap’s Business Source License will be turned into a General Public License indefinitely, which would allow anyone to copy their source code.

The expiration of the license means that other competitors of Uniswap, such as SushiSwap, Curve [CRV], and Balancer [BAL] can use the tools in Uniswap’s arsenal and improve their own protocol.

How will UNI fight back?

Uniswap could improve its competitiveness among other DEXs by releasing an upgraded version of its protocol in the near future.

Nevertheless, it has been observed that the number of daily active developers contributing to the Uniswap protocol and the frequency of code commits to its GitHub have started to decrease.

Read Uniswap’s [UNI] Price Prediction 2023-2024

This suggested that Uniswap could still take some time before coming to the market with a new product.

UNI, however, remained unaffected and its prices continued to soar. Despite rising prices, the network growth and velocity of the token declined, which could be a cause of concern for holders.